in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Incorrect AMT Capital Loss Carryover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

When I imported data from my stock broker, the taxes due more than doubled. Upon further investigation I've noticed that I have to pay AMT. I have capital gains in 2021 and capital loss carryover from 2020 which will offset those gains.

I've started doing research and found this link

https://fairmark.com/general-taxation/alternative-minimum-tax/amt-capital-loss-trap/

If not for the information provided in that website I would have wasted many hours trying to figure out capital loss carryover and AMT

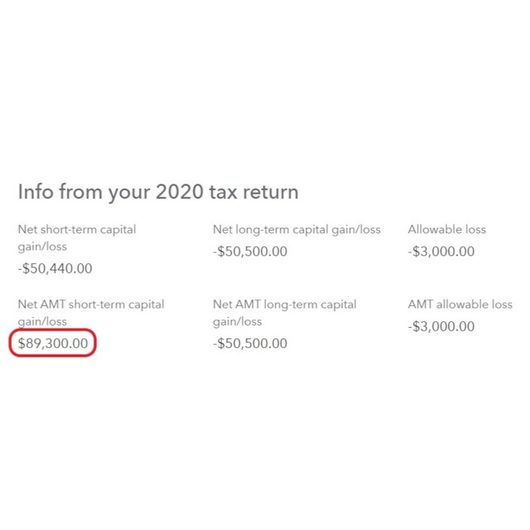

Coming back to the problem in TT, the "Net AMT short-term capital gain/loss" is completely different from "Net short-term capital gain/loss" for year 2020.

For reference if my 2020 "Net short-term capital gain/loss" is -50,000, "Net AMT short-term capital gain/loss" is showing as 130,000. I assume this incorrect amount triggered AMT. However "Net long-term capital gain/loss" and "Net AMT long-term capital gain/loss" from 2020 is exactly the same.

There is no way to find out how TT calculated a different "Net AMT short-term capital gain/loss" amount as I don't have Schedule D AMT in 2020 and all my losses are from simple stock and option trades.

I believe this is a bug in the software. Tax filers unaware of this end up paying thousands in additional taxes.

It will be really helpful if TT keep the "Net AMT short-term capital gain/loss" field blank if it can't find a schedule D AMT from previous year and let the user enter the amount.

Question: Can I correct the "Net AMT short-term capital gain/loss" to reflect the carryover loss from 2020?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

Yes, if you are using TurboTax online you can make adjustments to your prior year AMT carryover losses by following these steps.

- From the Income & Expense page, scroll down to Capital Loss Carryover

- Click Edit, and the next page will display the following, Here's what we have for you.

- Click Edit again and make the adjustments you feel need to be made.

If you are using TurboTax desktop, the process is essentially the same. In the Investment Income section, select Capital Loss Carryover and respond to the questions on the pages that follow.

@AJ_S21

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

Yes, if you are using TurboTax online you can make adjustments to your prior year AMT carryover losses by following these steps.

- From the Income & Expense page, scroll down to Capital Loss Carryover

- Click Edit, and the next page will display the following, Here's what we have for you.

- Click Edit again and make the adjustments you feel need to be made.

If you are using TurboTax desktop, the process is essentially the same. In the Investment Income section, select Capital Loss Carryover and respond to the questions on the pages that follow.

@AJ_S21

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

Thank you for your response, but I don't have AMT carryover loss from prior year (2020) to adjust. I have a regular (if you can call that) carryover loss from 2020.

AMT has been triggered for 2021 when I entered short term profits for 2021 even when I have a greater regular carryover loss (from 2020).

Instead of bringing the regular carryover loss as it is from 2020, TT is showing a positive number in the field "Net AMT short-term capital gain/loss" which I believe is triggering the AMT. My question is with a straightforward carryover loss from last year which is more than the profit I made this year, why is AMT triggered?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

AMT should not be triggered if the 2020 carryover losses offset your gains from 2021. In TurboTax online, your 2020 Net AMT short-term capital loss should be reflected as a negative number. In contrast, in TurboTax desktop, losses of this type are usually entered as positive numbers.

If your 2020 net AMT short-term capital loss is incorrect, were you able to edit your 2020 capital loss information to reflect the correct amount of capital loss?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

"If your 2020 net AMT short-term capital loss is incorrect, were you able to edit your 2020 capital loss information to reflect the correct amount of capital loss? "

Yes, I was able to change the AMT short-term carryover loss. After I made it same as my 2020 capital loss carryover, AMT is no longer applicable.

I'm using TT online. I still can't figure out how the AMT carryover loss carryover is shown positive and almost twice my 2020 carryover loss amount. Below is the screenshot of the discrepancy (Modified the actual numbers) My original question is how did TT arrive at the number shown in red?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

Yes, I actually ran into this same issue. I had a very large capital loss carryover, then for 2021 I had a very large capital gain. I almost fell out of my chair when TT calculated my AMT. I was sitting there thinking this has to be wrong. I am only able to take the standard deduction, yet my tax due increased by about $45,000! After hours of trying to figure this out, I also found the article you referenced and then your post. Fortunately I was able to bring up my equivalent forms for 2020 to help verify how it should be. TT seems to just grab a number out of thin air....I have no idea how it came up with that. After more research I found where to fix it. I have been trusting TT for many years but now there are serious questions in my head if TT can be trusted. I consider this a very serious error in their software. Not only did they issue the software with this problem, they also have not yet patched it. This is very irresponsible conduct. If I ever see a problem anywhere near like this again with TT, it will probably be time for me to try someone else's software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

I run into exactly the same issue, here is how I fixed it:

- From the Income & Expense page, scroll down to Capital Loss Carryover

- Click Edit, and the next page will display the following, Here's what we have for you.

- Click Edit again and the next page will display: Great, we'll guide you, starting with some info from your 2020 tax return

- Click Continue you arrives at the page displaying: You probably don't, but we have to ask—do you have different carryover amounts for AMT?

- Chose Yes, I did (This is uncommon.) and then click on Continue

- Now you can edit/correct your AMT capital loss carryover on the page displaying: In that case, let's get some info about your AMT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

Your post is very helpful but in my case, Turbo tax failed to interview me about prior year (2020) capital loss carryover nor prepared a capital loss carryover schedule D for tax year 2021. My first time using Turbo tax and naively believed their motto "100% Accurate Calculations Guarantee". Any ideas how to amend this mistake? Thanks very much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

This issue is still not fixed. In Turbo Tax 2021 the Capital Loss Carryforward Worksheet states I have Short Term Loss Carryforward of X and Long Term Loss Carryforward of Y. In TurboTax 2022, for no discernible reason, these numbers are changed to 0 for the Short Term Loss, while for the Long Term Loss and picks the Capital Gains Distribution number from line 13 on my 2021 Schedule D (instead of line 15).

The link you found was also what turned me on to this - other than not wanting to believe AMT is that evil.

I reentered the numbers manually on the 2022 Capital Loss Carryover Worksheet - lines A and B at the top - and presto : no more AMT. So, I think it worked.

Intuit needs to fix this ! It can cost people thousands of dollars.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

I believe there is an issue with the 2022 Turbotax Premier software importing the wrong lines/values from the 2021 Schedule D:

Posting this here in case this thread remains active, as the other thread has had no response.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

As David55NN stated, this is a known issue that is being worked on by TurboTax. You can sign up for updates using the link below:

Why isn't my Capital Loss Carrying Over?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

@BrittanyS Can you send a new link. The previous one no longer exist.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

If the link provided no longer works that means that the issue has been resolved.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect AMT Capital Loss Carryover

Using TT Premier desktop, just about to start filing returns, when I noticed something strange about capital loss carryover and capital loss carry forward? Have just started looking into this, when I came upon this conversation. It seems that the capital loss carryover/carry forward issue is NOT resolved. I will need to look at past returns to see if/when a discrepancy turned up.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524121432

Level 1

titan7318

Level 1

ted-wetekamp

New Member

blackstone79

Level 2

barnabyf

Level 3