- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I checked "Sold my rental property this year" but no sales related forms are generated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

I checked "Sold my rental property this year" on TurboTax Desktop Home and Business, but I don't see any sales related form and questions generated. What should I do to get Schedule D & related forms, such as Form 4797 generated?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

See this TurboTax support FAQ for reporting the sale of rental property - https://ttlc.intuit.com/community/rental/help/i-sold-my-rental-property-how-do-i-report-that/01/2625...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

Thanks for the quick reply. The FAQ basically told me to jump to property profile and check the box "I sold or dispose of this property in 2020". Well I did. I would send you a screen shot if I can. The problem is that NOTHING happened after the box was checked. No Sch D, no related form get generated. I am not sure if this is a BUG or not. I had similar issue a few years back. Checked that I sold the property, and trust that Turbo Tax took care of the filing, but it did not. I ended was Audited prob because of that. Don't want to do that again even if you can buy Audit protection.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

On the screen where you checked that you sold the property, you didn't read the small print that informed you to report the sale of each individual asset in the assets/depreciation section.

Reporting the Sale of Rental Property

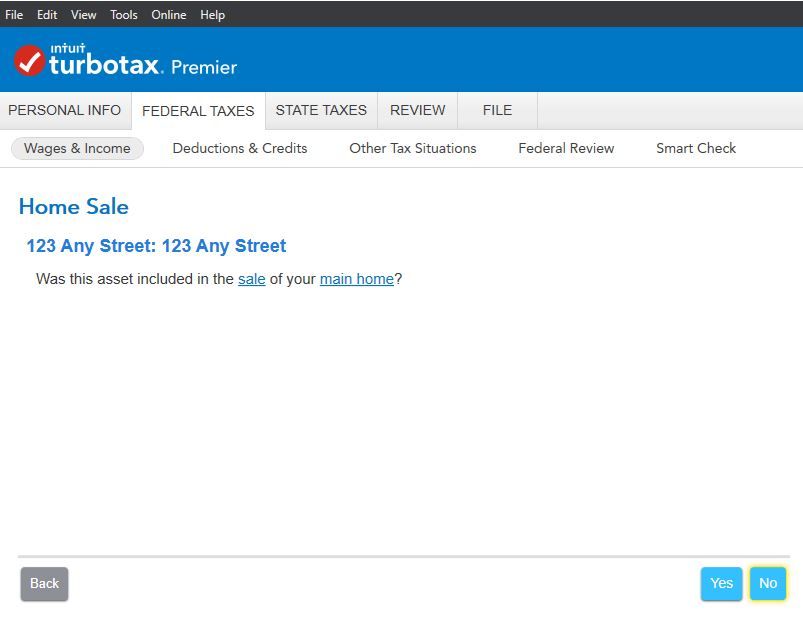

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

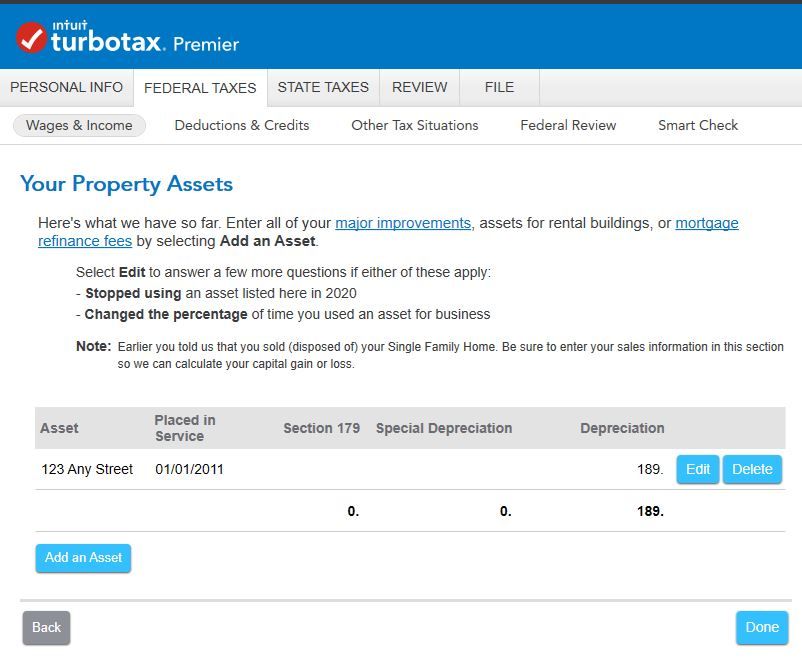

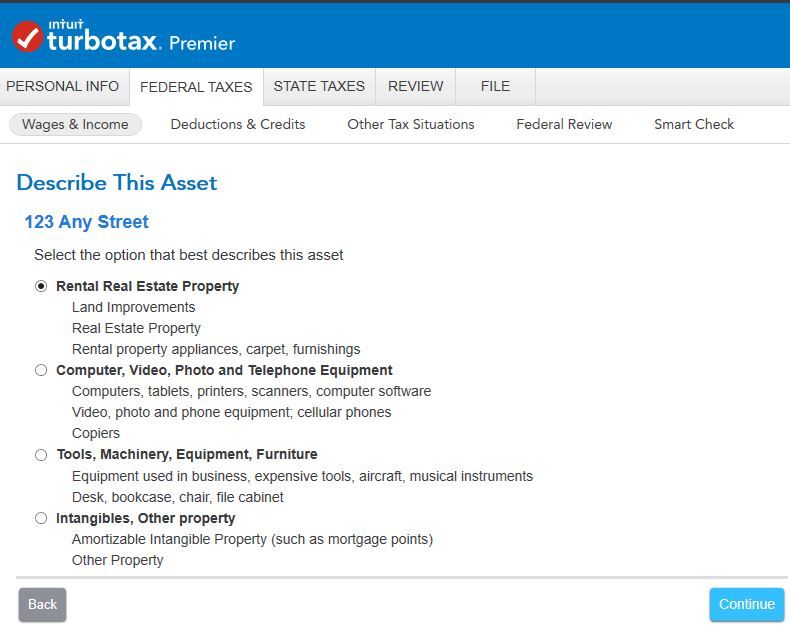

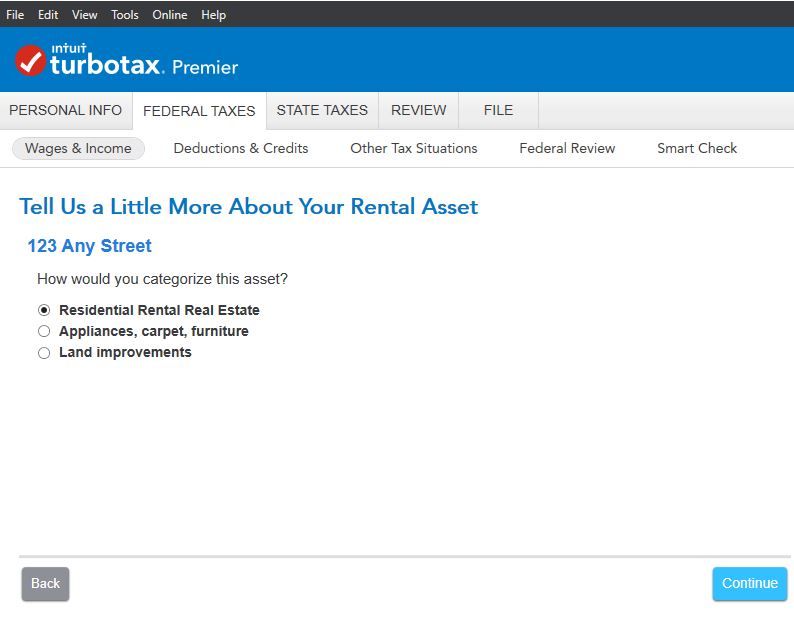

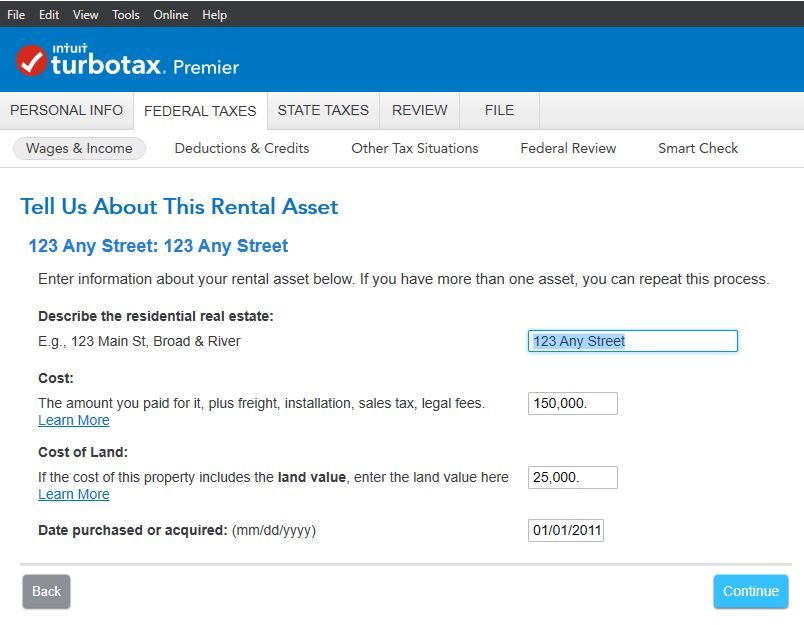

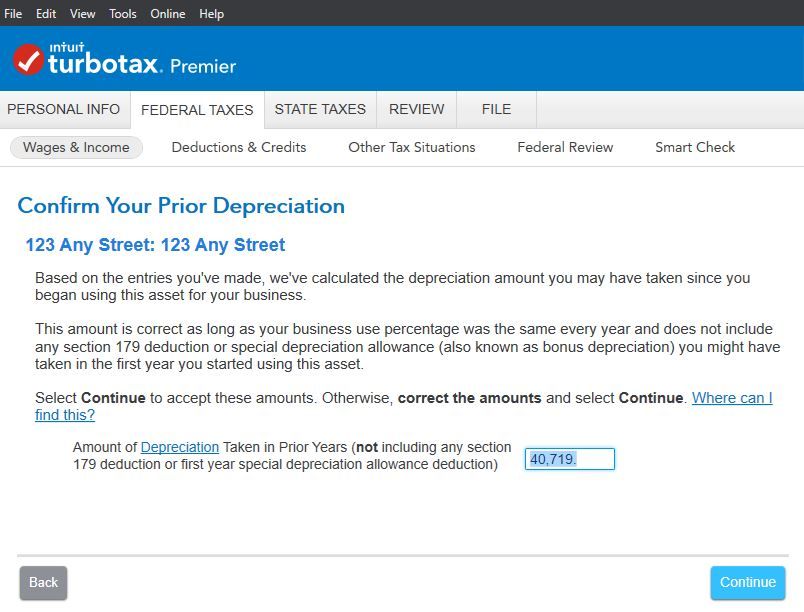

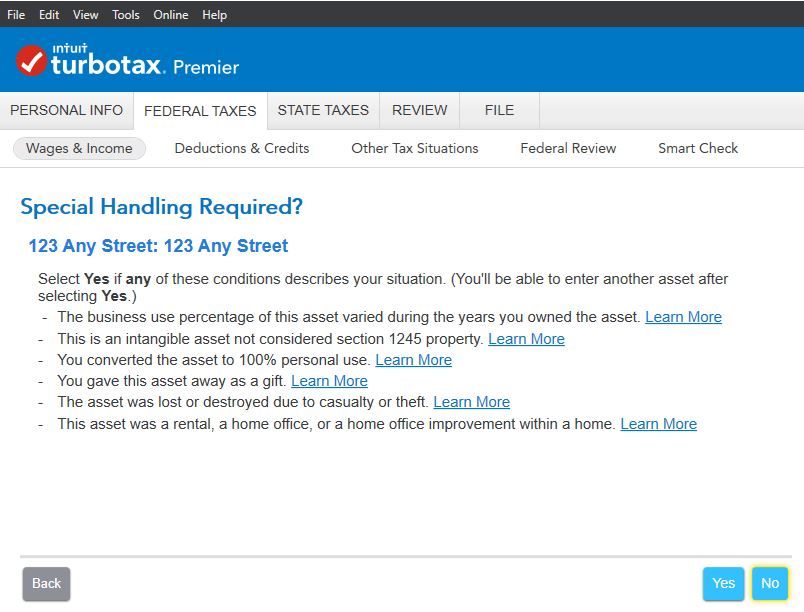

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2020". Select it. After you select the "I sold or otherwise disposed of this property in 2020" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even if it's zero. Then you MUST work through the "Sale of Property/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

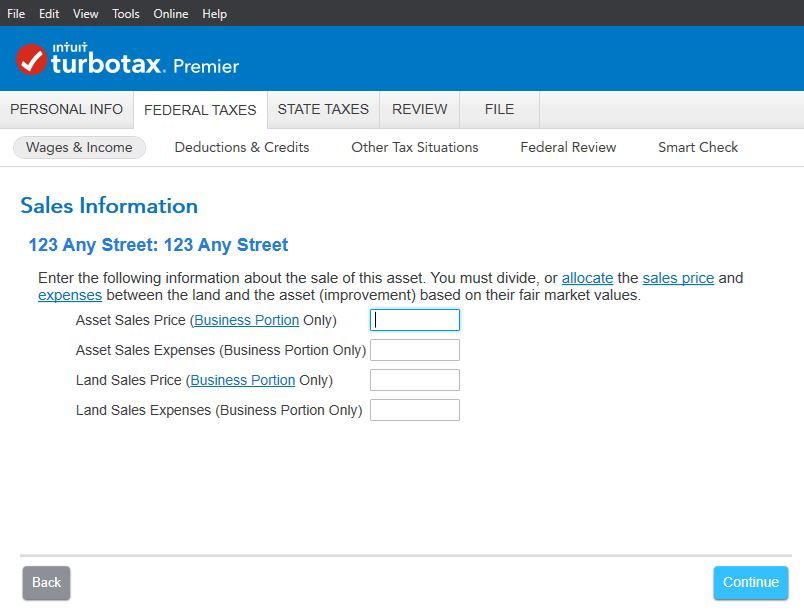

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1 on some assets. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1 on some assets.

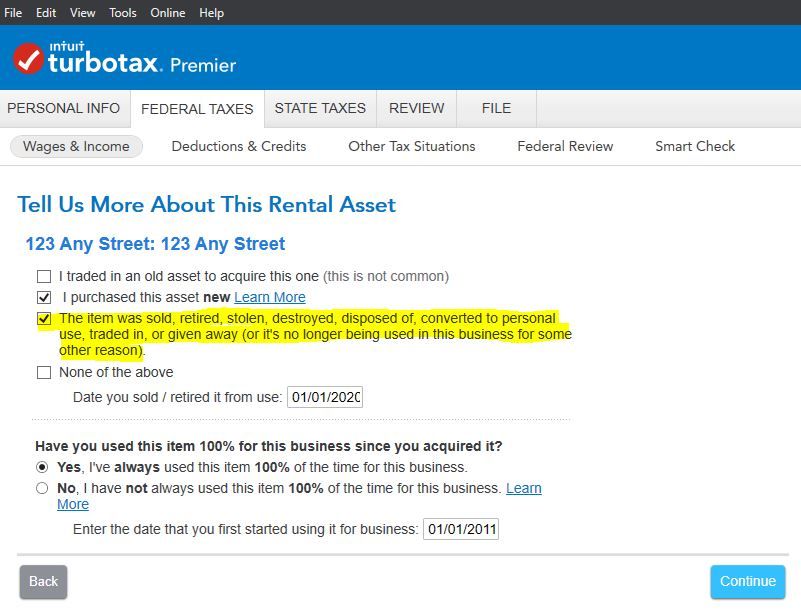

Basically, when working through an asset you select the option for "I stopped using this asset in 2020" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

Rental Property Sale reporting sequence -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

I ended up have a call w Turbo Tax support, and she directed me to jump to Schedule D, fill it in. After that, Form 8949 showed up (because I ended up with a small loss after accounting for all the fees) The problem is resolved.

I think it is a BUG in TT not to automatically trigger a Sch D & related forms. She won't comment on that at all.

See below if you need to see some details of how to find Schedule D. It is not obvious to me at all that is how one would do it.

I just have to click on "Search" on TT and type in "Schedule D" and hit return. Then click on "jump to schedule d". Choosing other items takes you to questions other people ask about the subject. However relevant, it is not the tax form you want. I am so used to picking an suggested search result as I start to type that I would not be able to see "jump to .." link if it is not for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

@kvp wrote:I ended up have a call w Turbo Tax support, and she directed me to jump to Schedule D, fill it in. After that, Form 8949 showed up (because I ended up with a small loss after accounting for all the fees) The problem is resolved.

Schedule D/Form 8949 is wrong.

Look at the pictures that were posted above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

@DoninGA Thank you so much for taking the time to give me the steps with the screenshots. You are absolutely right. I did missed checking one of the boxes on the page titled "Tell Us More About This Rental Asset" I missed checking the one you highlighted yellow "The item was sold, retired, ...." That is why I did not get Sch D generated. I have to mark your answer as the best answer as the details it includes helps someone like me who would rather be running my own business than filling out tax forms. I only do it once a year, after all.

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I checked "Sold my rental property this year" but no sales related forms are generated

@kvp wrote:That is why I did not get Sch D generated.

Make sure you un-do what you originally did and do it the way Don showed. It needs to show up on Form 4797, NOT Form 8949.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

yuetwsoo

New Member

Ian B

New Member

Harry C1

New Member

MSCOOKIE1

New Member

freddytax

Level 3