- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I sold rental home. A search on this topic tells me that it is under rental income expense/de...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold rental home. A search on this topic tells me that it is under rental income expense/depreciation. It is not there.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold rental home. A search on this topic tells me that it is under rental income expense/depreciation. It is not there.

Enter all the 2024 income and expenses for that rental first

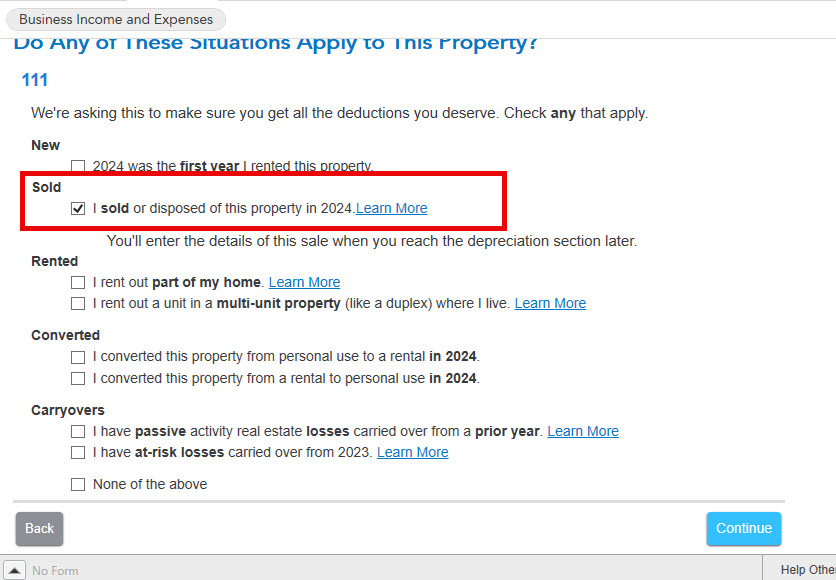

Go to the "Property Profile" section, and select "I sold this rental in 2024" on the "Do Any Of These Situations Apply To This Property?" screen.

Continue through that interview but do not leave the Rental Section

Scroll down to Sale of Property/ Depreciation

Yes, I want to go to my asset summary

Select EDIT for the property

Continue through this interview and be sure to select on the "Tell Us More About This Rental Asset" screen ALL-

I purchased this asset (if appropriate)

The item was sold

Yes or No to 100% use

Continue through the interview and report the sale

Sale proceeds over cost will be capital gain (capital gain tax rate)

DEPRECIATION RECAPTURE will be Ordinary Income (your tax rate)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold rental home. A search on this topic tells me that it is under rental income expense/depreciation. It is not there.

It doesn't go thru anything to do with rental property sale. The software is not functioning.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold rental home. A search on this topic tells me that it is under rental income expense/depreciation. It is not there.

This route simply takes one into adding the property itself to its sold assets. It's incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold rental home. A search on this topic tells me that it is under rental income expense/depreciation. It is not there.

in screens after the one shoown (it takes you nowhere) you should come to one that says at the top "Review Your

XYZ Rental Summary"

on that screen, there's a line that says "Sale of Property/Depreciation" Click on the link.

as a side note, a sales price must be entered for each asset so that 1) the gain/loss and depreciation recapture is correct and 2) so the property is gone when you do 2025.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

waynelandry1

Returning Member

Lukas1994

Level 2

jigga27

New Member

branmill799

New Member

anonymouse1

Level 5

in Education