- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Multimember LLC- Rental Investing Passive or Active?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multimember LLC- Rental Investing Passive or Active?

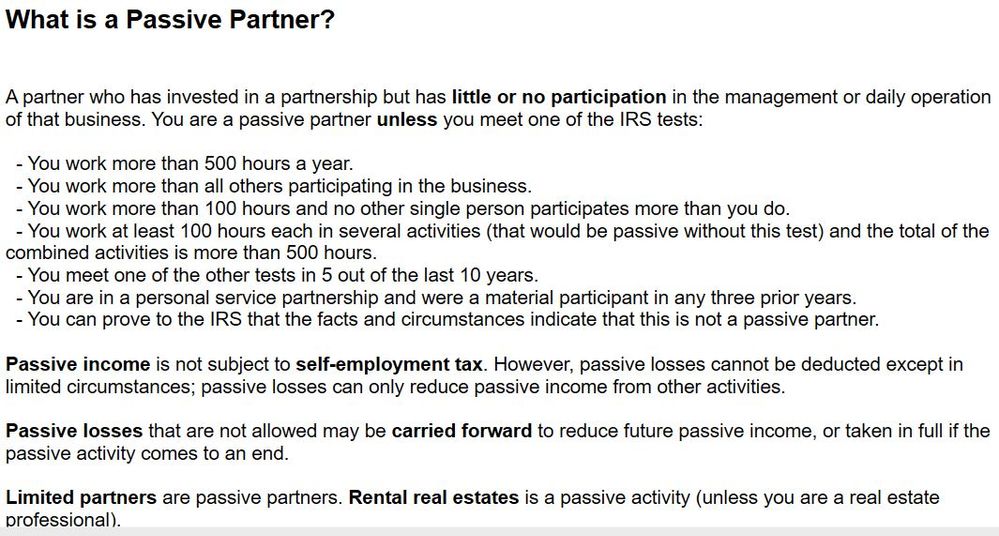

First question- Because I'm manager for this LLC who makes all the decision, should I select actively involved in Form 1065? But below screen shot for this question tells all rental activities are passive. I am not real estate professional.

Second question- my wife who is another member (not the manager) who also helps me with finding tenants, should I select actively involved in Form 1065?

Third question- Because it this LLC is pass thorugh entity, I pay taxes through personal return. While filling the personal return, Form 8582 also asks Rental Real Estate Activities With Active Participation. Should I answer this question as YES only if it is active participation is selected in Form 1065?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multimember LLC- Rental Investing Passive or Active?

Simple answer is, you are both actively involved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multimember LLC- Rental Investing Passive or Active?

@narendran-kandas wrote:While filling the personal return, Form 8582 also asks Rental Real Estate Activities With Active Participation.

Again, the answer is "Yes" (based upon your set of facts) since active participation is a fairly easy standard to meet.

See https://www.irs.gov/publications/p925#en_US_2021_publink1000104573

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shimib

New Member

clmiller52

Level 1

davidsilverman2-

Level 3

atxdesigns

Level 2

TexasRedFish

Returning Member