- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

@lauriescag wrote:

You said "You don't need to worry about 'shares sold for taxes'; this income was reported on your W-2."

I am using the desktop version of TT Premier. I finally got ALL my issues resolved with RSU/NQSO (thanks to all the help from this site's experts) but now I am getting a question about the shares sold for taxes during the review - what do I do?

I ran into this exact scenario for my 2022 taxes.

This seems to happen when you use the "Shares Withheld (Traded) to Pay Taxes" box when the 1099 is also reporting the sell to cover transaction.

For example, even though shares were traded to withhold taxes, they were still reported on the 1099 as a sell transaction. Entering both the 1099 sell transaction AND "Shares Withheld (Traded) to Pay Taxes" quantity will create a deficit of shares causing the error. In my scenario, my 1099 reports the "sell to cover" action as a regular sale instead of omitting it from the 1099 completely (since it was all withheld). When I tried to enter them as"Shares Withheld (Traded) to Pay Taxes" I got this same error. My scenario is posted here which may fit a similar situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

It was sold to cover your federal withholding and is also included in box 2, of your W-2. The buy and sell will be basically the same dollar amounts due to the sale occurring when you were awarded the shares. (Income reported on your W-2, as well as federal withholding).

The income reported in you W-2 is the amount that becomes your cost basis (and if you paid any discounted amount for the shares).

You should have income on your W-2 and then a sale reported for the shares the employer redeemed/sold on your behalf. Report the 1099-B separately under Investment Income instead of in the RSU section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

@DianeW777 wrote:Report the 1099-B separately under Investment Income instead of in the RSU section.

Thanks, by this do you mean answer "No, this is not employee stock" when asked in the software? As an alternative to that, I kept it as an RSU, but entered 0 for "Shares Withheld (Traded) to Pay Taxes" and manually adjusted the cost basis for the sell-to-cover transaction. That should be sufficient and accomplish the same goal, right?

I think this is the main point to try to make though... Nowhere in the TurboTax software does it lead the user towards marking RSU's as "not" RSU's or ignoring the prompt to enter "Shares Withheld (Traded) to Pay Taxes" on `sell-to-cover` sells if the sell shows on your 1099. It just prompts you to answer questions and if you answer them accurately or fill in the forms based on the correct/logical answer (ex: entering sold shares for "Shares Withheld (Traded) to Pay Taxes" when you literally do have "Shares traded to pay taxes" or accurately marking an RSU as an RSU) it can lead an average user astray very easily.

I'm sure to a tax expert it seems trivial but average TurboTax users don't know all the nuances they are relying on the software to lead them down the right path.

Luckily with helpful people like yourself 😃, and by doing research, users can figure out these situations where the software doesn't make real-world sense given the scenario.

Anyways, rant over -- Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Yes, you will accomplish the same goal. We appreciate your experience and feedback.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

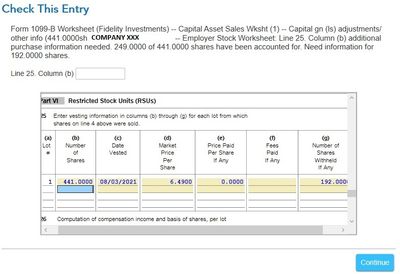

Every year it's the same problem, and new problems, with entering RSUs in TurboTax (I used the desktop version) and have wasted days year after year (what our lovely Gov't wants its citizens doing) getting TurboTax to even be close to actual values. For the 2021 tax year, using Tom Young's workaround worked fine, which was to delete all imported or EasyStep nonsensical data and manually enter the amounts in the Capital Asset Sales Worksheet, being sure to enter the actual Cost Basis (Fidelity reports this in the Supplemental Information area instead of on form 1099-B. Fidelity, are you listening? Get customer focused and fix the Cost Basis field ... you know what values it needs b/c it's an RSU you transacted!). TurboTax for 2022 fails using Tom Young's workaround because when it checks for errors, it generates an Employee Stock Transaction Worksheet for each RSU transaction and complains that box 10 hasn't been checked. To get around this, it's necessary to Open Form, select the worksheet, check 10d Restricted Stock Units (RSU), scroll down to section Part VI and enter values for 25 (b) Number of Shares, (c) Date Vested, (d) Market Price Per Share, and (f) Fees (there's always a fee) and Number of Shares Withheld If Any. TurboTax foolishly labels (d) as Market Price. Call this Proceeds as shown on Form 1099-B to reduce confusion! Likewise, do away with the per share nonsense. And to make matters worse, 3 Selling Price (per share) truncates the 4 digit fraction to a whole integer, which really messes up the Net sales price!!! TurboTax has stupidly done this for years! The math never comes out right when you base it on price per share so stop it! Just have fields for Date Acquired, Date Sold, Proceeds, and Cost Basis and LEAVE IT AT THAT! That's all the IRS cares about, so stop pretending like your ridiculous set of calculations that NEVER get it right are somehow an ROI for your extremely expensive software, that you haven't really improved for decades.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

2023 and this RSU stuff still not right with Turbotax nor Fidelity :'(

[edit: Removing my comment as it was just me complaining about how impossible this is to figure out]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Hi Marilyn,

I have the same questions since unfortunately I got a CP2000 notice for 2 transactions

1) is the Sell to Cover which I am still struggling on how best to enter in TT Premier 2022 because I can't find the screen you posted earlier ie. this screen that show total RSU's, #'s sold to pay taxes. I get the regular screen as the other person posted that asks you to enter the date acquired, cost basis etc.

can you please post how to enter that if possible ?

2) I have another transaction that was a RSU vest and sell on the same day in Dec 2022. The amount attributed to taxes was listed as " Equity tax cover adv " e.g $100, but I did not get paid any proceeds (via payroll) until Jan 2023 at which point the equity tax cover was removed e.g. $100 (-) (negative) sign and the gross amount was listed e.g. $300

I will have an inquiry out to our broker that provides these transactions but it is very confusing.

I would love some help on (1) i.e how to enter RSU sell to cover in TT premier

At this point, I am getting so frustrated that I would be willing to hire an EA/tax expert as well

thanks

Sunil

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

I am reading your post with dread since I have the issue now in a bigger way for the 2023 year for which I will file this year in 2024 i.e many sell to cover transactions.

It is really sad if TT has still not made it simple enough to capture this complexity. I might have to start paying someone to do this if this persists

Does any one know if it is possible to get hire a so called Enrolled Agent and get help while working on TT Desktop products ?

Sigh

Sunil

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

No "expert does your taxes" help with the desktop version. But there are other options. If you would like help with your tax return, we are glad to help in several ways - including doing the return for you. Please see the options if you want help online here. For the desktop, you have us, here in community. We do have a new referral program and you may want to use a local to get your questions answered and find your balance.

The important thing is to understand how the RSU is being reported and to track the amount being reported in your income. The lots sold to cover the taxes will appear on the 1099-B and the sales will be included in your tax paid on your w2. Usually, the 1099-B will not have the cost basis since that comes from your employer and is not related to the broker. This is why you need to know the amounts included in your compensation.

The software changes each year so how you enter it will change. For 2022, you had to go to the other uncommon situations. For this year, you should be able to enter your 1099-B which shows the lots sold, enter the basis - which is included in your w2 box 1. The program will ask about tax paid and you leave that part blank in the 1099-B section since it is included in your w2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Hi

I got a single release statement for my sell-to-cover transaction, but two different entries in my 1099-B.

273 shares vested = 177 shares sold and 96 shares sell-to-cover (these are the 2 separate entries in my 1099-B).

How do I treat those two entries in the 1099-B with respect to this screen. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Thank you. Luckily, I was able to find a step by step guide to see the vest price/cost basis vs the sell price and figure out the real cost basis for all the sell to cover transactions so all is good.

thank you and to everyone who answered.

Sunil

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Hello, I read through all the posts. I was unable to find the correct solution.

Cost Basis is 0 for sell-to-cover in 1099-B

Should this be adjusted manually to equal the Proceeds?

Even if I delete the import & manually enter, I still have the same issue, which is "What is the cost basis?"

I didn't sell any, they were sold to withhold taxes (all proceeds went to IRS and I presume my W2 box 2 includes this total proceeds). By reporting this as gain with cost basis 0 - makes it look like you are paying taxes again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

I have the similar question here.

According the example provided by TT desktop, the problem on each sale of the shares released could be covered. But what about the tax withhold shared which is sold on my behalf?

to find the cost basis, try to find it with the broker. e.g. ETrade has "Stock Plan Transactions Supplement" where it shows all correct cost basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

It looks like I have the same problem as many people here: during the year I was granted RSU shares by my company every month and sold them.

My company does the sell-to-cover thing, to cover taxes in advance. I see the "Equity tax cover adv" entry eating up to 40%+ of my shares value :( . I am actually paid on the following month, already deducted that amount.

Now I received my 1099-b and the sell-to-cover entries are all there, but the corresponding taxes ARE NOT. Worst of all, I did the math on my W-2 and they are not on box 2 as well! Yes, you read it right, the taxes paid on the sell-to-cover shares are not reported on box 2 of my W-2.

Now my question is: how do I report the taxes already paid but not reported in W-2? I am using Turbo Tax Home and Premium 2023 Desktop.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

My only problem was Cost Basis 0 on 1099-B

I simply overrode that number after import to match with N*StockPriceOnVestDate

In my case, there was a small loss for Sell-to-Cover shares because they were sold on the next day at lower SP.

Hope this helps someone.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

glmfedtax

Level 2

priestleydave

New Member

margomustang

New Member

troyponton

New Member

KarenL

Employee Tax Expert