- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

Trying to sell a rental condo using 1031 exchange. I didn't realize I could have claimed depreciation for the 2 years it wasn't rented due to repairs and COVID. For my 2020 taxes I only show schedule E for my other rental. I think I must have chosen that it wasn't rented or available? I can't find on my turbotax forms where that question would be listed, but when I tried to amend it still didn't ask me about that property. I guess that means I changed it to personal use. NOW I want to do a 1031 exchange this year. Can I go back and undo changing it to personal use? Is it possible I chose something on my 2019 returns because it was only rented 6 months in 2019?

The other option is to edit my returns to convert it back to rental in 2021 by amending my return and skipping 2020 entirely. Do I need it to have been a rental for a certain amount of time to do the 1031 this summer.?...Any advice

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

This is a duplicate post that does not contain needed information already provided in the post at https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/property-rented-2016-...

If you rented to your child paid below FMRV, and/or if you claimed the child as a dependent, then the property is considered personal use and treated as a 2nd home. So it would not qualify for a 1031 exchange.

If the property qualifies as a rental for 2020 and on (which is possible, but doubtful), you'll have to first check your 2019 tax return to see if you converted it to personal use. If you did, then you'll need to amend the 2019 return to undo the conversion.

Then you'll need to amend the 2020 and 2021 tax return to report the rental income/expenses on SCH E for each year. When you amend those two years, you will 'NOT" be able to import the depreciation history or the PAL Carry overs, and will have to enter them manually.

Once you have amended all the returns in chronological order, you can then start your 2022 tax return and make absolutely certain you import from the "AMENDED" 2021 tax return, so the depreciation history and PAL carry overs are imported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

Thank you for responding and explaining how to amend.

How do I see if I converted it to personal use in 2019 or 2020? I know I have rents claimed in 2019 but I don't see a spot where it says whether I converted or not.

My son living there is not recorded anywhere, it was meant to be short term, then covid blew up his plans to buy. He never officially changed his address. He is not a dependent.

I would have to download a tax file and desktop turbotax to amend 2019.

If it's not rented, but I did select "convert to personal use" does that mean I can't do a 1031 even though it was an investment property and not my primary home?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

I've looked at the PDF of my own tax return and can't find any calculation form or worksheet that indicates I converted a rental to personal use. I do know for a fact that I myself converted one of my rentals to personal use in 2018. But I can't find anything in the PDF that shows that.

I am assuming the property was placed in service before 2018.

Pull out the SCH E for both 2018 and 2019.

On that form you'll note that if you have more than one rental property, each property is assigned it's own column (A thru C) with the property for a specific column identified in PART I. (If you only have one rental property, then only column A is used.)

Look at line 18 amount under the column that is for your rental property. If those amounts are the same for 2018 and 2019, then you did not convert the property to personal use. (A few bucks difference between years is expected, and is not an indicator you converted.)

If the difference between those amounts is significant, with the 2019 depreciation amount being significantly lower, then most likely you converted the property to personal use in 2019.

You'd still need to confirm this by opening the .tax2019 file in TurboTax 2019 so you can edit that property to see if you checked the box for "I converted this property to personal use".

You need to confirm this, because if you converted it to personal use on Dec 31 of 2019, then the depreciation amounts for 2018 and 2019 could be so close that you would mistakenly think you didn't covert it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

You should see the income from your son reported on the sch E with expenses at fair rental value. Below fair market value, only the income is claimed and it is usually not reported on sch E but as Other Income instead. Below fair market value is considered personal use of your second home.

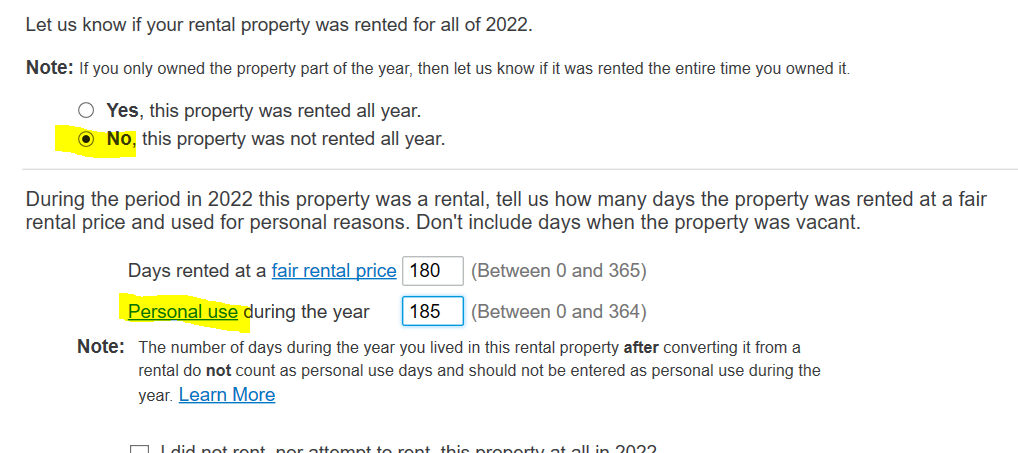

When you convert a rental to personal use, the program stops the depreciation at that point. The property profile asks if any situations apply to the property. You would have marked the conversion, the personal use days, and rented days. You can look at your sch E and the depreciation report, Form 4562 along with the Asset Wks.

You can also compare the depreciation amount with prior years. Depreciation is the same amount every year until you convert/ dispose and then it is prorated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

Placed in service i neither 2015. rented thru 2019. In 2019 We claimed rent for only half the year. All the lines on Schedule E expenses for 2019, EXCEPT line 18, are roughly 50% of the previous year which makes sense because in 2019 I put fair rental days of of 190 and personal use days of 145. Line 18 shows $515 for 2019 and $3056 for 2018 when it was rented all year. I know the residential depreciation would have been 2904 for the whole year of 2019 based on the depr and amort report 4562. The other depreciation lines for 2019 were 37, 105 and 119, so I don't know where the $515 comes from, it's way less than 50% of the total depr for the year of $3165.

Schedule E for 2020 only shows our other property, this one is gone.

Do I need to fix something for 2019 or can I just amend 2020 and 2021 so it is a rental and claim expenses with $0 income and 0 days rented and 0 days personal, stating Covid and repairs as reasons if asked? I will then claim some rent for 2022 which will be all offset by expenses anyway. I just CANNOT figure out what to choose in TT because the options are first time rental or convert personal to rental /rent to personal or sold.

My main goals are to preserve rights to use 1031 exchange and to not have to pay deprecation recapture on depr I didn't take if we can't do 1031. Afraid claiming 2 years of no rent will trigger a problem as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

AAAAH, you just gave me alight bulb moment. I must have converted it by putting personal use days when I should have put 0. At that time it wasn't rented, but I thought that it had to total up to 365 days!

We never lived there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

Carl, Amy posted something about the spot where I enter the number of personal days and rented days. That could be what triggered it to be converted? Or does it ask that anyway? I guess it might ask it anyway because some personal use doesn't automatically convert it does it? Still trying to open that 2019 tax file, but it's making me use the desktop program and it won't download both NJ and SC. It gets hung up on SC and I don't want to pay $45 for SC anyway because I probably don't need it. (we have an out of state rental in SC)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

which makes sense because in 2019 I put fair rental days of of 190 and personal use days of 145

Think you messed up there. While possible, I seriously doubt you lived in the property as your primary residence, 2nd home, vacation home or any other "personal pleasure" type of use for 145 days of the tax year, while the property was classified as a rental. (KEY HERE FOR PERSONAL USE DAYS!!!! *WHILE THE PROPERTY WAS CLASSIFIED AS A RENTAL*).

So unless you or a related person "actually did" live in the property for 145 days as your primary residence, 2nd home, vacation home or any other "personal pleasure" type of use, and the property was classified as a rental for the entire tax year, your personal use days would be ZERO.

. I must have converted it by putting personal use days when I should have put 0. At that time it wasn't rented, but I thought that it had to total up to 365 days!

Not quite. Days rented and personal use days must add up to 365 "or less". Personal use days while the property is classified as a rental do count against you, as far as rental expenses go. But vacant periods do not count against you.

you need to amend the 2019 return to show the property was classified as a rental for the entire tax year with ZERO personal use days.

Then you need to amend the 2020 tax return to enter the correct amount of "prior year deprec" on that one. Then you need to amend the 2021 tax return for the same reason. The big PITA with this, is that when you amend a tax return, you can not import anything from the prior year tax return. So for both the 2020 and 2021 tax return, you'll have to manually enter the correct amount of "prior year's deprec" taken. What can make it even more complicated, is if you have multiple assets listed in the assets/depreciation section, as you'll have to ensure each individual asset shows 100% of the allowed depreciation for each tax year.

Of course, this is also assuming the property actually qualifies to be reported on SCH E for 2020 and 2021. Having rented to a "related party" at less than FMRV (Fair Market Rental Value) means the rental income is reported as "other income" and nothing gets reported on SCH E, as the property is considered to have been personal use during such time.

Overall as I see it, throwing a 1031 exchange in the mix really messes things up but good. I would highly suggest you seek professional help in dealing with this. Especially if your state taxes personal income. Otherwise, this could turn into a double-whammy if you're ever audited on this or called out by the IRS or the state. Should that happen, the associated costs would probably make the cost of professional help seem like a pittance in comparison.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

Carl, Amy posted something about the spot where I enter the number of personal days and rented days.

I saw that. To clarify: (Caps for emphasis/importance)

Personal use days is the number of days you or a related family member lived in the property rent free, as your primary residence, 2nd home, vacation home, or any other type of "personal pleasure" use *WHILE* *THE* *PROPERTY* *WAS* *CLASSIFIED* *AS* *A* *RENTAL*.

The number of days before it was converted to a rental, or after it was converted to personal use, *do* *not* *get* *counted* for anything.

That could be what triggered it to be converted?

Nothing "triggers" a conversion from personal use to rental, or from rental to personal use. Take a look at the screenshot @AmyC posted in her previous post. You actually have to take physical action to select the box for "I converted this property from personal use to a rental", or "I converted this property from a rental to personal use".

It gets hung up on SC and I don't want to pay $45 for SC anyway because I probably don't need it. (we have an out of state rental in SC)

I myself am in FL and don't deal with state taxes. However, I got some news for you, and you're probably not going to like it.

Assuming SC is not your resident state, you should be filing a non-resident return with SC every year so that you're showing your losses every year. Otherwise, when you sell that property in SC a significant portion of your gain may be taxable by the state in SC, since you didn't show SC that you depreciated the property and operated at a loss every year.

You really need to seek professional help yesterday, if not sooner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

luckily I have been filing my SC returns! I just don't think they're going to change related to this since this is not SC income. I have to see if there's a way to just download the individual returns and not the whole bundle. I haven't had to pay SC anything yet. Still riding the covid loss on the SC property! This is the first year where I think we'll owe on that.

How does the IRS know if a family member officially rented vs vacant, or non- family member rent for less than FMV?

Def going to try to talk to an accountant. I'm still confused on the 1031 part. Don't care too much about the depreciation etc as long as I can do the 1031. I'll just kick the can down the road as far as recapturing depreciation I should have taken or not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

@cindywhitall wrote:How does the IRS know if a family member officially rented vs vacant, or non- family member rent for less than FMV?

There are various ways the IRS could learn of the situation but, generally, it is an honor system.

Note, however, that a breach could involve severe penalties.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

luckily I have been filing my SC returns!

Thats a good thing, and I really don't concern myself with what others may say or think on that front.

I just don't think they're going to change related to this since this is not SC income.

What makes you think the rent received for the SC property is not SC income? It most certainly is. But, you offset the taxability of that income by reporting the rental income/expenses to the state, so as to show the state you are "in fact" operating at a loss, thus justifying you not paying any taxes on that income to SC.

This will come into play big time, in the tax year you sell the SC property, as your PAL carry over losses will offset your taxable income on any gain realized from the sale. Not only for SC state taxes, but also for your resident state taxes and federal taxes.

Depending on how SC treats depreciation, you can probably expect SC to tax you on recaptured depreciation taken, or the depreciation you "should" have taken.

How does the IRS know if a family member officially rented vs vacant, or non- family member rent for less than FMV?

The federal tax system works mostly on the honor system. But there's several ways they could know. First, they have to look. I do know that the IRS will do "ramdom draws" every year on tax returns to "take a closer look at". Most of those closer looks check out just fine. But there are those that "raise eyebrows" usually resulting in a letter from the IRS requesting some type of proof or verification for expenses claimed, or income received.

As an example, if one sees a significant reduction in rental income on a property from the previous year, that "could" raise an eyebrow. There could very well be a legitimate reason for it too. Maybe not.

Now on the "random draw" thing, I kinda wonder if they're still doing that since they were backlogged for more than a year with the COVID shutdown lasting so long. Also, if you recall the IRS wants to hire 87,000 more agents in addition to the 82,000 they already have. It's a good bet they don't want those extra agents to go after rich people.

I'll just kick the can down the road as far as recapturing depreciation I should have taken or not.

The IRS will love you for that. Especially if/when it bumps you into the next higher tax bracket.

If possible, you should do a "sit down face-to-face" with a CPA so they have all the details to make things right. Also, ensure they provide you with a copy of your tax return(s) that includes all worksheets and calculation forms so you can actually see, trace, and "follow the numbers" to understand how a figure is arrived at. You'll need that information if you want to continue using Turbotax after the CPA has fixed things right. Confirming the validity of your 1031 exchange is first and foremost, keeping in mind you are the one that has to "prove it" to the IRS is questioned on it.

Three rules to keep in mind when dealing with the IRS.

1) You are guilty until proven innocent.

2) The burden of proof is on the accused (that would be you!) and not the accuser.

3) If it's not in writing, then it did not occur.

As far as I know for now, congress has not approved the funding for 87,000 more agents. But that doesn't mean that can't change with the next election cycle, or the one after that, or the one after that, or the..... you get my point.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

@cindywhitall wrote:Def going to try to talk to an accountant. I'm still confused on the 1031 part.

You can speak with an experienced tax professional or a qualified intermediary. Regardless, keep in mind that Section 1031(a)(1) provides that gain can deferred on an exchange of real property held for productive use in a trade or business or for investment.

No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property is exchanged solely for real property of like kind which is to be held either for productive use in a trade or business or for investment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have a schedule E on my 2020 or 2021 returns, Did I converted to personal use? want to do 1031 exchange

@Carl first, thank you so much for your patience and complete answers to my many questions.

I do know that SC wants to tax me and will get me on the depreciation etc if we sell, that's why I have filed with them every year. We just haven't owed yet because the early depreciation and expenses were high. This is the year we use up our carry forward loss 🙄. What I meant is that the condo I am selling is in New Jersey and SC can't tax me on that, so selling it won't affect my SC taxes, so there's no point in amending them. At this point I'm leaning towards leaving it as is, but will try to find an accountant to speak with at least.

You said :

Most of those closer looks check out just fine. But there are those that "raise eyebrows" usually resulting in a letter from the IRS requesting some type of proof or verification for expenses claimed, or income received.

As an example, if one sees a significant reduction in rental income on a property from the previous year, that "could" raise an eyebrow.

That is the reason that I did not attempt to continue to claim expenses or depreciation. There was no reduction in income (relative to expenses), since we stopped claiming it as a rental. IRS isn't wasting time on us (unless the get those agents, lol!) We pay LOTS of taxes because we only claim the standard deduction. The SC condo has a management company, so no red flags to set off there, probably very similar to every other one down there.

As for the depreciation I didn't take these last 3 years on the NJ condo, it can't be more than $8000, so if I have to pay tax on that later if we sell the property we 1031 exchanged it for, I'll deal with it. I

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

howverytaxing

Returning Member

user17592014175

Level 2

sfvaziri3913

Returning Member

Twin1954

Returning Member

SB2013

Level 2