- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Casualty Loss on A/C Unit for Rental Property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

During Hurricane Sally, a tree fell on and destroyed an exterior air conditioning unit that was not fully depreciated. As I see it, I will be able to deduct the remaining depreciation of this as a Casualty Loss. My question therein lies with the brand new unit that I purchased for $3900.00 (a pretty substantial chunk of change out of pocket during a disaster which resulted in almost $500,000.00 of damage to my rental property). Can I take the new unit as a Casualty Loss expense, or must I now depreciate it over 27.5 years?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

If you designate the A/C unit as a Land Improvement in TurboTax, the default depreciation period will be 15 years, which is more appropriate. You will see this option in TurboTax if you classify the asset as Rental Real Estate Property.

If you use the desktop version of TurboTax, you can go directly to the Asset Entry Worksheet and manually choose the appropriate years of depreciation based on the useful life of the asset.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

Yes, you can claim a casualty loss on the A/C unit destroyed during Hurricane Sally.

Hurricane Sally was declared a federal disaster - see Alabama Hurricane Sally (DR-4563-AL)

To enter casualty losses in your return, this done through the Casualty and Theft deduction. This deduction covers property that’s damaged as a result of a disaster, such as a storm, flood, fire, car accident, or similar event, and also covers stolen property. Property includes anything you own.

To enter this in TurboTax:

- Got to the "Federal Taxes" tab

- Click on "Deductions & Credit"

- Scroll down to "Other Deductions and Credits" and click on "show more" to the right of it

- Click "Start" next to "Casualties and Thefts" continue to follow the onscreen guide.

Note: For information on determining the basis of your business or income-producing property, refer to IRS Publication 584-B, Business Casualty, Disaster, and Theft Loss Workbook.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

My question is not about whether I can claim the destroyed unit as a Casualty Loss. I know I can do that. What I want to know is can fully depreciate the NEW unit this year instead of expensing over 27.5 years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

I am in a Qualified Declared Natural Disaster area as well. TurboTax is not marking it as a Qualified Disaster Area on the asset entry form/sheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

Since the total cost of repairs exceeded $10,000, you will have to depreciate the cost of the replacement unit over 27.5 years.

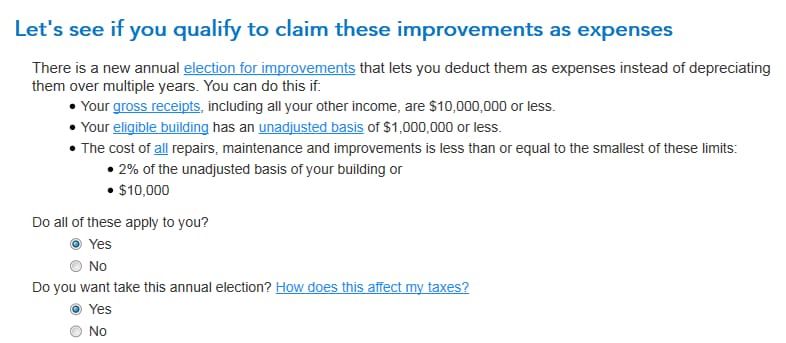

Under certain circumstances, you can elect to expense the cost of building improvements, but the cost of your repairs (nearly $500K) exceeds the limits established for this option.

In the Business Asset interview, TurboTax will ask you "Did you make improvements to a building you used for this business in 2020?" If you say Yes, you'll see this screen:.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

I don't understand your answer. The NEW a/c unit only Cost $3900.00.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

Forget the $500,000, I'm not taking it. I'm only asking about the $3900.00 for the air conditioner. In addition, I don't know why TurboTax is not showing the selection for Qualified disaster on the asset entry form, even though I select that option during the step-by-step section during the asset entry process.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

The "Qualified Disaster " requirement doesn't apply to your ability to expense the new unit - it is a separate, new election for improvements.

See the post: What can I expense or depreciate with the business safe harbor election?

Look at the drop-down: For 2019, Building Improvements (it also applies to 2020)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

Thank you for your fast response to my question, but in studying the links that you sent on the safe harbor elections, it has brought up another question. My business is a mobile home park, valued at $1,000,000. The air conditioning unit was for one of the mobile homes that I own and rent. I have the mobile home in my books that I purchased for $17000 (unadjusted basis). The requirements for the safe harbor for improvements seem to say that the all my maintenance expenses, etc. must be less than 2% or $10,000. Two percent of $17000 is only $340, haha. I never have expenses less than that amount for a mobile home. Do I use the unadjusted basis for just the mobile home, or do I use the unadjusted basis for my mobile home park as a whole since it is the business? Still not sure whether to take this safe harbor or depreciate this out for a blooming 27.5 years, which to me is ridiculous since an air conditioner never last that long.

Thank you again for answering my persistent inquiries.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualty Loss on A/C Unit for Rental Property

If you designate the A/C unit as a Land Improvement in TurboTax, the default depreciation period will be 15 years, which is more appropriate. You will see this option in TurboTax if you classify the asset as Rental Real Estate Property.

If you use the desktop version of TurboTax, you can go directly to the Asset Entry Worksheet and manually choose the appropriate years of depreciation based on the useful life of the asset.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

howellw

New Member

naokoktax

New Member

misstax

Level 2

keithl1

Level 2

misstax

Level 2