- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Final K1 Statement on Real Estate Form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K1 Statement on Real Estate Form

Very much have appreciated @Rick19744 and many others contributions to the K1 forum and hoped to get last minute feedback on my final K1.

Received a Final K1 from a real estate partnership which sold its only asset in Dec 2023 from which I received my distributions. Purchased asset in 2019.

From the K1 (1065):

L:

| Beginning Capital Account | -2266 |

| Capital Contributed During Year | |

| Current year net income (loss) | 45297 |

| Other increase(decrease) | -143 |

| Withdrawal and distribution | 42888 |

| Ending Capital Account | 0 |

From Part III

Box 2: Net rental real estate income 12337

Box 9c: Unrecaptured section 1250 gain: 3974

Box 10: Net Section 1231 gain (loss): 32960

Box 19: Distributions: 42888

I've struggled with the turbotax question tree and had hoped someone can weigh in on if my choices makes sense:

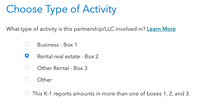

> I selected this as partnership was liquidated as a result of sale of the assets in the partnership

>Complete disposition seemed most applicable here as I did not sell my interest in the partnership, rather the partnership was liquidated. This option, to my understanding, generates a final K1

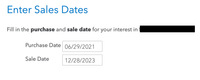

>What sale date should be used here? The date that my distribution is posted seems most applicable.

>Again, sale price without a sale appears incorrect? It does not appear consistent with K1 documentation

>Is this scenario consistent with "disposition of an interest in a partnership?" Based on my read, I selected no

>Ultimately, I carried over losses on this property that offset gains. Is this unusual for real estate deals?

Appreciate the late advice. I thought I had this figured out but now am hoping for a second pair of eyes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K1 Statement on Real Estate Form

Some follow-up comments:

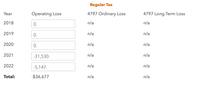

- Your initial post indicated that you began the investment in 2019, however, you start with 2021 in your recent response. What happened in 2019 and 2020? No K-1?

- Your tax basis cannot go below zero. Forget any liabilities when determining your tax basis. These are really used in determining if allocations can be made at the partnership level and only complicate this equation for you. In the end, they should net out having no impact.

- Based on the additional information:

- Tax basis at the end of 2021 is $3,469 (35,000 - 31,531)

- For 2022 you begin with the 3,469 and first reduce the basis by the distribution of 587 leaving 2,882. You then reduce the basis by 2,882 (of the 5,187 loss) arriving at zero. Not sure how your actual return handled this, but this is what SHOULD have occurred.

- For 2023 your basis begins with 0, increased by the 32,960 and 12,337 which totals 45,297.

- So assuming no K-1 in 2019 and 2020, when TT asks for your tax basis or whatever terminology they use, you would enter the 45,297. The sales price is the 42,888 distribution. TT should then reflect a small capital loss on form 8949 and Sch D of 2,409. This is arrived at by subtracting the distribution (sales price) from your tax basis; leaving you with the 2,409. A positive tax basis remaining means a capital loss, if this would go negative that would indicate a capital gain.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K1 Statement on Real Estate Form

Here are a few comments:

- If there is an ending date on the K-1, use that as the sale date. If not, just use 12/31/2023

- You should have been maintaining a separate "tax basis" schedule. What is listed on the K-1 is tax capital. While these may close in theory, your tax basis cannot go below zero, however, the tax capital can go below zero; as noted in your facts.

- I think your choice of "liquidation" is fine.

- Complete disposition needs to be checked as well. This will free up any suspended losses, which based on your facts you in fact have suspended losses.

- Don't get hung up on "sale price" and the liquidation. End result will be the same for tax purposes.

- For the sales proceeds use the $42,888 figure.

- When updating your tax basis for the final K-1, DO NOT adjust it for the liquidating distribution noted in the previous bullet.

- You will need your tax basis amount when asked by TT for your "cost basis".

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K1 Statement on Real Estate Form

Thank you @Rick19744 I'm afraid I'm lost on tracking tax basis, I'm assuming that tax basis is same as "Partnership Basis" asked for in TurboTax?

I understand tax basis = money contributed, liability contributed, income partnership received LESS losses and nondeductible expenses.

For 2021 this would be:

35000 + 61202 ( 59403 QNR financing + 1799 non recourse share of liability contributed) + (0 income) -31531 (losses) = 64671

On my 2021 tax Box 20 Code Z, there is a note that "unadjusted bias of assets is 84225". Seems like I'm missing something

Not sure I should attempt 2022 or 2023 estimation without knowing I'm on the right track ...

| 2021 | 2022 | 2023 | |

| Starting | 0 | 3469 | -2266 |

| Initial Investment | 35000 | ||

| allocable net income | -31531 | -5148 | 45297 |

| cash distribution | 587 | 42888 | |

| Box 2 rental inc/loss | -31531 | -5147 | 12337 |

| Box 10 | 32960 | ||

| Box 19 Distribution | 42888 |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K1 Statement on Real Estate Form

The UBIA reported for Schedule K-1 Box 20 (QBI) is not related to your tax basis in the investment. In most cases, your tax basis is your calculated partnership basis, not the ending capital that appears on Schedule K-1 Part L.

Your calculation of adjusted basis appears to be accurate, as long as there were no other adjustments on prior K-1s for items specifically allocated to you (and not reported in the allocated partnership income). These items are typically reported on a Supplemental Information page that comes with Schedule K-1, and may include charitable contributions, non-deductible expenses, etc.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K1 Statement on Real Estate Form

Some follow-up comments:

- Your initial post indicated that you began the investment in 2019, however, you start with 2021 in your recent response. What happened in 2019 and 2020? No K-1?

- Your tax basis cannot go below zero. Forget any liabilities when determining your tax basis. These are really used in determining if allocations can be made at the partnership level and only complicate this equation for you. In the end, they should net out having no impact.

- Based on the additional information:

- Tax basis at the end of 2021 is $3,469 (35,000 - 31,531)

- For 2022 you begin with the 3,469 and first reduce the basis by the distribution of 587 leaving 2,882. You then reduce the basis by 2,882 (of the 5,187 loss) arriving at zero. Not sure how your actual return handled this, but this is what SHOULD have occurred.

- For 2023 your basis begins with 0, increased by the 32,960 and 12,337 which totals 45,297.

- So assuming no K-1 in 2019 and 2020, when TT asks for your tax basis or whatever terminology they use, you would enter the 45,297. The sales price is the 42,888 distribution. TT should then reflect a small capital loss on form 8949 and Sch D of 2,409. This is arrived at by subtracting the distribution (sales price) from your tax basis; leaving you with the 2,409. A positive tax basis remaining means a capital loss, if this would go negative that would indicate a capital gain.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K1 Statement on Real Estate Form

Thank you for your responses. You were so helpful in me being able to file. Was also able to check on prior years returns to ensure I had done my math correctly. Absolute great response.

Some clarifications.

I made an initial typo. Investment occurred 2021, not 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K1 Statement on Real Estate Form

You are welcome

Also keep in mind the date of replies, as tax law changes.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thisblows

Returning Member

Naren_Realtor

New Member

DennisK1986

Level 2

Judes1

New Member

MrsMacAdoo

New Member