- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@lauriescag wrote:

You said "You don't need to worry about 'shares sold for taxes'; this income was reported on your W-2."

I am using the desktop version of TT Premier. I finally got ALL my issues resolved with RSU/NQSO (thanks to all the help from this site's experts) but now I am getting a question about the shares sold for taxes during the review - what do I do?

I ran into this exact scenario for my 2022 taxes.

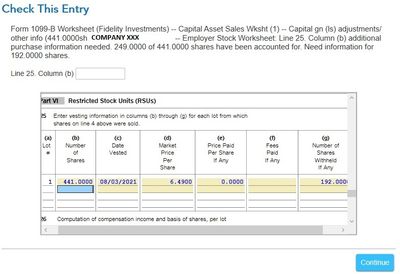

This seems to happen when you use the "Shares Withheld (Traded) to Pay Taxes" box when the 1099 is also reporting the sell to cover transaction.

For example, even though shares were traded to withhold taxes, they were still reported on the 1099 as a sell transaction. Entering both the 1099 sell transaction AND "Shares Withheld (Traded) to Pay Taxes" quantity will create a deficit of shares causing the error. In my scenario, my 1099 reports the "sell to cover" action as a regular sale instead of omitting it from the 1099 completely (since it was all withheld). When I tried to enter them as"Shares Withheld (Traded) to Pay Taxes" I got this same error. My scenario is posted here which may fit a similar situation.