- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: How to enter carryover passive losses from previous year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter carryover passive losses from previous year

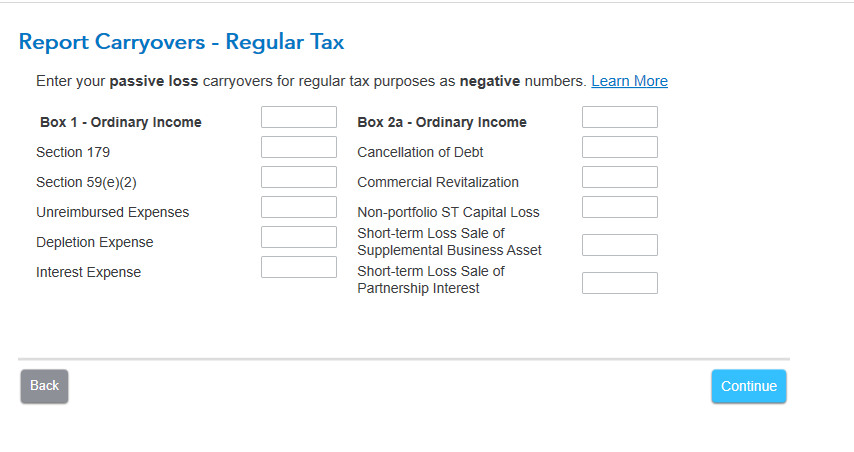

My CPA prepared taxes last year. I have form 8582 and all relevant work sheets. But I am still clueless on how to enter information on attached screen in Turbo Tax (Home & Business 2019 CD version).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter carryover passive losses from previous year

What is the passive activity? Rental property? Was it reported on a K-1 (from a S-corporation, Partnership or Estate)? Or was it reported as your rental rental on page 1 of Schedule E?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter carryover passive losses from previous year

On rental property which I own directly and two LLC where I am passive limited partners which owns real estate (like apartments)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter carryover passive losses from previous year

If you receive a K-1 reporting your rental income/losses, then *ONLY* page 2 of the SCH E has data on it concerning your rental property.All rental income/expenses would be dealt with on the 1065 Partnership/multi-member LLC return, and that includes the carry over losses. They would not be on your personal return at all.

However, you mention that you do have IRS Form 8582. That form is only used when reporting rental income/expenses on page 1 of the SCH E as a part of the 1040, 1040-SR or 1041 estate return. Therefore I am assuming you report this rental income on page 1 of your SCH E as a physical part of your 1040 personal tax return. If that assumption is wrong, stop reading now and correct me.

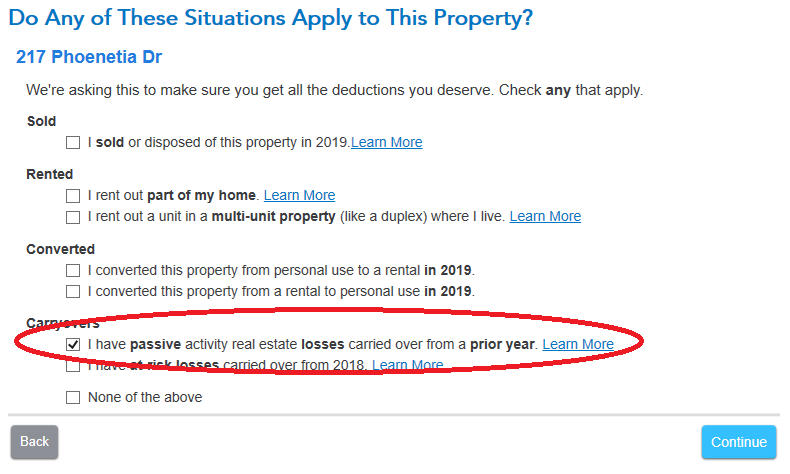

When you start entering this rental property for your first time in the 2019 program, see the screen shot below for what you "MUST" select in order to account for your prior year's carry over losses. You'll find this screen in the "Property Profile" section for the rental.

Now if any of the other information from last year's return doesn't agree with what TurboTax figures, then it's most likely because "you" entered incorrect data or made a wrong selection. So don't "assume" anything and go changing figures done by the program on your own, without asking about it first. The most common area where folks go changing what the program figured has to do with depreciation. 99.999% of the time the program is right, and the user is wrong. So if you question what the program figures, *PLEASE* for the sale of your wallet, please ask about it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HNKDZ

Returning Member

DallasHoosFan

New Member

garne2t2

Level 1

mjtax20

Returning Member

epiciocc12

Level 2