- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to report vested RSU which are not sold?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report vested RSU which are not sold?

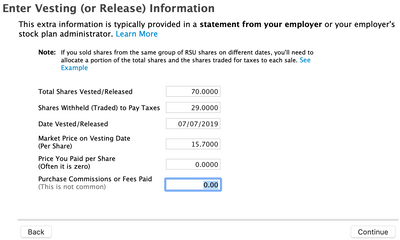

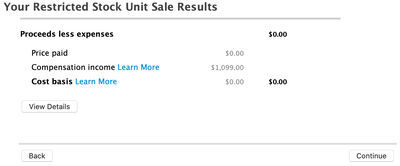

I have vested RSU which I have not sold yet. I understand that I have to report it in the tax return. I do not have 1099 from the broker for that transaction but I do have the transaction statement. In which they report 70 units lapsed (vested), total Fair Market Value $15.7 x 70 =$1099, 29 units withheld for taxes. Amount $1099 is in W2.

Problem is that there is no option or dialog for reporting RSU vest in TurboTax Premier.

So, I did the following trick.

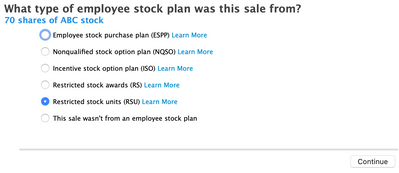

Wages and Income tab - Investment Income section – Stocks, Mutual Funds – Update – Add more Sales

Q. Did you get 1099-B or brokerage statement for these sales? A. Yes

I put the name of institution XYZ and account number.

Q. Tell us about XYZ 1099-B A. I’ll enter sale at a time.

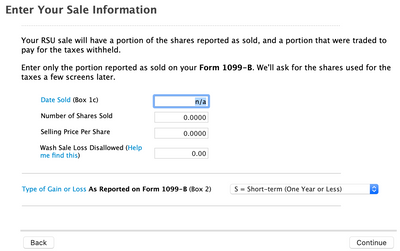

I had to put n/a in the date field otherwise TTP shows error.

I put "0" in all fields regarding sale. Then I continue with grant details.

Finally, I got the Vesting Information dialog:

Bingo!

By the way my actions didn’t affect my tax and W2 reporting looks legit.

Please, tell me if it is OK or there is another way to report vested RSU.

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report vested RSU which are not sold?

You may have got the right answer, I didn't really check that, but you did it the hard way and put erroneous information into your income tax return. There is absolutely no need to somehow tell the IRS about stocks you received via RSUs that you didn't sell.

First off, the act of "vesting" creates compensation, already included in your W-2 and most like reported to you in Box 14, and "compensation" creates the need to "withholding", and that's also included on your W-2. Since you didn't get a 1099-B, though you claimed you did, you could have stopped at the point that you entered your W-2. The point is, having not received a 1099-B for the sale of stock "for taxes", your entire required income tax return reporting is covered by entering the W-2.

In a "same day sale" situation - vesting and sale on the same day - brokers are not required to send you a 1099-B, though they are required to send you some "statement" with similar information. Had the broker actually issued you a 1099-B then you would also be required to enter that 1099-B on your income tax return.

The typical same day sale creates a small loss due to selling commissions and fees and you are perfectly within your rights to enter that sale into your income tax return, even without a 1099-B, in order to get the tax advantage of the loss. But the correct way to enter that sale is to tell TurboTax that you didn't get a 1099-B and enter the sale that way. That way the sale gets entered correctly on Form 8949 as a "Box C" trade instead of as a "Box A" or "Box B" trade, depending on how you entered your "1099-B"

There is no need, none, to enter the sale by using the "RSU" guided interview. All of the "RSU" aspect of the stocks you received was handled on the W-2. When and if you sell that stock you are simply selling plain-vanilla "stock", stock that is no different than a stock you might have purchased through a broker. When enter the sale you can simply tell TurboTax that you "purchased" the stock on the vesting date and a per share basis that's the same as the per share "fair market value" that your employer used to calculate the compensation figure reported on your W-2.

I'd advise you to delete that trade that you've entered. Presumably nothing will change on your income tax return with that deletion. Then, if you want to, enter the sale by telling TurboTax that you did sell stock, that you didn't get a 1099-B, that you "bought" the stock on the vesting date at the price used by your employer. If your sale has the "typical" result, a small loss, you should see your income go down slightly and your refund go up slightly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report vested RSU which are not sold?

You may have got the right answer, I didn't really check that, but you did it the hard way and put erroneous information into your income tax return. There is absolutely no need to somehow tell the IRS about stocks you received via RSUs that you didn't sell.

First off, the act of "vesting" creates compensation, already included in your W-2 and most like reported to you in Box 14, and "compensation" creates the need to "withholding", and that's also included on your W-2. Since you didn't get a 1099-B, though you claimed you did, you could have stopped at the point that you entered your W-2. The point is, having not received a 1099-B for the sale of stock "for taxes", your entire required income tax return reporting is covered by entering the W-2.

In a "same day sale" situation - vesting and sale on the same day - brokers are not required to send you a 1099-B, though they are required to send you some "statement" with similar information. Had the broker actually issued you a 1099-B then you would also be required to enter that 1099-B on your income tax return.

The typical same day sale creates a small loss due to selling commissions and fees and you are perfectly within your rights to enter that sale into your income tax return, even without a 1099-B, in order to get the tax advantage of the loss. But the correct way to enter that sale is to tell TurboTax that you didn't get a 1099-B and enter the sale that way. That way the sale gets entered correctly on Form 8949 as a "Box C" trade instead of as a "Box A" or "Box B" trade, depending on how you entered your "1099-B"

There is no need, none, to enter the sale by using the "RSU" guided interview. All of the "RSU" aspect of the stocks you received was handled on the W-2. When and if you sell that stock you are simply selling plain-vanilla "stock", stock that is no different than a stock you might have purchased through a broker. When enter the sale you can simply tell TurboTax that you "purchased" the stock on the vesting date and a per share basis that's the same as the per share "fair market value" that your employer used to calculate the compensation figure reported on your W-2.

I'd advise you to delete that trade that you've entered. Presumably nothing will change on your income tax return with that deletion. Then, if you want to, enter the sale by telling TurboTax that you did sell stock, that you didn't get a 1099-B, that you "bought" the stock on the vesting date at the price used by your employer. If your sale has the "typical" result, a small loss, you should see your income go down slightly and your refund go up slightly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report vested RSU which are not sold?

Tom,

Thank you very much. Everything you said makes perfect sense.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Idealsol

New Member

chinyoung

New Member

dinesh_grad

New Member

user17552925565

Level 1

meltonyus

Level 1