- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- No need to report a 2021 1099-B for stock sale in 2018?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No need to report a 2021 1099-B for stock sale in 2018?

Hello,

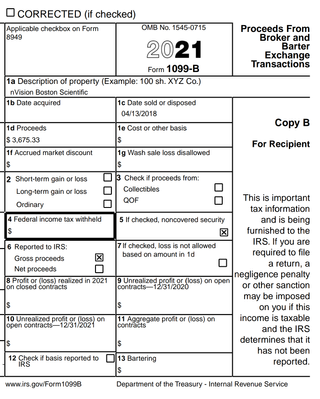

I entered my 1099B and because of the trade date 1C was 4/13/18 (company was sold in 2018, but I didn't get this money until 2021), it's not a short sale, etc. and it's long term investment from 2012, Turbotax said I can delete the form and no need to report for 2021. Is that correct? It seems too late to still report it as 2018 income. I attached my 1099B for your reference.

Thank you,

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No need to report a 2021 1099-B for stock sale in 2018?

You didn't receive the proceeds until 2021, so it would not have been taxable in 2018. Rather, it is taxable in the year received - 2021. Enter the 1099-B as shown, but instead of 4/13/2018 enter the date you received the proceeds as the sales date.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No need to report a 2021 1099-B for stock sale in 2018?

You should have used the trade date back in 2018 to report the sale on your 2018 return. If you did, you do not need to report the sale on your 2021 return. Be sure you have a record (2018 return) showing you already reported the sale.

If you did not use the trade date and report it in 2018, then you would report it as received in 2021 and enter the 1099-B with the date you received the funds as the sale date.

Be sure to keep good record of explanation on how the funds were reported in 2021 vice 2018.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No need to report a 2021 1099-B for stock sale in 2018?

You didn't receive the proceeds until 2021, so it would not have been taxable in 2018. Rather, it is taxable in the year received - 2021. Enter the 1099-B as shown, but instead of 4/13/2018 enter the date you received the proceeds as the sales date.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No need to report a 2021 1099-B for stock sale in 2018?

Hi David,

Thanks for your reply. To clarify, how does this relate to other cases where the sell date or disposal date is e.g. on Dec 31st, but the settlement happens in the following year. Based on that situation, guidance there is always to use the actual sale date (In December), not when money is actually received (settled) for tax purposes.

FYI: In my example, the actual sale date / stock price was from 2018, but the money was held in an indemnity account and could only be released after all lawsuits were settled to determine the remaining available money.

Thanks in advance for your reply.

Thanks,

Serge

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No need to report a 2021 1099-B for stock sale in 2018?

You should have used the trade date back in 2018 to report the sale on your 2018 return. If you did, you do not need to report the sale on your 2021 return. Be sure you have a record (2018 return) showing you already reported the sale.

If you did not use the trade date and report it in 2018, then you would report it as received in 2021 and enter the 1099-B with the date you received the funds as the sale date.

Be sure to keep good record of explanation on how the funds were reported in 2021 vice 2018.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

makeitreynes

New Member

Taxfused

New Member

KS1111

Returning Member

jschoomer

Level 3

Alisha1976

New Member