- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Not finding where to enter 1099-S in Deluxe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not finding where to enter 1099-S in Deluxe.

I've found the Investment Income and 1099-B, but there isn't any link to the 1099-S. Clicking on Add more sales doesn't give you a category to select. It only gives you 1099-B options. Any suggestions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not finding where to enter 1099-S in Deluxe.

You may be required to update to Premier Edition in order to enter your 1099-S. See if the TurboTax FAQ I'm linking below helps you out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not finding where to enter 1099-S in Deluxe.

Kat, thanks so much for answering. I had tried before that link you provided and it did not get me to a screen that I could enter 1099-S information. Only 1099-B. I also upgraded to Premier and the options weren't any different. Since I probably won't get any direct help from TurboTax, I will just have to fill out the 1099-B form the best I can with the 1099-S info. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not finding where to enter 1099-S in Deluxe.

@BrianVW I know this has been an issue for many TT Desktop users this year. I was under the impression that the Online platform still shows options for the various types of investment income.

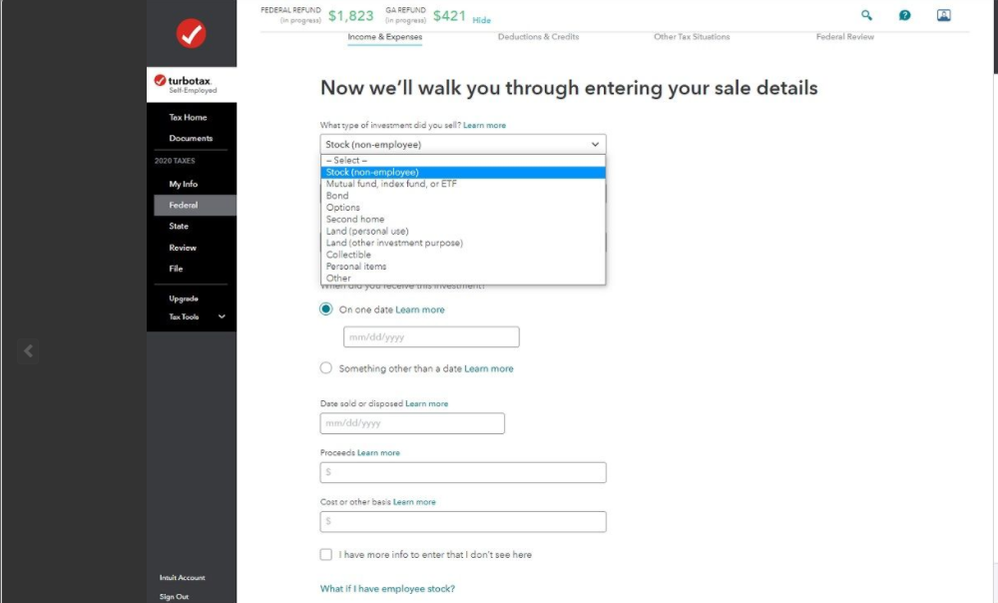

For your sale, do you not see this screen? See screenshot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not finding where to enter 1099-S in Deluxe.

Unfortunately, I'm not seeing that option in the Premier version. It appears that you are using Self Employed, which might be slightly different?

I did get ahold of TurboTax and they also seemed to struggle coming up with an answer. Their final answer was not to input it in Investment Income but to enter it under Less Common Income/Sale of Home. It really doesn't seem accurate since it was a sale of a piece of land, not primary residence. But that is probably what I'll go with. Thanks so much for helping me get to this point!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not finding where to enter 1099-S in Deluxe.

BrianVW,

If the 1099-S is for the sale of a home, then I find that if I go to Forms view and select Schedule D, there is a Quick Zoom button to a Home Sale Worksheet. If you are using Step-by-Step, you might find

https://ttlc.intuit.com/community/entering-importing/help/where-do-i-enter-form-1099-s/00/26218

of value in navigating to the relevant portion of Desktop Premier. It did work on my TT Premier Desktop copy updated this morning.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not finding where to enter 1099-S in Deluxe.

Thanks, the Form view was definitely helpful. It still bothers me that they have it titled as a main home, which is not the case for our vacant land sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not finding where to enter 1099-S in Deluxe.

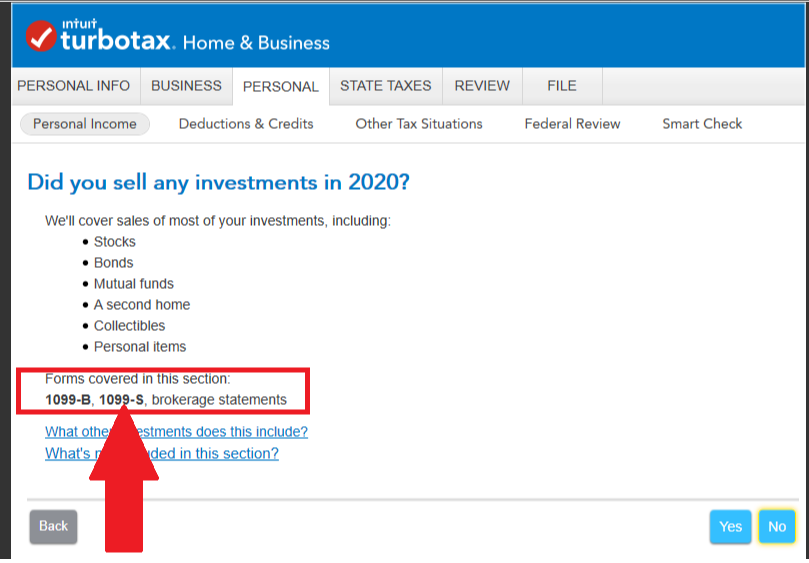

@BrianVW I was under the impression that you're using the Online platform (hence, my screenshot).

If you are using the Desktop (CD/Download) platform, the screenshot I'm sharing below should be available on every TurboTax Desktop edition. Thanks to Champ @Anonymous_ for the screenshot!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not finding where to enter 1099-S in Deluxe.

I also have farm land that I need to show as gifted capital gains on from a 1099-S from the closing attorney. I figured out how to do it with TT Deluxe but after entry it shows up on a 1099-B. So I'm thinking the IRS is going to get a 1099-S from the attorney so what to do about the discrepancy? Talked to a nice lady at TT who identified herself as a CPA and questioned her about this. She said all capital gains like this are going to show up on1099-B - that there is NO 1099-S form generated- it simply will wind up on 1099-B. During the entry proscess you should select "F" (Long Term transactions not reported to you on 1099-B) which will show up on the 1099-B worksheet and form 8949 and this is supposed to square it with the IRS. Check all the 1099-B worksheets and the 8949 that F is shown and correct them on each 1099-B worksheet if not. I still feel queasy about it but someome on this site said they had purched TT Premier and it was no different from the TT Deluxe-it still showed up on a 1099-B. I think TT is a little slack on this one.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

steveepms

New Member

yolotom

Returning Member

TopRoofing

Returning Member

sarah-kozlowski

New Member

ghbrooks4

New Member