- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K1 Statement on Real Estate Form

Very much have appreciated @Rick19744 and many others contributions to the K1 forum and hoped to get last minute feedback on my final K1.

Received a Final K1 from a real estate partnership which sold its only asset in Dec 2023 from which I received my distributions. Purchased asset in 2019.

From the K1 (1065):

L:

| Beginning Capital Account | -2266 |

| Capital Contributed During Year | |

| Current year net income (loss) | 45297 |

| Other increase(decrease) | -143 |

| Withdrawal and distribution | 42888 |

| Ending Capital Account | 0 |

From Part III

Box 2: Net rental real estate income 12337

Box 9c: Unrecaptured section 1250 gain: 3974

Box 10: Net Section 1231 gain (loss): 32960

Box 19: Distributions: 42888

I've struggled with the turbotax question tree and had hoped someone can weigh in on if my choices makes sense:

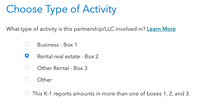

> I selected this as partnership was liquidated as a result of sale of the assets in the partnership

>Complete disposition seemed most applicable here as I did not sell my interest in the partnership, rather the partnership was liquidated. This option, to my understanding, generates a final K1

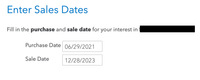

>What sale date should be used here? The date that my distribution is posted seems most applicable.

>Again, sale price without a sale appears incorrect? It does not appear consistent with K1 documentation

>Is this scenario consistent with "disposition of an interest in a partnership?" Based on my read, I selected no

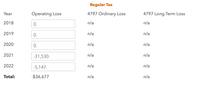

>Ultimately, I carried over losses on this property that offset gains. Is this unusual for real estate deals?

Appreciate the late advice. I thought I had this figured out but now am hoping for a second pair of eyes.