in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: How do I indicate the date on which I converted my rental property to my primary residence?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate the date on which I converted my rental property to my primary residence?

I indicated in TT that I converted my property “from rental to primary residence”. In the “Asset” section, I went through the questions for the “New Rental Property” to calculate the cost basis for the purchase in 2021 and to record number of fair rented days. However, there was no question about whether I stopped using the asset in 2021.

Do I need to record when I stopped using the asset in 2021? If so, How do I indicate the date on which I converted my rental property to my primary residence?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate the date on which I converted my rental property to my primary residence?

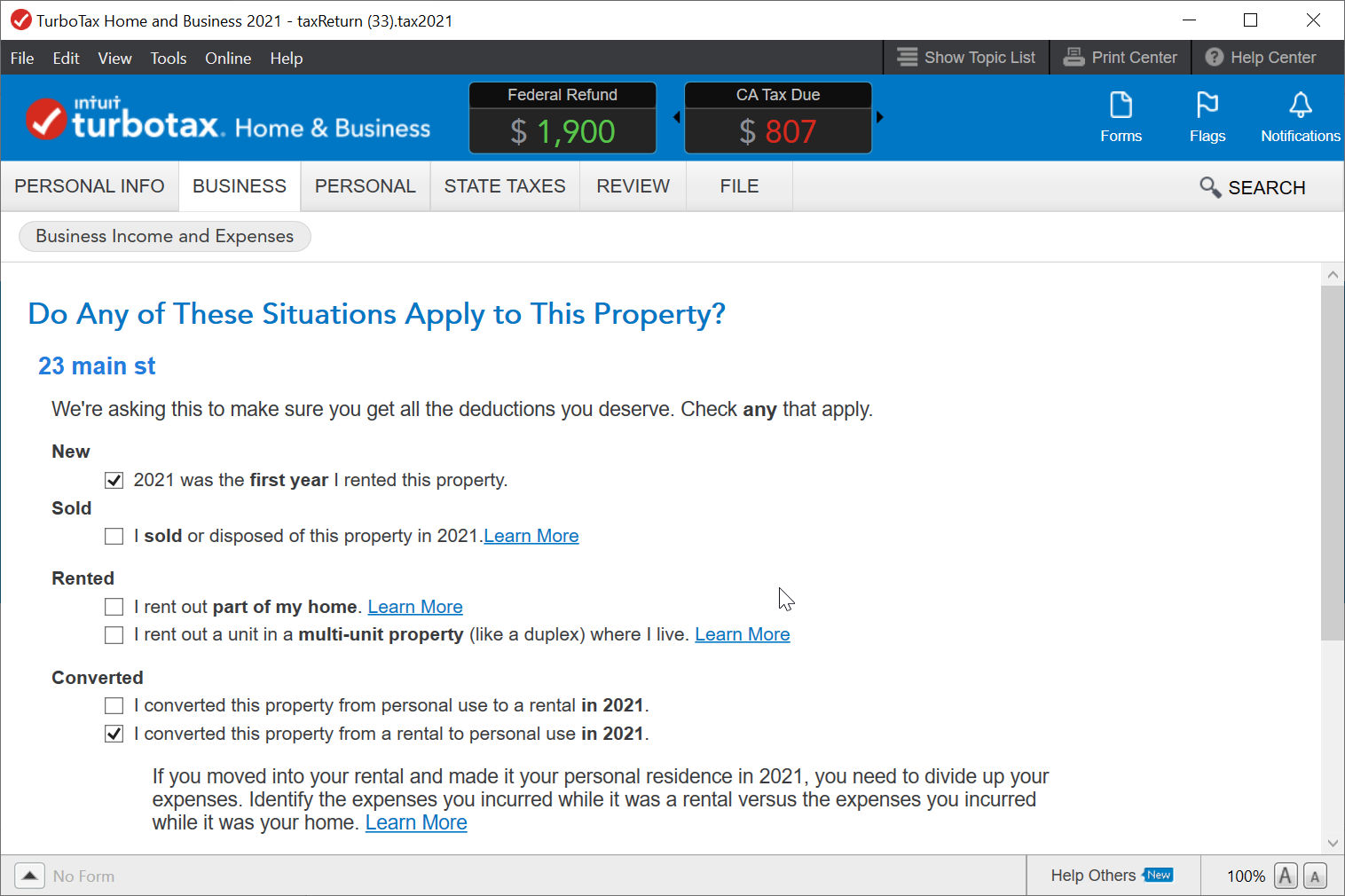

There is a section entitled Any of these Situations Apply to This Property. Here you will indicate that 2021 was the first year you rented the property and that you converted it from personal to business use. I have included a screenshot at the bottom of the page.

To report the date you stopped using the asset, go to the Assets/Depreciation section of your rental summary,

- start answering questions until you reach a page that says Your property Assets, select edit where your rental property is listed.

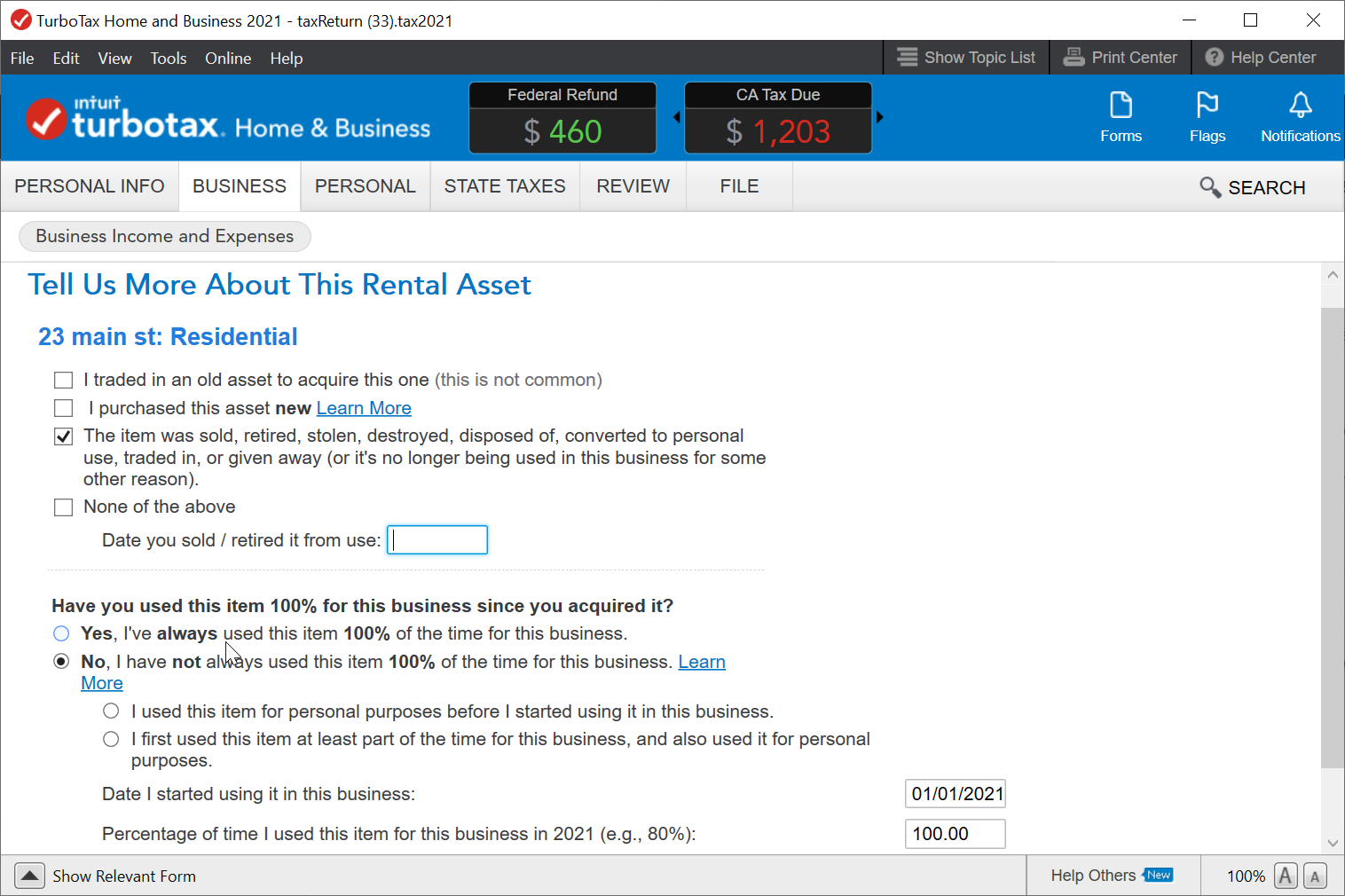

- Answer the questions until you get to a screen that says Tell us more About This Rental Asset. Select the item was Sold, Retired .....

- When you make this selection, a pop up will occur that asks you when you retired it from use. I have a second screenshot showing this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate the date on which I converted my rental property to my primary residence?

That is exactly what I would like to do. Does this require TT Home & Business?

In TT Premier 2021, I answered these questions:

“Tell us about your situation this year”, I selected: “First Year Rented” and “Converted Home to Rental or Rental to Home”

“How was My-Rental converted?”, I selected: “From rental to primary residence”

“Was My-Rental rented every single day in 2021?”, I selected: “No”. I then entered the “Fair Rented Days”.

When I Edit the details related to the "New Rental Property", TT Premier 2021 gives me a "Tell us more about your purchase of The-Rental" screen and then asks a series of questions about cost basis. I assume that's because I purchased the rental property in 2021. I would like to indicate that the asset was converted to personal use... but I don't see how to get TT Premier 2021 to show a screen where I can provide that info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate the date on which I converted my rental property to my primary residence?

Duplicate post.

@chriswa1 you did not convert the home to a rental. It was already a rental when you purchased it. The only conversion you did was converting it from a rental to personal use. For details on what to do, see my response in your other thread at https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/re-how-do-i-indicate-...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

THtax2024

Level 1

eric6688

Level 2

ttla97-gmai-com

New Member

user17525168329

Level 1

user17524181159

Level 1