- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Let's see if we can get this cleared up for you. When you are signed into your TurboTax Online account the steps below will take you to the entry of your 1099-S for your second home.

- Click on Wages & Income (left black menu) > Scroll to Investments and Savings > Select Start or Revisit beside Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B) -- Other includes Form 1099-S

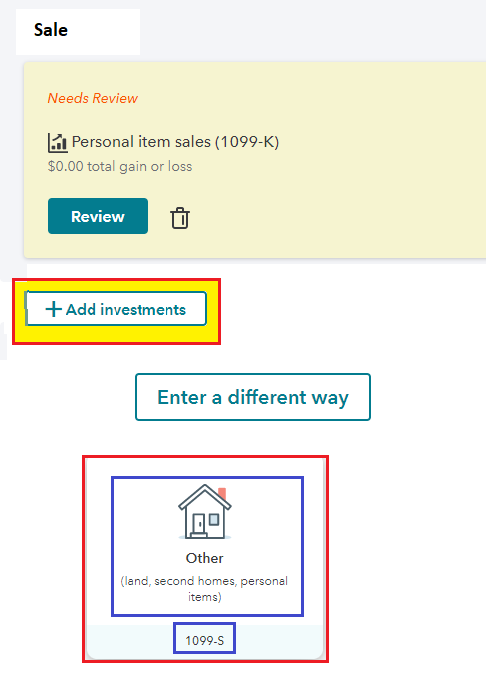

- Select 'Add Investment' > On the Screen Get ready to be impressed click Continue

- Select Enter a different way > Select the box shown previously and below for your convenience

- Continue to enter your sale of your second home.-

- Name your sale

- Type = Second Home

- Select how you acquired it

- Date received

- Finish sales information

Form 8949 is not always required to be filed with your Form 1040. The 1099-S is sufficient to report directly on Schedule D.

Individuals.

Individuals use Form 8949 to report the following.

- The sale or exchange of a capital asset not reported on another form or schedule.

- Gains from involuntary conversions (other than from casualty or theft) of capital assets not used in your trade or business.

- Nonbusiness bad debts.

- Worthlessness of a security.

- The election to defer capital gain invested in a qualified opportunity fund (QOF).

- The disposition of interests in QOFs.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 14, 2023

1:24 PM