- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Moved PA to MD - Compensation Summary + interest income summary

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved PA to MD - Compensation Summary + interest income summary

Hi,

My wife and I moved from PA to Maryland halfway through 2024 (6/15/24). We both work for the same company in PA, and mostly work from home in MD, but we do drive up once a week to the office. So essentially for the first half of the year we lived and worked in PA, and for the second half of the year, we lived in Maryland and worked in PA. Neither of us changed jobs, we just moved and mostly work from home.

I am currently working on the PA State return, and coming across the Compensation Summary section – and it lists four of our W-2 sections (one section for each of us for both MD and PA). With the message “If you were a resident of Indiana, Maryland, New Jersey, Ohio, Virginia, or West Virginia (reciprocal wage states) and worked in Pennsylvania you may need to change the wages to zero to claim a refund.”.

When I look at our pay stubs – after our move in June, we are no longer being taxed for PA state on our stubs, only for the local township in PA where the office is located.

- I am curious about the reciprocal wage state situation – do I need to do anything here? When I go into the Maryland sections of each W-2 listed, it shows the correct MD earnings amount and there is a box that says “Make this income taxable in PA”, which I have NOT selected. I assume this is the correct way to move forward, and that I am NOT being taxed by PA for this MD amount. When I go into the PA W-2 sections under Compensation Summary, it assumes the PA amounts (which are correct) should be taxed for PA, which is correct. So – do I need to do anything with this as a reciprocal wage state? If I’m understanding correctly, TT is already determining the correct situation for me, but I want to make sure I’m not misunderstanding.

- After moving on from this section, I’m taken to the Interest income summary section. I have a few things on this section – we both have High Yield Savings Accounts, and we have a joint Checking account that earns us interest, as well as some brokerage accounts. This section suggests that I need to “edit (change) each interest income item to reflect interest earned only while you were a Pennsylvania resident.”. So in this section, I need to calculate and remove the amount of money we earned as interest while we were in Maryland. I’ve taken the total dollar amount for each account and divided by 12, then multiplied that number by the number of months we were in PA. Then I’m putting the number that should be taxed by PA into the “Adjustment Amount” box as “Other adjustment”. I’m not completely clear on if what I’m supposed to put in the box is supposed to be the number that is taxed by PA (earned in PA), or the number that should not be taxed by PA (earned in MD). Which is the correct way?

Thank you for your help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved PA to MD - Compensation Summary + interest income summary

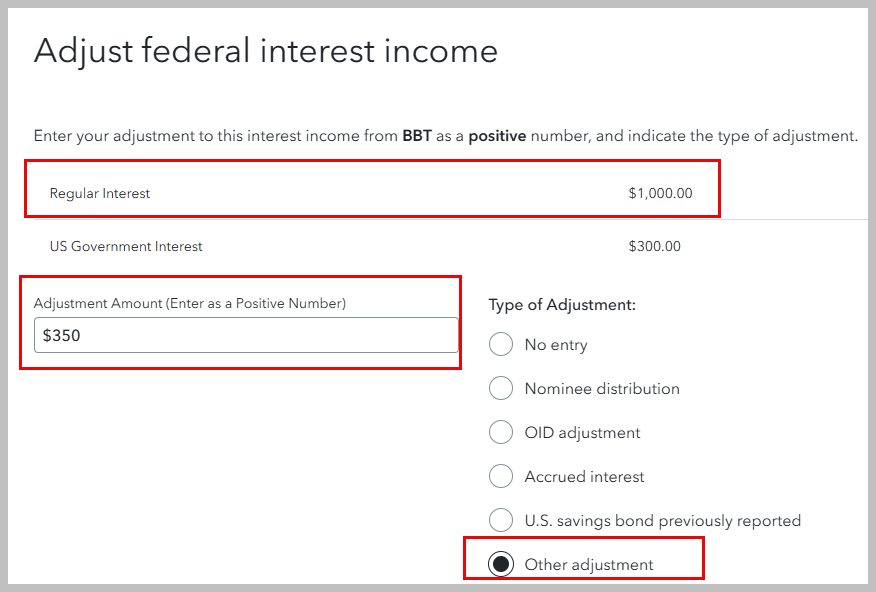

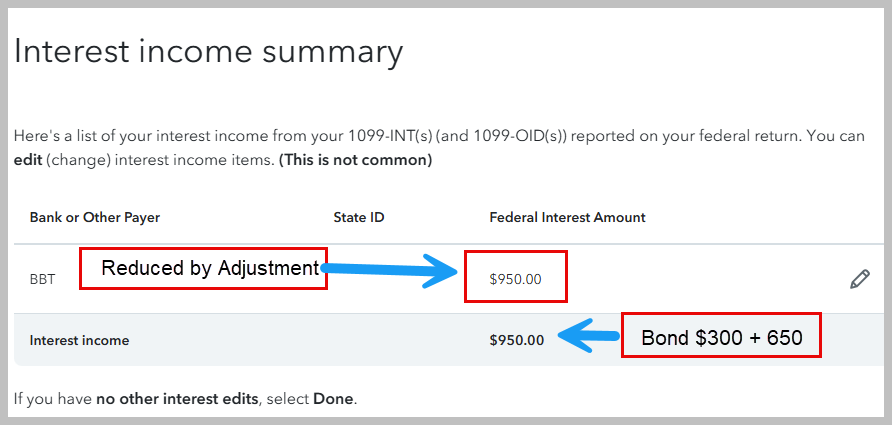

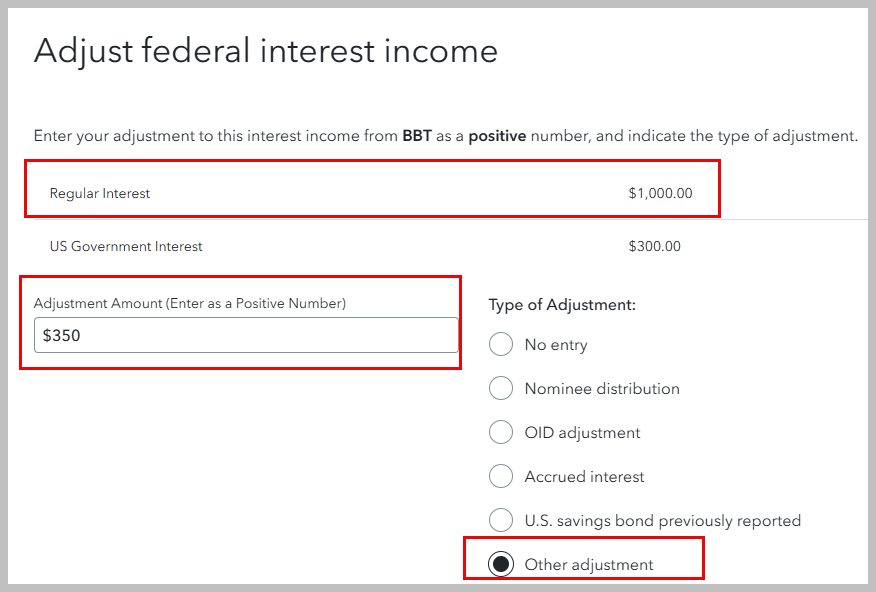

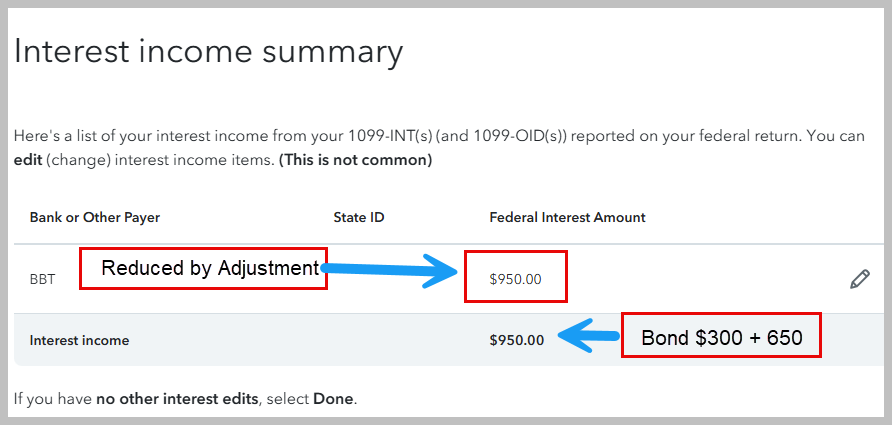

In this entry for the PA interest, you are entering the amount of interest that should not be taxed to PA as a positive amount. If the tax goes up it's possible that something else triggered it. You should see the correct taxable amount for PA on the following screen when you continue. See the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved PA to MD - Compensation Summary + interest income summary

Answers to your questions are listed below.

- Reciprocal agreements apply when you live in one state but work in another adjacent state. They do not apply in your situation. It does not apply to part year residency. Income earned where you reside is taxable to the part year state where you lived when you earned the money. Do not select 'Make this taxable in PA'. You have made the right choice.

- Yes, based on the statement '

- See the images below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved PA to MD - Compensation Summary + interest income summary

Thank you, @DianeW777 . For #2- one thing that is confusing me about this approach is I seem to be paying more tax in PA for a Maryland account by doing it this way. I have about 5 accounts listed in this section (Interest income summary), and one of them is a local Maryland joint checking account that we opened up after we moved to Maryland. So this account never belonged to us while we lived in PA.

This account earned us about $409 for the year. Since it is not an account we had in PA, all of the interest earned should be zeroed out for PA. I previously had the number $409 in the box, and my overall PA taxes "due" was showing as $206. When I change the amount to $0 as suggested (stating that $0 of the interest was earned while in PA), my PA taxes due are now $219. Wouldn't this suggest that by saying $0, Turbo Tax is assuming the entire amount should be taxed by PA? If the box is meant to be "taxable to PA", and I put $0, why did my taxes due to PA increase just based on this MD account?

I would assume since the box is "Adjustment amount", I would "adjust" it by $409 since that is the amount that would need to be adjusted away from PA if that makes sense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved PA to MD - Compensation Summary + interest income summary

I understand your thought process. However when I entered the amount that should NOT be included my overall PA interest income was less on the following screen (not posted).

Double check by reviewing your state tax summary:

From the left rail menu in TurboTax Online, select Tax Tools (You may have to scroll down on the left rail menu.)

- Select Tax Tools

- On the drop-down select Tools

- On the pop-up menu titled “Tools Center”, select View Tax Summary

- On the left sidebar, select Preview my 1040 or State return

For TurboTax Desktop, change to 'Forms' and review the forms

[Edited: 03/08/2025 | 1:23 PM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved PA to MD - Compensation Summary + interest income summary

Hi @DianeW777, thanks for this info, but what should I be looking for when I review the 1040/State returns? I am still confused as to why adjusting the number to $0 (supposedly suggesting $0 that is taxable to PA), would then increase my tax burden with PA. If the account was only available to me when I was in Maryland, shouldn't my tax liability to PA decrease when I make the adjustment?

I am mainly trying to figure out what the box wants me to input - does it want me to input $0 to indicate that zero dollars should be taxed by PA? Or does it want me to input $409, to suggest that $409 is the number I am requesting to adjust so that I am not taxed by PA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved PA to MD - Compensation Summary + interest income summary

In this entry for the PA interest, you are entering the amount of interest that should not be taxed to PA as a positive amount. If the tax goes up it's possible that something else triggered it. You should see the correct taxable amount for PA on the following screen when you continue. See the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved PA to MD - Compensation Summary + interest income summary

@DianeW777 - Thank you for this response, this is what makes sense to me. Your response here is in conflict with your previous response, which is what was confusing me. In the first post you responded to in this thread, the image you included suggested I should enter in the box the "Amount taxable to PA", which is the opposite of what your latest response says. But your latest response makes sense to me - that the amount in the box should reflect the amount not taxable to PA.

This has given me the lower PA due amount, which is in line with the MD account, which should not be taxed by PA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved PA to MD - Compensation Summary + interest income summary

Thank you for taking the time to alert me.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cirithungol

Returning Member

BobTT

Level 2

CRoxl

Level 1

melmorsh

Level 2

Rlwaldm

New Member