- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boil...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boiler system and turbotax is saying I need to fill out a 1099.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boiler system and turbotax is saying I need to fill out a 1099.

No, you do not need to be a business to issue this form. You would use your name, address, and under payer's TIN, you will use your Social Security Number. You will need to get the contractor's information also including his TIN. That could either be his Social Security Number or an EIN for his business, if they have that number. This must be filed by Jan 31.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boiler system and turbotax is saying I need to fill out a 1099.

Businesses are required to file 1099s to their vendors if they pay more than $600 per year.

Landlords are generally not businesses, although this is somewhat confused and it is being debated.

The IRS has stated that even if you are not required to file a 1099, you may do so voluntarily, because it helps to increase tax compliance. If you don't have an EIN, you would use your SSN.

Finally, you don't need to issue a 1099 even if you are a business, if the person you are paying is an S- or C-corp. You only need to issue the 1099 to partnerships and sole proprietors. You find this out by giving the vendor a form W-9 to fill out to collect their tax number, and see which box they check on the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boiler system and turbotax is saying I need to fill out a 1099.

Yes, if you paid a contractor more than $600, you need to issue them a 1099-NEC. To do this in Turbo Tax online.

- After signing in to TurboTax, open or continue your return.

- Select Tax Home from the left-side menu (you might already be there)

- Scroll down and select Your account.

- Select Create W-2s and 1099s.

- Follow the instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boiler system and turbotax is saying I need to fill out a 1099.

Do I select sole proprietorship on the 1099 even though I've never set myself up as a business?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boiler system and turbotax is saying I need to fill out a 1099.

No, you do not need to be a business to issue this form. You would use your name, address, and under payer's TIN, you will use your Social Security Number. You will need to get the contractor's information also including his TIN. That could either be his Social Security Number or an EIN for his business, if they have that number. This must be filed by Jan 31.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boiler system and turbotax is saying I need to fill out a 1099.

Whether you need to issue a 1099-Misc became a little fuzzy under the new 2018 tax law. Landlords are, generally, still NOT require to issue 1099-Misc forms to service providers.

But, a landlord 1099-misc may be required to qualify for the QBI deduction. Reference: https://www.nolo.com/legal-encyclopedia/do-landlords-need-to-file-form-1099-misc.html Most rental properties do NOT qualify for the QBI deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boiler system and turbotax is saying I need to fill out a 1099.

Businesses are required to file 1099s to their vendors if they pay more than $600 per year.

Landlords are generally not businesses, although this is somewhat confused and it is being debated.

The IRS has stated that even if you are not required to file a 1099, you may do so voluntarily, because it helps to increase tax compliance. If you don't have an EIN, you would use your SSN.

Finally, you don't need to issue a 1099 even if you are a business, if the person you are paying is an S- or C-corp. You only need to issue the 1099 to partnerships and sole proprietors. You find this out by giving the vendor a form W-9 to fill out to collect their tax number, and see which box they check on the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boiler system and turbotax is saying I need to fill out a 1099.

@Opus 17 wrote: "Landlords are generally not businesses, although this is somewhat confused and it is being debated."

Very true. This web reference has a very good discussion of this issue:

https://www.nolo.com/legal-encyclopedia/is-your-rental-activity-business-investment.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I complete a 1099 if I'm not a business? I rent a house and paid over $600 for a new boiler system and turbotax is saying I need to fill out a 1099.

I rent a house and paid over $600 for a new boiler system

It's not clear if you rent "out" a house, or if you "pay rent" for a house. If you pay rent, you have nothing to deduct, report or claim anywhere on your tax return. Just like you don't have to report paying $30,000 for a new car.

If you are a landlord, (I assume you are) then all rental income/expenses get reported on SCH E.

I'm not a business

Yes you are if you are a landlord. But since rental income is passive, it gets reported on SCH E instead of SCH C. Passive income is not subject to the self-employment tax, doesn't count towards social security or a tax deferred retirement account. So that's one reason it's reported on SCH E and not SCH C.

The new boiler system is an asset that becomes a physical part of the structure. So it's entered in the Assets/Depreciation section and depreciated over time.

As a landlord that owns the property you are not required to issue a 1099. But you most certainly can if you want to.

TurboTax is saying I need to fill out a 1099.

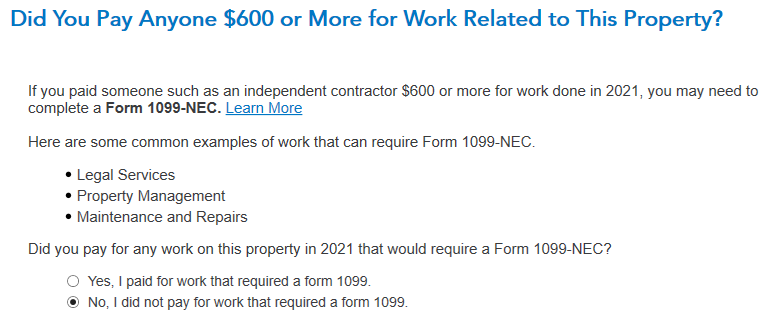

That's because you told the program as shown in the screen shot below, that you are required to. You're not.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

exintrovert

New Member

Mike-2

Level 1

Ssmith18

Level 1

shtomlin

Level 1

Titanopsis

New Member