- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: How to file Maryland K-1 504 form (MD resident)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Maryland K-1 504 form (MD resident)

Use these steps to enter the MD trust Schedule K-1 box 3 and box 4 amounts in your Maryland nonresident tax return:

- If your box 4 amount on the MD trust K-1 is for U.S. Govt interest reported in box 1 or box 2 of federal K-1 for the trust, that amount can be entered during the federal K-1 entry by entering the U.S. Govt. interest amount under the applicable box 1 and/or box 2 amount.

- If your box 4 amount on the MD trust K-1 is for U.S. Govt capital gains reported in box 4a of the federal K-1, you will be prompted to enter the MD trust K-1 box 4 U.S. Govt interest during the Maryland state return questions.

- For MD trust K-1 box 3 "Additions", if you are using TurboTax Download/CD, you can enter these Additions in Forms mode (click the top right in blue bar). Use the Open Form button to search for the “Other Additions Worksheet-Nonresident” form and entering the Additions on Line a (name of trust in text field, and amount in the amount field).

- If you have subtractions in the MD trust K-1 other than U.S. Govt interest/gain (already entered in the steps 1 and 2 above), you can use the Open Form button to search and find the “Form 502SU” form and enter the Subtractions not already entered as U.S. Govt interest/gain there.

- If you are using TurboTax Online, the steps 1 and 2 above are the same. But, for the MD trust K-1 box 3 Additions and "other than U.S. Govt" box 4 Subtractions, you will need to find the "Here's the income that Maryland handles differently" screen in your Maryland state return questions. On that screen, under the Business heading, you need to find the Partnership and S Corporations Adjustments line. Start or Review that line to enter the box 3 Additions and "other than U.S. Govt" box 4 Subtractions. If the Partnership and S Corporations Adjustments line is not under the Business heading, you may need to contact TurboTax for further assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Maryland K-1 504 form (MD resident)

I am fiduciary filing taxes for my mother who passed away in 2020. There was a trust and I’m preparing the federal 1041. All trust income has been distributed to family members in 2020 and they will have K1’s which will distribute their respective income to their respective 1040 and state tax returns. The taxable trust income is 0 on 1041.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Maryland K-1 504 form (MD resident)

No - Even though the income is distributed to the beneficiaries of the trust, you must file a MD fiduciary return if:

- the trust is required to file a federal fiduciary income tax return or is exempt from tax under Sections 408(e)(1) or 501 of the Internal Revenue Code (IRC), but is required to file federal Form 990-T to report unrelated business taxable income, and

- Has Maryland taxable income.

For more information, please see: MD Instructions for filing fiduciary income tax returns

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Maryland K-1 504 form (MD resident)

I received a Maryland K-1 504 but there is nothing reported in the "Distributed Net taxable Income, ..." Section. I also cannot find the Trusts, Estates, or Partnerships section on the page entitled "Here's the income that Maryland handles differently". There was only one amount on Federal form 1041 K-1 in box 14, labeled "H". Does this mean that there is nothing to fill out on form 504, and that is why nothing is showing up? Please advise, thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Maryland K-1 504 form (MD resident)

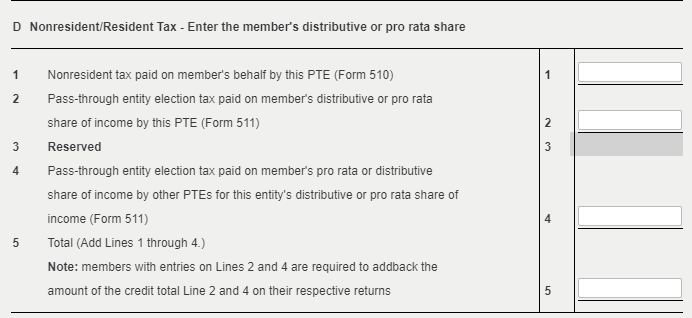

How do you input on a MD K-1 (504) Line 5? The Beneficiary's share of nonresident tax paid by PTE.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Maryland K-1 504 form (MD resident)

Enter the beneficiary's shar of nonresident tax paid by PTE at the screen Maryland Schedule K-1 Information.

In TurboTax Online, In the Maryland income tax return, enter the entity information at the screen Tell us about this Maryland Schedule K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Maryland K-1 504 form (MD resident)

This is screen is for partnerships and corporations. I need where to input a Trust return K-1. Are you saying to enter on the partnership and corporation screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Maryland K-1 504 form (MD resident)

Yes, enter any Schedule K-1 with pass-through entity tax on the page "Tell us about this Maryland Schedule K-1."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dennison-jenna

New Member

Katie1996

Level 1

jackkgan

Level 5

IndependentContractor

New Member

yingmin

Level 1