- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Land and improvement values

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land and improvement values

I get the cost of the land. Turbotax asks for an improvement value. On my Tax Bill, the following numbers appear:

- LAND VALUE = 46,900

- BUILDING VALUE = 318,100

TOTAL VALUE = 365,000

ASSESSED VALUE = 146,000

What do I put on the turbotax "IMPROVEMENT VALUE".

Is the assessed value the improvement value? Or is it the building value? Or neither?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land and improvement values

Fulton County:

Assessed value is 40% of the fair market value.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land and improvement values

The improvement value is the value added to the land. In this case the $318,100 attributed to the house.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land and improvement values

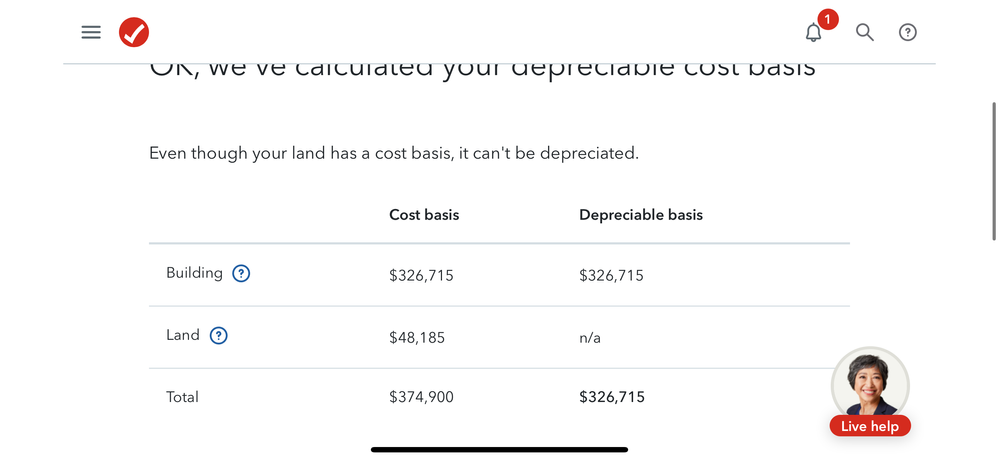

I am running into a wall. TurboTax is stating my cost basis is $374900.

based on my math, is the land is 46900 and the building 318100. The land is 12.85% and building 87.15%.

what I do next is take 374900 and only calculate the building portion (87.15) = 326725

however. Look at the attachments. The number is off. It’s showing $326715 rather than 326725

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land and improvement values

Your cost basis is what you paid for the house plus any capital improvements. If you did not make any improvements, there is nothing to add. If you fenced the yard and added a garage, you have things to add.

Your numbers don't match the ones shown. You need to change the numbers you entered so that the depreciable house amount is the lower of cost basis or fmv.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land and improvement values

The depreciable amount is 374,900

the land value and improvement (building value) I am obtaining from the Fulton county assessors

what number are you saying I need to change

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land and improvement values

You know the land is not depreciated. You know the lower of cost basis or FMV when the rental is placed into service. If the correct number for depreciation is $374,900, your picture shows $326,715 which is a big difference. It seems to me that you would have a capital improvement of $374,900 -318,100 = $56,800. You can also put the full amount for the house and leave capital improvement blank.

The amount you enter for depreciation of the house should be what matches your records and information so that your tax return is right. The program asks a lot of questions trying to help but can take you sideways. Your goal is to have the right number being used for depreciation. You can change the house and land values to force the program to use the numbers you know are right.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

imanusa83

New Member

h86those7taxes84ever

Level 3

asktoknow

New Member

Wanncorp11

New Member

Taxlax

Level 4