- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Federal and State Schedule E discrepancy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal and State Schedule E discrepancy

My PA Schedule E is flagged for me to provide data to a second property but I have no second property. My Rental and Royalty Summary section on federal return is correct and only lists one property. How can I fix PA schedule E to remove the second non-existent property?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal and State Schedule E discrepancy

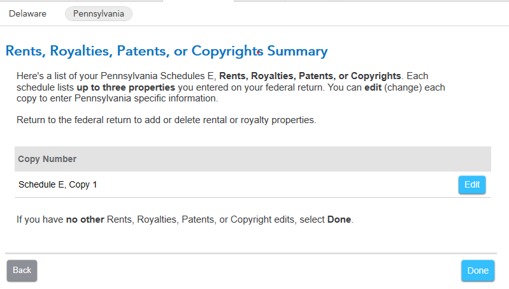

You can fix this by deleting the Pennsylvania Schedule E. Make sure you are not deleting your Federal Schedule E. Here is how:

- Click on Tax Tools near the bottom of the left side menu.

- Select Tools.

- Click on Delete a form.

- Scroll down to Pennsylvania Return.

- Look for Schedule E (Schedule E, Copy 1) under Pennsylvania Return, click Delete to the right.

- Confirm that you want to delete the form.

Because you still have a Federal Schedule E, the PA form will regenerate right away, but without the phantom property from last year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal and State Schedule E discrepancy

Your state return is populated by data entered into your Federal Return, so you want to make sure that TurboTax is not showing a secondary rental property. Here is how you can check while you are in TurboTax:

- While in your Tax Home,

- Select Search from the top right of your screen,

- Enter Schedule E,

- Select Jump to Schedule E,

- Continue through the on-screen prompts, until you

- see your Rental and Royalty Summary,

- Select Delete next to the secondary property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal and State Schedule E discrepancy

Thanks for your reply Regina. As I explained in my statement I did go to the Rental and Royalty Summary for my federal return and that property is not there. It was a property that I rented last year but not this year. It has already been deleted but I can't yet get around the forced entries into the state return. More help is appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal and State Schedule E discrepancy

Oh, I see. Your State return has been populated with the property you disposed of last year. Try this,

- While your are in your Tax Home,

- Select State from the left side of your screen,

- Select Your State Return,

- Follow through the On-Screen Prompts until you get to your Rental & Royalty Property Summary.

It should be here on this screen for you to delete.

Hopefully, this does it!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal and State Schedule E discrepancy

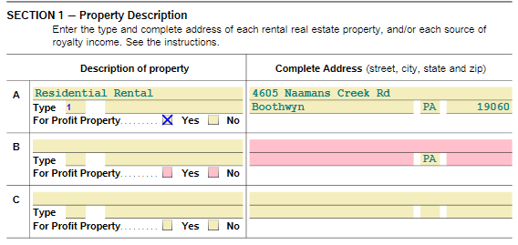

No luck. The property is not listed in the state Rental and Royalty Summary. There is one property listed and this is a valid rental property that is entered as property A on Schedule E.

The pink shaded boxes shown below for property B on Schedule E are the ones that are preventing me from finishing. The form believes I have a second rental property to enter.

Any more suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal and State Schedule E discrepancy

You can fix this by deleting the Pennsylvania Schedule E. Make sure you are not deleting your Federal Schedule E. Here is how:

- Click on Tax Tools near the bottom of the left side menu.

- Select Tools.

- Click on Delete a form.

- Scroll down to Pennsylvania Return.

- Look for Schedule E (Schedule E, Copy 1) under Pennsylvania Return, click Delete to the right.

- Confirm that you want to delete the form.

Because you still have a Federal Schedule E, the PA form will regenerate right away, but without the phantom property from last year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal and State Schedule E discrepancy

Thank you Julie, that worked.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kac42

Level 2

rtoler

Returning Member

yingmin

Level 1

Kh52

Level 2

soccerdad720

Level 2