- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You should see the income from your son reported on the sch E with expenses at fair rental value. Below fair market value, only the income is claimed and it is usually not reported on sch E but as Other Income instead. Below fair market value is considered personal use of your second home.

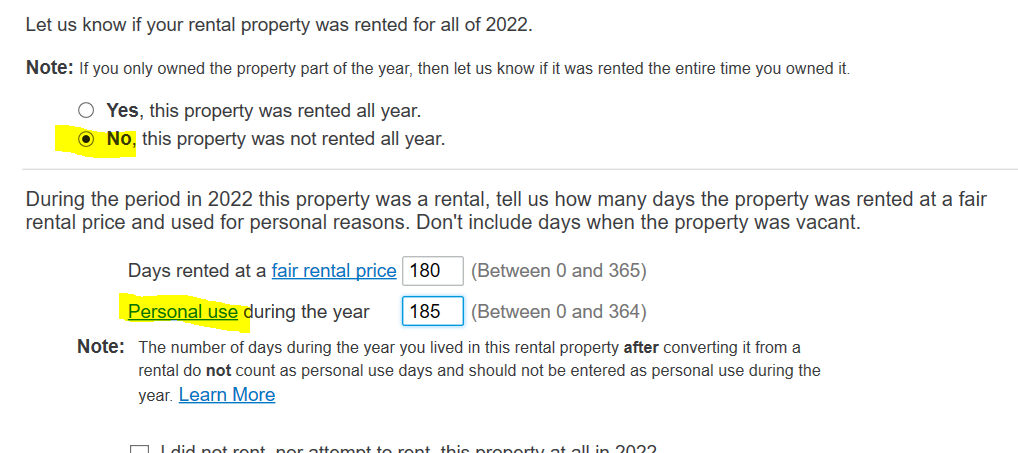

When you convert a rental to personal use, the program stops the depreciation at that point. The property profile asks if any situations apply to the property. You would have marked the conversion, the personal use days, and rented days. You can look at your sch E and the depreciation report, Form 4562 along with the Asset Wks.

You can also compare the depreciation amount with prior years. Depreciation is the same amount every year until you convert/ dispose and then it is prorated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"