- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Hi... Using different numbers, I am convinced of the same thing. The Fed Tax withheld on the W-2 doesn't come close to reflecting the additional federal tax withheld from the RSU's. Confused...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

@bkhinrichs. It appears as if you are suggesting that your W-2 is not accurate in that it is missing the withholding amounts from the sale of the RSUs. If that is the case, you will need to discuss the matter with your employer. Generally, you need to enter your W-2 information as it appears on your W-2 because the IRS also has a copy of your W-2 and if you were to change the withholding numbers to reflect what you think they should be, upon e-file you might get a rejection because your W-2 amounts will not match what the IRS has on file.

When entering your information into TurboTax regarding the sale of your RSUs, you will see a page where you will enter information about, among other things, total shares vested, and shares withheld to pay for taxes. Below is a screenshot of this page.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Where is that Screenshot located in TT, I have been struggling to enter the RSU information, and I have yet to see that screen. I received a 1099B, and in TT that's where I start entering information, but it does not lead me to a screen like that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

To get to the Vesting Information screen:

- In the Federal > Income & Expenses > Investment Income section of your return, click Start/Revisit next to Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- Answer Yes and then select stocks. Import or enter your transactions manually. If the transactions are already entered, click Edit next to the RSU sale and skip to step 4.

- For the RSU transactions, make sure to select Yes to Do these sales include any employee stock?

- Enter the transactions as they appear on the 1099-B with RSU selected as the type of investment.

- If the basis reported on the 1099-B is not correct, you will be able to adjust it to match the supplemental information provided. Click The cost basis is incorrect or missing on my 1099-B.

- If your cost basis is listed for you, you may click the I found my cost basis button. Otherwise, click I can't find it and need help.

- Click Continue and enter the required information on the next screen and hit Continue twice more.

- That will take you to the Let's get some purchase info about this RSU sale screen.

Make sure the total shares match the number of shares sold in order for TurboTax to correctly adjust the basis. If the RSUs come from different lots, you will have to enter each one separately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

I can not get to that window in TT, I can follow to Step 1, Then it asks me: Did you sell any Investments

in 2021?, I click Yes.

Did you get a 1099B, I click Yes

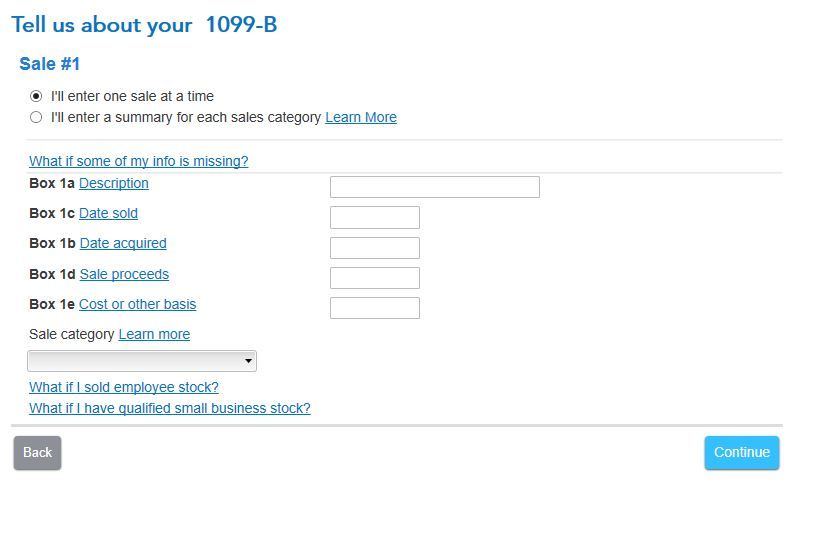

Then it asks me to Import, I have to click I'll type myself because my brokerage isn't listed, I go to next screen and enter the name of the brokerage, press continue, then the screen looks like this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

You are in the regular entry area for a 1099-B, which is fine if you know what the Cost Basis of your stock is.

You can enter your 1099-B as is, then indicate that you 'need to adjust the Cost Basis' to what it really is, as it is most likely incorrect on your 1099-B.

This post on Reporting RSU Sales is very helpful.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

I was awarded 100,000 RSUs with a double trigger event for IPO & vesting. After both happened, I still had a 210 day lockup period which ended on 12/10/20. My company set the taxable amount on my shares at close of market on 12/9/2020 when the stock price was $47 per share. The company then executed a sell to cover that took until 12/16/2020 to complete during which time the share price dropped to $39 per share by the time shares were received (made available to me) on 12/17/2020. This resulted in an over taxation amount of $8 per share so my W-2 stated a taxable amount that was $800,000 over the actual amount I received. How should I address a situation where the sell to cover took much longer than expected and the share price dropped 17% during the sell to cover. I had no access to the shares to do anything until the morning of 12/17 when they showed up in my account. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

There are two issues present in your situation. The first involves taxation of RSUs, and TurboTax can assist with RSU taxation. The second involves compensation, and TurboTax cannot assist with the specifics of your compensation as it relates to your RSUs. Moreover, the compensation issue has to be resolved first before addressing the taxation issue.

You mentioned that there was a "triggering event" and a "lock-up period" which prevented vesting until around mid-December 2021, at which time the stock price had declined by approximately $8 per share. Generally, RSU vesting occurs when all restrictions have been removed and the employee has full ownership of the shares. On the date of vesting, a value is assigned to the shares (generally the market price) and the employee is free to hold the shares or sell them. In your case, the vesting was not of the type that would ordinarily occur in the typical RSU case. If we understand you correctly, what you are saying is that your W-2 overstates your compensation and should be corrected. Given the facts of your situation, the compensation issue needs to be resolved with your company

Accordingly, until you resolve the compensation issue, we cannot advise regarding the RSU taxation. Moreover, because the company is a public company, their RSU compensation (and compensation generally) is likely discussed in its annual and quarterly reports. Such reports are filed with the Securities & Exchange Commission and are publicly available. You might want to review the sections in such reports relating to RSU compensation to determine the specific characteristics of your RSU plan.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

You stated this "After both happened, I still had a 210 day lockup period which ended on 12/10/20. My company set the taxable amount on my shares at close of market on 12/9/2020 when the stock price was $47 per share"

What you said there is that the shares were granted but NOT vested until end of day 12/9/2020 This is the very definition of an RSU. The share price at the end of the day on 12/9/2020 (vesting date) is what the FMV of the shares "at vesting" was. This is one of the really ugly facts about RSU grants. At the instant they vest, you are taxed on the value as income. So, your W2 is correct. This is the way the system works. The fact that the stock price dropped while the "sell to cover" action was taking place is irrelevant to your W2 income as is the fact that the remaining shares were not "released" to you until after the sell-to-cover action had completed.

This has happened to me 2 years in a row now. Last year it took 2 separate sales to cover, and this year it took 3 because the stock dropped. In addition, my shares vested during a blackout period, so I couldn't transact any of them EXCEPT for the sell-to-cover action.

This year at least, for me, ETrade had a better supplement which had all the corrected cost basis values for each separate sale. So, as MANY people have said here, you just enter the sales as "non employee" stock and adjust the cost basis per the supplement. And, as a check, if you have an amount reported in box 14 on your W2, that should equal the cost basis on the supplement...that's how you know what portion was reported as income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

I've ran into this multiple times when I started working for a company that used RSU's as part of your comp. I also received the CP2000 form from the IRS. The two 1099B's I receive is 1 for the sell-to-cover taxes, and then the RSU sales minus the taxes. What IRS attempted to do was declare that both 1099B's were both income. So if you paid 10,000$ in taxes for 25,000$, the IRS attempted to claim that my tax liability was for $35000. Obviously this dramatically increased my tax liability and overstated my overall taxable income which can put you into another tax bracket without you even knowing it. Because of this, they attempted to fine me for under paying and then demanded the perceived tax liability. The good news is that the taxes have a different reference code on the 1099B from the RSU as income. Also I went into the payroll system and downloaded copies of the RDU checks cut on my behalf. When you have all the checks, you should be able to reconcile the taxes with the checks with the Sell-to-Cover total amount. The remaining was the actual proceeds received as income. Those two number matches the overstatement on the CP2000. So all I did was explain how the two 1099B's are to be considered. I put this documentation into a big PDF document and faxed it to the IRS referencing the the CP2000 letter, the challenge and justification in written form, outlining every steps of the math. Also I challenged the penalty with interest. It took them two years discover this. the CP2000 was for tax year 2018 but they didn't alert me to the situation until 2020. They had no reason to force a penalty especially since I could clearly show how their own math impacted the taxes incorrectly and the time window was based on their waiting for 2 years to bring it my attention. About 3 weeks after the CP2000 response was sent and received, the I got a letter in the mail indicating they agreed with my assessment and no penalty was justified.

The way this is handled by TT is really confusing and clear as mud. Hope this helps 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

"The two 1099B's I receive is 1 for the sell-to-cover taxes, and then the RSU sales minus the taxes."

How did you get two 1099-B's? I received only one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

You said "You don't need to worry about 'shares sold for taxes'; this income was reported on your W-2."

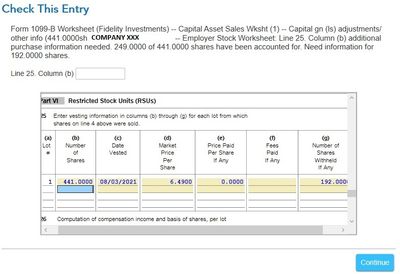

I am using the desktop version of TT Premier. I finally got ALL my issues resolved with RSU/NQSO (thanks to all the help from this site's experts) but now I am getting a question about the shares sold for taxes during the review - what do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Are you able to leave this blank and Continue? If not, will entering 192 shares (shares unaccounted for in your screenshot) let you continue?

You may need to delete all entries about vesting, etc. and just leave your 1099-B entry to report the sale if this doesn't resolve your issue.

Per @TomYoung:

"Understand that share number entered in the box "Shares Withheld (Traded) to Pay Taxes" has only one effect. It subtracts from the box above it - shares vested - to determine the number of shares available for sale."

Click this link for more info on Shares Sold for Taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

Hi @TomYoung

When one of my RSU grants vested in 2021, my brokerage first sold part of the stock to cover the tax liability but due to market fluctuations, their computation fell short of the taxes that needed to be recovered. So they had to sell 1 more stock. Consequently my 1099-B has 2 stock sale transactions on the same day but at different selling prices. The single stock sale entry throws Turbotax off and it flags it as an error. If I merge the two into a single sale (Turbotax instructions say that each sale should be on a separate line), Turbotax asks me to send some additional paperwork to IRS. I want to proceed in a way that won't trigger a notice CP2000 from IRS. How would you recommend I reflect these in Form 8949 (and the Capital Asset Sales worksheet and Employee Stock Worksheet which are for my records only)? Look forward to your advice. Thanks a bunch!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report RSU that were sold to cover taxes? I have done extensive research and I see multiple options on turbotax to do this each leading to different tax due amount

You can use the summary method as you did by combining the sales. TurboTax is letting you know the Form 8949, a copy of Form 1099-B and Form 8453 must be mailed to the IRS. This is normal and routine when transactions are summarized and will not be a trigger for a CP2000 notice.

Mail your statements along with Form 8453 to the following address within three days after the IRS accepts your tax return:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254

If you need a blank Form 8453, you can download this pdf, enter your address information and check the box for Form 8949 (this form is really just a cover sheet).

@arorapankaj

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

michael_s_peterson

Level 2

5LG8-6WT4-K8DY-KQQK

New Member

allancwatson

New Member

risman

Returning Member

evltal

Returning Member