- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I have a short term capital gain on a second home. I need to ensure I have form 8949, schedule c and schedule d for this transaction. How do I enter this please?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a short term capital gain on a second home. I need to ensure I have form 8949, schedule c and schedule d for this transaction. How do I enter this please?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a short term capital gain on a second home. I need to ensure I have form 8949, schedule c and schedule d for this transaction. How do I enter this please?

Sale of a second home is entered in the investment section of TurboTax. Follow these instructions:

- Open or continue your return in TurboTax.

- In the search box, search for sold second home and select the Jump to link in the search results.

- Answer Yes on the Did you sell any investments in 2018? screen.

- If you land on the Here's the info we have for these investment sales screen, select Add More Sales.

- Answer No to the 1099-B question.

- On the next screen, select Second Home (choose this also for inherited homes) or Land. Select Continue.

- Follow the instructions to completion.

This will generate a schedule D and Form 8949. Schedule C is for self-employment income and will not be generated by the sale of a second home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a short term capital gain on a second home. I need to ensure I have form 8949, schedule c and schedule d for this transaction. How do I enter this please?

To enter this sale of a second home in TurboTax Online or Desktop, please follow these steps:

- Once you are in your tax return, click on the “Federal Taxes” tab ("Personal" tab in TurboTax Home & Business)

- Next click on “Wages & Income” ("Personal Income" in TurboTax Home & Business)

- Next click on “I’ll choose what I work on” (jump to full list)

- Scroll down the screen until to come to the section “Investment Income”

- Choose “Stocks, Mutual Funds, Bonds, Other” and select “start’ (or “update” is you have already worked on this section)

- The first screen will ask if you sold any investments during the current tax year (This includes any sale of real property held as an investment property so answer “yes” to this question)

- Since you did not receive a 1099-B, answer “no” to the 1099-B question

- Choose type of investment you sold - select Second Home

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a short term capital gain on a second home. I need to ensure I have form 8949, schedule c and schedule d for this transaction. How do I enter this please?

I have TurboTax 2022 Premier. I sold a second home. When I click on no 1099B, the system does not display a place to select Second Home, as you said it would. If I enter all my data, the system does not generate form 8949. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a short term capital gain on a second home. I need to ensure I have form 8949, schedule c and schedule d for this transaction. How do I enter this please?

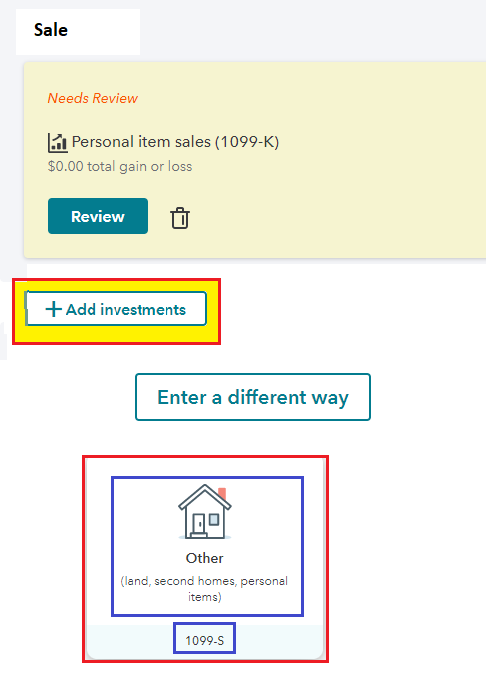

Go to Wages & Income

- Scroll to Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto)

- One of 2 screens could come up

- Did you have investment income in 2022? - Yes

- Or Add another investment

- Continue to Let's import your tax info

- Choose Enter a different way

- Select Other

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a short term capital gain on a second home. I need to ensure I have form 8949, schedule c and schedule d for this transaction. How do I enter this please?

Your suggestion will not work. As I stated before, I do not have a 1099B. I have a 1099S. When you answer the question for no 1099B, the system displays a screen to enter the sale. Thats it. I enter the sale price, dates, and cost basis, completing the addition of the sale. I then click on "Forms" to look at the 8949 that should have been generated, but it is not in the list of forms for my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a short term capital gain on a second home. I need to ensure I have form 8949, schedule c and schedule d for this transaction. How do I enter this please?

Let's see if we can get this cleared up for you. When you are signed into your TurboTax Online account the steps below will take you to the entry of your 1099-S for your second home.

- Click on Wages & Income (left black menu) > Scroll to Investments and Savings > Select Start or Revisit beside Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B) -- Other includes Form 1099-S

- Select 'Add Investment' > On the Screen Get ready to be impressed click Continue

- Select Enter a different way > Select the box shown previously and below for your convenience

- Continue to enter your sale of your second home.-

- Name your sale

- Type = Second Home

- Select how you acquired it

- Date received

- Finish sales information

Form 8949 is not always required to be filed with your Form 1040. The 1099-S is sufficient to report directly on Schedule D.

Individuals.

Individuals use Form 8949 to report the following.

- The sale or exchange of a capital asset not reported on another form or schedule.

- Gains from involuntary conversions (other than from casualty or theft) of capital assets not used in your trade or business.

- Nonbusiness bad debts.

- Worthlessness of a security.

- The election to defer capital gain invested in a qualified opportunity fund (QOF).

- The disposition of interests in QOFs.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sidney

New Member

jackson725450

Level 2

g456nb

Level 1

CalkinsV

New Member

jansmith5

New Member