- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

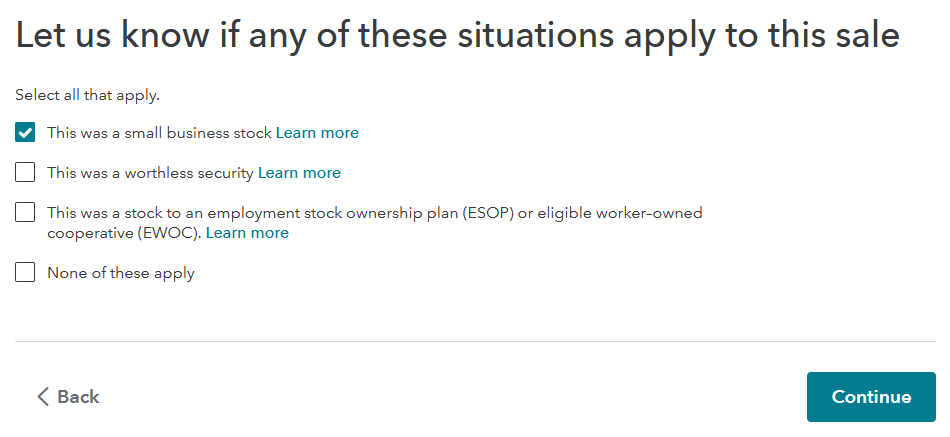

Did you ensure that you checked the requisite boxes (see screenshot below)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

I kept seeing mention of another screen/set of questions, but this is not coming up for me, no matter how I seem to enter the stock sale.

Would you be able to mention the steps that brought up this questionnaire for you?

Here is where I'm entering the stock sale:

- Stocks, Mutual Funds, Bonds, Other

- Did or will you receive a 1099-B form or brokerage statement for these sales? No...

- Add more sales

- What type of investment did you sell? Stock (non-employee)...

- How did you receive this investment? I purchased it...

- Entered all relevant dates (> 5 years), proceeds, purchase price, etc...

- Let us know if any of these situations apply to this sale. This was a small business stock...

- Do you need help figuring out your cost basis? No...

That is all. It wraps up there and calculates taxes due on those proceeds. I never see the prompt/screen you included. What did I miss?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

Do you see anything like the screen in the screenshot below? I did this test in TurboTax Home & Business, by the way, so I am not sure how you have to answer the questions in an online version. Perhaps you can indicate that you need help with that basis question and see if you get a different result.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

No, I do not see any questions like this at all, which is clearly the problem.

I'll try going through the cost basis flow and see what happens, but it seems odd that this would work so much different than another version of TurboTax. The current steps seem overly simplified for sure.

Thank you again for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

@chad8 wrote:I'll try going through the cost basis flow and see what happens....

The cost basis flow seems to work so try that. I went through the sequencing in the Online version of TurboTax Premier and got the result in the screenshot below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

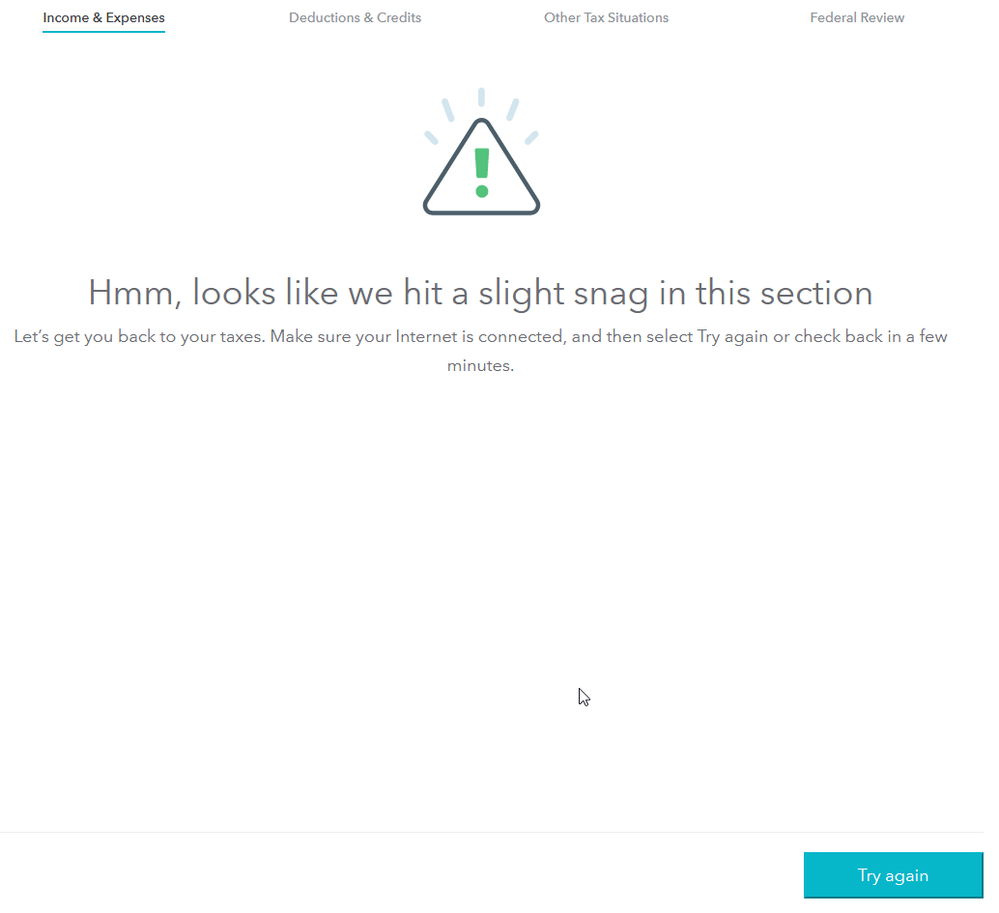

I went through and selected to go through the Cost Basis flow as noted, but I am getting an error each time once I input the data (either manually entering the cost basis or entering the purchase price method).

Note: I am not having internet connection issues. This is specific to this workflow. I can go back and every other section of TurboTax works just fine. I have now tried to go through this workflow over the course of a full day and this error only occurs after trying to finish the cost basis workflow for the Small Business Stock sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

TurboTax clearly doesn't seem to like what I'm entering as my cost basis, but I'm not sure why it's an issue one way or another. It's small, but definitely a positive number, so I don't understand the error when I input the data.

Any other ideas? I can't proceed at all at this point.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

I can only suggest contacting Support (link below) at this point.

They should be able to walk you through the process and address any anomalies during data entry.

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

Will do, thank you for trying to help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a stock sale that qualifies for the 100% exclusion on gains under Section 1202 (Qualified Small Business Stock), but TT is not recognizing this. Help.

I was able to find a way around the error. During the cost basis wizard, it kept asking for the "Number of Shares", but it was not a required field.

I tried leaving that field completely blank, and once I did that, I was able to move to the next screen with the QSBS questions and select the appropriate option.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Cindy10

Level 1

Slowhand

New Member

keithl1

Level 2

cfreeman244

New Member

sgk00a

Level 1