- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I can’t have my tax. The money hasn't arrived in five months , I am trying to use the option to collect my money in a American bank account, but I can´t use the option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can’t have my tax. The money hasn't arrived in five months , I am trying to use the option to collect my money in a American bank account, but I can´t use the option.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can’t have my tax. The money hasn't arrived in five months , I am trying to use the option to collect my money in a American bank account, but I can´t use the option.

" I can’t have my tax."

Do you mean you have not received your tax refund yet?

We do not understand the issue. If you already filed your return, you cannot change how you want to receive your refund. If you tried to send it to a closed bank account, it will go back to the IRS and then the IRS will mail you a check. You mentioned an American bank account. The IRS will not make a deposit to a foreign bank account. They will only mail a check to the address on your tax return if you are in a foreign country.

Many federal refunds have been delayed by the pandemic. Have you been checking on the IRS refund site?

To check on regular tax refund status via automated phone, call 800-829-1954. (This line has no information on Economic Impact Payments.)

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

TurboTax gives you an estimated date for receiving your refund based on a 21 day average from your date of acceptance, but it can take longer. Many refunds are taking longer during the pandemic.

Once your federal return has been accepted by the IRS, only the IRS has any control. TurboTax does not receive any updates from the IRS. Your ONLY source of information about your refund now is the IRS.

You need your filing status, your Social Security number and the exact amount (line 20 of your Form 1040) of your federal refund to track your Federal refund:

To track your state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

https://ttlc.intuit.com/questions/1901548-why-do-some-refunds-take-longer-than-others

If you chose to have your TurboTax fees deducted from your federal refund, that will take some extra time, while the third party bank handles the refund processing.

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

https://ttlc.intuit.com/questions/2840013-does-accepted-mean-my-refund-is-approved

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can’t have my tax. The money hasn't arrived in five months , I am trying to use the option to collect my money in a American bank account, but I can´t use the option.

Yes, I have not received your tax refund yet.

Sorry but I don´t speak in English

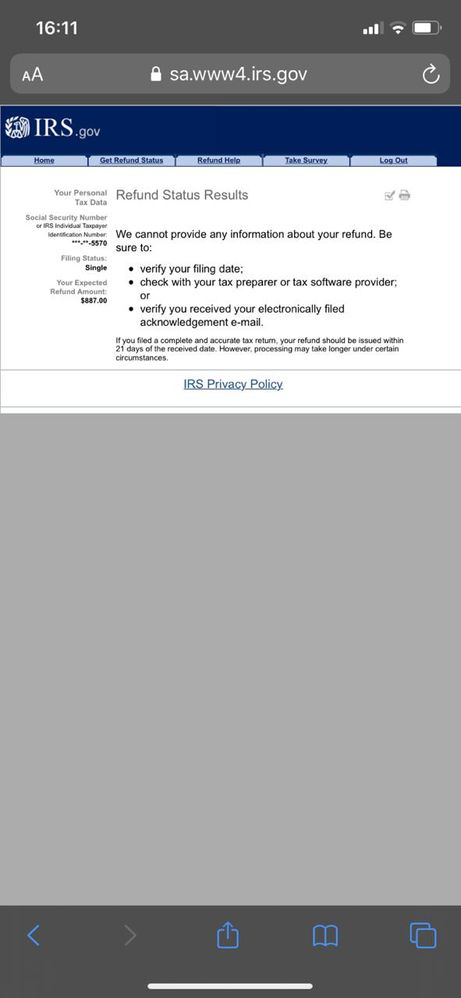

I have problems, because I followed the instruction to collect my tax $887 in Turbo Tax in March 2020, but still I can’t have my money. The first time I used the option to had the money in my address in Chile, but this hasn't arrived in five month, I am trying to use the option to collect my money in a American bank account on IRS.

I checked the IRS, but it does not give me information about the arrival of my money, which makes me doubt the process. For this reason I am requesting the deposit of my money to a current US bank account, to speed up the process. I need help to have my money with this option because I have waited for money to come to my house for a long time, please. I hope a solution for my situation please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can’t have my tax. The money hasn't arrived in five months , I am trying to use the option to collect my money in a American bank account, but I can´t use the option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can’t have my tax. The money hasn't arrived in five months , I am trying to use the option to collect my money in a American bank account, but I can´t use the option.

You cannot change how to receive your refund after you file. Since you live in Chile, the IRS will only mail a check to you in Chile--if that is the address you used on your tax return. If you are not seeing any information on the IRS site, you need to make sure your e-file was accepted:

Check here:

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

If your e-file was accepted, then make sure you are using the right information to check on the IRS site: You need your Social Security number or ITIN number, your filing status and the amount from line 20 on the federal Form 1040.

If the e-file status tool says the return was rejected, that means the IRS has not received it and is not processing it. If it says rejected, post back here for further help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can’t have my tax. The money hasn't arrived in five months , I am trying to use the option to collect my money in a American bank account, but I can´t use the option.

I was accepted in tubo tax

What is "line 20 on the federal Form 1040"? I never have completed this imformation on IRS. I use security numbre, filing status and date of return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can’t have my tax. The money hasn't arrived in five months , I am trying to use the option to collect my money in a American bank account, but I can´t use the option.

Line 20 is the amount of your refund. And line 21a. See 1040

https://www.irs.gov/pub/irs-pdf/f1040.pdf

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

chia578438

New Member

walterh254

New Member

hylda95

Level 1

mario10fernandez

Returning Member

lucasnorman321

New Member