- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report vested RSU which are not sold?

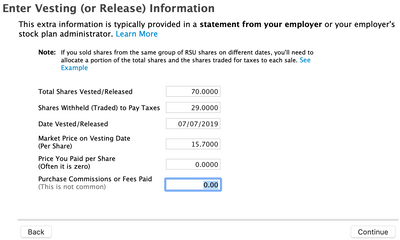

I have vested RSU which I have not sold yet. I understand that I have to report it in the tax return. I do not have 1099 from the broker for that transaction but I do have the transaction statement. In which they report 70 units lapsed (vested), total Fair Market Value $15.7 x 70 =$1099, 29 units withheld for taxes. Amount $1099 is in W2.

Problem is that there is no option or dialog for reporting RSU vest in TurboTax Premier.

So, I did the following trick.

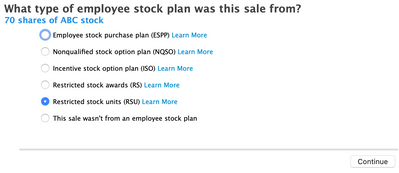

Wages and Income tab - Investment Income section – Stocks, Mutual Funds – Update – Add more Sales

Q. Did you get 1099-B or brokerage statement for these sales? A. Yes

I put the name of institution XYZ and account number.

Q. Tell us about XYZ 1099-B A. I’ll enter sale at a time.

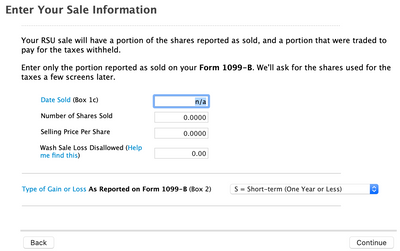

I had to put n/a in the date field otherwise TTP shows error.

I put "0" in all fields regarding sale. Then I continue with grant details.

Finally, I got the Vesting Information dialog:

Bingo!

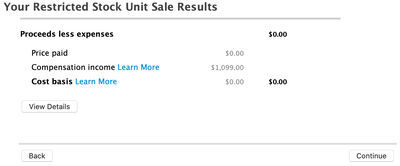

By the way my actions didn’t affect my tax and W2 reporting looks legit.

Please, tell me if it is OK or there is another way to report vested RSU.

Thank you