in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

TurboTax doesn't really have a "native" interview or process for stock sold with NUA. You might need to figure out your results outside of TurboTax and then make entries in TurboTax that come to that result. If you had sold that stock on the same day it was distributed to you you would have reported LTCG in the amount of the NUA. Price movement since the distribution date is considered short term gain or loss or long term gain or loss depending on how long you owned the stock before selling.

You say you "have the cost basis at that time" (of distribution I assume) and that's because a 1099-R was issued to you since it was a distribution from a retirement plan. That cost basis is still your cost basis.

Since the stock was moved to an after-tax brokerage account its sale should result in you eventually receiving a 1099-B which you might have to break up into two sales if you have short term gain or loss resulting from price movement from the time of distribution to the date of sale.

Tom Young

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

Hello,

In July 2019 I transferred company stock from my 401k to a brokerage account via the NUA method. I recvd the 1099R statement with the cost basis of the account at that time so that part of it is fine. However, I have since sold some of the shares in the brokerage account but there was no cost basis showing for these shares. How do i figure out the cost basis of these sold shares Since I was buying stock for 29 years when this was in my 401k or Is the cost basis the closing price of the stock at the time it was transferred to this brokerage account?

Thank you in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

This would be the stock price when you first bought the stock. This is why there was no cost basis reported because the brokerage did not know the basis you paid when you bought it. There are several websites you can search historical stock prices. i can't recommend which one to pick but try googling the term historical stock prices and then search each one to try to get a consensus on the basis of that stock 29 years ago.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

I have the same issue. IRS rules state that taxes are required in the year of distribution for the cost basis, regardless of any withdrawals were taken. I'm assuming withdrawals greater than the cost basis amount are then taxed at the appropriate capital gains rate. I'm using Turbo Tax Premium, but don't think the calculations are correct. Is Turbo Tax not able to calculate appropriate taxes for NUA distributions?

I was also playing with different scenarios for this year's estimated taxes. I entered income of $50K with capital gains, from the distribution taken last year, of $20K. We are married and filing jointly. According to the tables the rate on capital gains for 2019 is 0% on income less than $78,750. Why did Turbo Tax show a tax increase when the capital gains were entered?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

So where is the the user of TT supposed to enter the information?

The 1099-B form that I received only has an entry for the total proceeds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

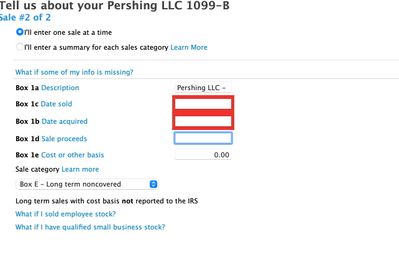

You can make a correction in the 1099-B entry screen.

As you continue through the interview you will be able to manually enter each transaction.

- Box 1e is the Cost or basis.

- If it blank on your 1099-B, leave it blank.

- Just below that is a check box The cost basis is incorrect or missing on my 1099-B.

- Let us know if any of these situations apply to this sale

- Select None of the above.

- I know my cost basis and need to make an adjustment.

- Enter your adjusted cost basis.

An earlier poster did indicate that you will have to go back through the stock history to determine it's original value.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

I have there cost basis for when it was transferred from my 401k to the Brokerage, which was just a few months before I sold about 1/2 of the stock.

Is this the screen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

Yes. Since your 401(k) stock was transferred to a brokerage account via the Net Unrealized Appreciation (NUA) of Employer Stock method, and subsequently sold, you should receive Form 1099-B, which you are correctly handling in your screenshot. .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

I have similar questions. Last year I transferred over company stock into a Broker Account utilizing the NUA. This year I have had several transactions of selling stock, which are being placed on a 1099-B form within Turbo Tax. A few questions?

1. Box 1e Cost or Other Basis. Is this the cost of the stock after it was transfered over to the broker account last year OR the original Cost I used when it was purchased (many many years ago).

2. Since rolling it over to the Broker account, the price has increased which means since it has been less then 1 year I will owe long term Capital gains on the difference as well since rolling this over into the NUA. How do I capture that amount? Do I fill out another form to show those gains?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

Just want to clarify on your answer... Since the stock was moved to an after-tax brokerage account its sale should result in you eventually receiving a 1099-B which you might have to break up into two sales if you have short term gain or loss resulting from price movement from the time of distribution to the date of sale.

How do you break it up into two sales?

I sold some Stock from my Broker Account (NUA). Is the 1099-B the only form I use to report this? Will it capture both the sale of the total Stock and show long term Capital Gains?

Just a little confussed...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

My problem is that the Brokerage that received the company stock only has an entry for the Gross Proceeds.

All the other entries have $0.00

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to know if turbotax handles NUA stock sold. Company stock from pretax dollars that I used NUA strategy on retirement. I have the cost basis at that time.

Edited [Deleted Feb 10, 2021 7:30 AM PST]

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

turbosapper

Level 1

rodiy2k21

Returning Member

jmgretired

New Member

InTheRuff

Returning Member

user17522839879

New Member