- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I rent a house and paid over $600 for a new boiler system

It's not clear if you rent "out" a house, or if you "pay rent" for a house. If you pay rent, you have nothing to deduct, report or claim anywhere on your tax return. Just like you don't have to report paying $30,000 for a new car.

If you are a landlord, (I assume you are) then all rental income/expenses get reported on SCH E.

I'm not a business

Yes you are if you are a landlord. But since rental income is passive, it gets reported on SCH E instead of SCH C. Passive income is not subject to the self-employment tax, doesn't count towards social security or a tax deferred retirement account. So that's one reason it's reported on SCH E and not SCH C.

The new boiler system is an asset that becomes a physical part of the structure. So it's entered in the Assets/Depreciation section and depreciated over time.

As a landlord that owns the property you are not required to issue a 1099. But you most certainly can if you want to.

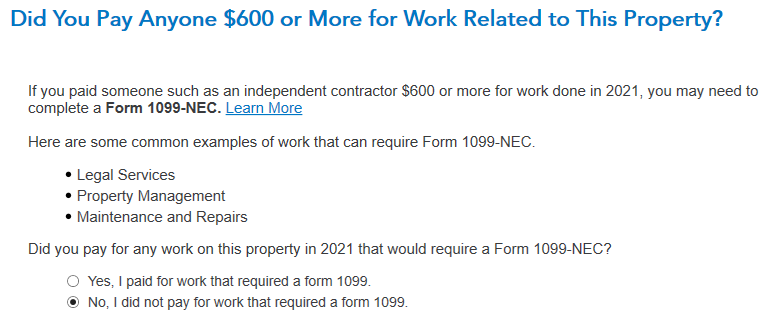

TurboTax is saying I need to fill out a 1099.

That's because you told the program as shown in the screen shot below, that you are required to. You're not.