- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I need to review a rental sale. It is showing a $ amount in the summary, but the edit/review will not show me any of the numbers/input that is providing that amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to review a rental sale. It is showing a $ amount in the summary, but the edit/review will not show me any of the numbers/input that is providing that amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to review a rental sale. It is showing a $ amount in the summary, but the edit/review will not show me any of the numbers/input that is providing that amount.

Are you referring to the sale of a rental property asset?

If so, the sale of the rental property assets would be reported on IRS form 4797 Sale of Business Property. View the form to see the numbers.

In many cases, the sale of the land is reported under Part I and the sale of the improvements are reported under Part III.

In TurboTax Online, you may print or view your full tax returns prior to filing after you have paid for the software.

- View the entries down the left side of the screen at Tax Tools.

- Select Print Center.

- Select Print, save or preview this year's return.

In TurboTax Desktop, select FORMS in the upper right hand corner of the screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to review a rental sale. It is showing a $ amount in the summary, but the edit/review will not show me any of the numbers/input that is providing that amount.

Thanks! I can see the amounts there, but I can edit any of them. I cannot get Turbotax to show me where it's getting the numbers from now.

MW

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to review a rental sale. It is showing a $ amount in the summary, but the edit/review will not show me any of the numbers/input that is providing that amount.

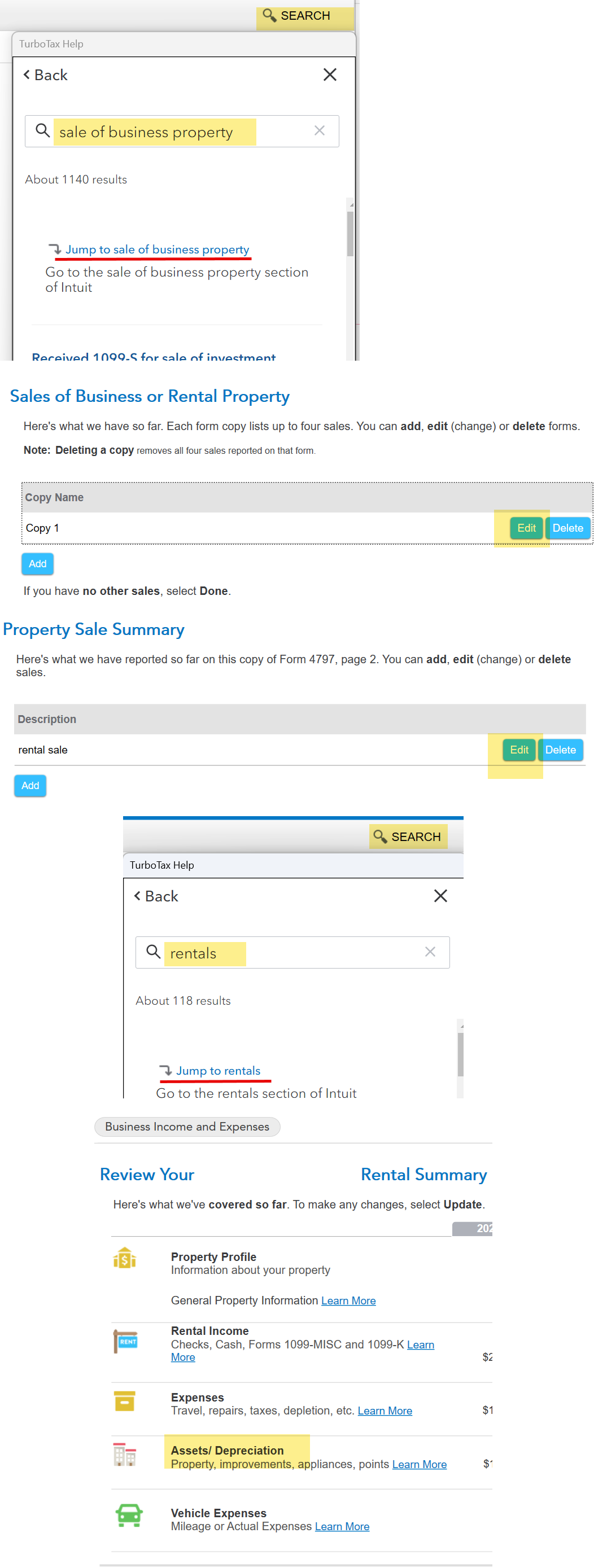

Search for sale of business property (copy an paste if needed). Then you should be able to edit your entries. Are you using the desktop software? If so, click on Forms to see all of the forms included with your return. If you are using TurboTax Online, you will need to go through the Print Center (Tools menu) to view your forms to see the data flow.

How do I edit or delete the sale of a business property I've already entered (Form 4797)?

Check the Rental Properties and Royalties section also, specifically the Assets section. To get there, search for rentals, use the Jump to link, and choose Edit. Then scroll down and update the Assets/Depreciation section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to review a rental sale. It is showing a $ amount in the summary, but the edit/review will not show me any of the numbers/input that is providing that amount.

I'm using the web based version, but when I go to the Sale of Business Property section and click on Copy 1 everything in there is blank and there are no other entries. I think there is a glitch in the software. The numbers are in there somewhere because it shows on the print form version, but I can't see them anymore.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mburback8

New Member

rosanta

New Member

udo_san

New Member

postman8905

New Member

laicrawford87

New Member