- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- how to report home sale with Variable Business Use Percentage over the years as rental with turbotax 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to report home sale with Variable Business Use Percentage over the years as rental with turbotax 2022

Offhand, I cannot find the answer to my following questions in the forum and would appreciate any help with my questions

Thanks

---------------

Issues

While trying to enter sale of business property (primary home with part time usage for rental) on answering yes to special handling of sale required (because business use percentage has changed over the years). Turbotax deluxe 2022 step-by-step process says that program (Turbotax deluxe 2022) cannot compute automatically the sale information.

Scenario

- bought home and rent out part of home from day 1, in 2018. Tax filed via Turbotax Home and Business 2018 (% of business use 66 2/3%)

- tax return filed with Turbotax deluxe 2019 (% of business use 66 2/3 %)

- tax return filed with Turbotax deluxe 2020 (% of business use changed to 50%)

- tax return filed with Turbotax deluxe 2021 (% of business use changed to 50%)

- sold property in 2022

- owner occupied from 2018-2022 (full duration)

- with proceeds of sale bought single family home in 2022 (not renting out)

Questions

- how can one enter the sale information of rental property (home) via Turbotax?

- Can Turbotax home and business 2022 handle this case? (in step-by-step process) and automatically generate Form 4797

- If not, is the workaround to switch to Forms and then enter the sales information via Form 4797 (if information is manually entered into Form 4797, will the information be automatically be transferred into Schedule D/Capital Gain/Loss). Will Turbotax generate the correct Form 8582 (if it is applicable)

Issues/Questions

In the scenario that Turbotax deluxe 2022 not being able to handle sale of rental property with variable business use percentage.

- can Turbotax home and business 2022 handle the sale of home (and exclude the business use percentage) in the step-by-step process of sale of home, including completion of Form 8949 and transfer to Schedule D

- or does one have to manually enter sale of home (primary residence partly used for rental) via Form 8949 and report any gains in Schedule D manually

If my understanding is completely off based, how can I go about report the rental(/home) property in my tax return, with Turbotax??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to report home sale with Variable Business Use Percentage over the years as rental with turbotax 2022

First of all, Turbo Tax Premier would be the best program to enter this information. Home and Business is fine but Turbo Tax Premier is less expensive and if you properly enter this, all the correct forms will be generated into the return, which includes the 4797 and 8949. Now to enter this properly, including the sale.

- In TurboTax, go to federal>wages and income>see all income>Rentals, Royalties, and Farm>Rental Properties and Royalties (Sch E)>start or revisit

- Answer Yes to the question Did you have any rental or royalty income and expenses in 2022 for property you own?

- Follow the on-screen instructions as you proceed through the rental and royalties section.

- We'll ask you to enter general information about your rental (like description, address, and ownership percentage)

- You will eventually reach a screen that says Do Any of These Situations Apply to This Property? here is where you indicate you sold the property. Then you will enter information about how long it was rented .

- Eventually, you'll come to the Rental Summary>sale of property/depreciation. screen, which is where you enter your rental income and expenses, assets and depreciation, and vehicle expenses. This determines what will be reported on the 8949 as well as the 4797. You do not generate these on your own.

- As far as your business use percentage throughout the years, you would not report this separately. This is determined by the amount of depreciation taken throughout the years, based on your business use percentage. If you reported your rental income and expenses previously with Turbo Tax, then Turbo Tax should have a record of your depreciation taken for every year you reported this as a rental activity. Hopefully, you have kept a record of all depreciation taken because if your record deviates from the actual depreciation taken, you have a chance to correct this amount in the program.

This is important because the depreciation needs to be recaptured to report on a 8949 (program does this automatically).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to report home sale with Variable Business Use Percentage over the years as rental with turbotax 2022

Thank you for the quick and thorough response.

After I have switched to premier edition, when I answered yes to special handling required of the sale of the rental property. I no longer get "the program cannot compute automatically the sale information - in the footnote". Instead, the message was "the program will transfer this amount to the right forms for you". However, even after completing the rest of the sale of rental property step-by-step, I did not come across the "...Eventually, you'll come to the Rental Summary>sale of property/depreciation. screen, which is where you enter your rental income and expenses, assets and depreciation, and vehicle expenses...." and definitely do not see a Form 4797 nor 8949. So I am not sure if the right forms have been populated. Did I miss anything?

As to my following case. Where I have rented out part of my primary residence for full ownership duration and have sold my primary residence.

Should I have completed the "sale of home" step-by-step first (before entering the sale of the rental property). I have questions on what information to enter in the sale of home step-by-step portion.

For selling price - I assumed it should at least be the sale price, reported in 1099-S. Box 2

But what about adjusted cost basis - do I subtract the accumulated depreciation , But the accumulated depreciation seems to have to be entered in the depreciation taken after 1997 step (after one has answered yes that part of home was rented after 1997)

After the completion of the "sale of home" step-by-step process, I do see a generated Form 8949.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to report home sale with Variable Business Use Percentage over the years as rental with turbotax 2022

This is tricky, here's what you do

For the rental portion of the sale, type in rentals in the search bar in the upper right hand corner

then, Jump to rentals

then Do you Want to go directly to your Asset summary

then Describe the Asset

then Enter, enter till you get to this screen

enter all the cost information, apportion the amount related to the rental, because the remaining portion will be towards your personal residence( I'll show you how to enter that later).

then this screen, remember to check off that you purchased and sold the asset

then this screen(please note that dates and percentages used do not reflect your personal information and for illustrative purposes only.

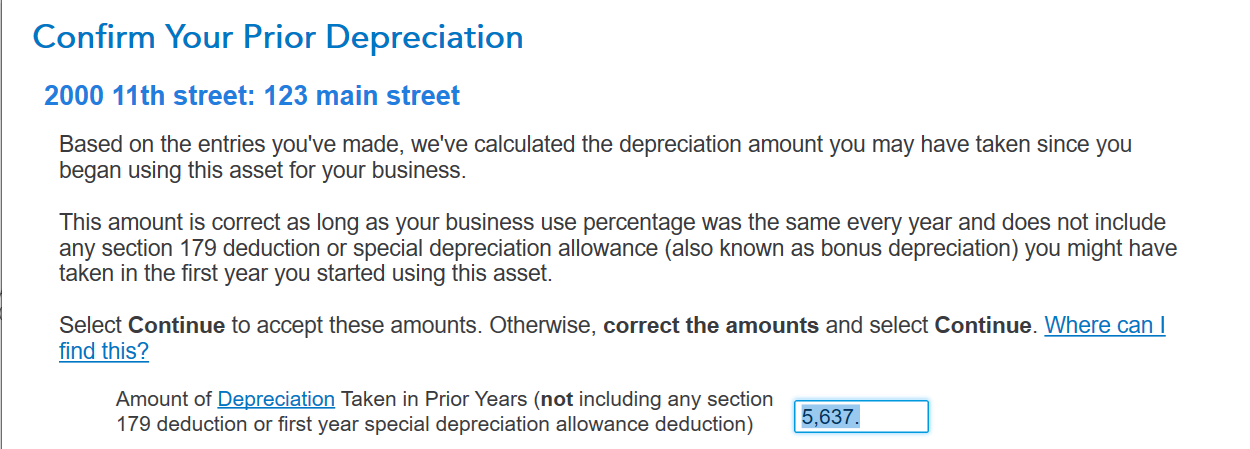

then this screen will autopopulate the prior depreciation taken based on the percentage portion used for the rental as you previously indicated.

here's the tricky part when you get to next screen which will ask you if special handling is required, you enter no. If you answer yes, it will "NOT" take you to next screen to input your sales information

And now for the sales portion of your home

On top, Wages and Income/ Sale of your Home

next screen Sale of your main home

hit continue, continue then input the adress of the home

then this screen

Remember, we only want to use the selling price portion that pertains to your personal residence of the home, not the rental

then to the screen which asks about the date and purchase price of the home . Remember, we only want to use the portion that pertains to your personal residence of the home and not the rental.

then continue, continue till you get to this screen

again, the 140 is for illustrative purposes only. You will figure out how many days during the period was used for the rental and enter it.

then next and then the screen Reason for Sale

then enter number of months used, and then number of months owned

then you will get to screen Depreciation Taken after 1997, hit Yes then this screen

Again, you will only take the amount that pertains to the personal use of the house. Take the total amount of depreciation accumulated on the house "less" the amount previously calculated for the business portion of it. See earlier illustration. $5,637.

And then just take the input to the finish line( a couple of yes or no questions) and everything should flow through seamlessly on Sch D line 10 for the sale of the house and line 11(4797) sale of the business property.

We invite you to come back and let us know the outcome!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to report home sale with Variable Business Use Percentage over the years as rental with turbotax 2022

Thank you for the detailed explanation I again. I followed your instructions and I have similar flow.

But I do have 6 questions in-lined. I have highlighted the questions in red and also embedded ??

Here's my observations

in turbotax

search - rentals

from result - - jump to rentals

income from rentals ... - yes

...

from rental and royalty summary/edit "rental property"

review your "property" rental summary

sale of property/depreciation - update

do you want to go directly to your asset summary - yes

review information - continue

did you stop using the asset in 2022 - yes

disposition information - enter date of sale

date acquired - was prepopulated (w/ correct date) - continue

special handling required - no

sales information

sales price (business portion only) - is it correct that I should enter

overall sales price * business use percentage??? (similar to

concept of pub 523 "business" version of work sheet 2)

sales expenses (business portion only) - is it correct that I should enter

overall sales expenses * business use percentage ???

personal residence

did you use rental property as personal residence after 1997 - yes

depreciation allowable for this property after.. 1997 $xxx1 ($xxx2 for AMT)

You should make a note of this number, because you will need it if this property

qualifies as your personal residence at the time you sell it.

prior AMT depreciation $xxx2 displayed - continue

installment sales - no

result - you have a gain of $xxx3 on your disposition of Residential

your depreciation deduction for Residental for 2022 is $xxx4

at end of step-by-step on sale of rental property, when i switched to forms - I do see result of Form 4797 being populated into Sch D. However, I dont see Form 8949 (form to report sale of Home), I assumed this would be generated by the "sale of home" step-by step interview.

From sale of home step-by-step

Sold a home - continue

sales information

Did you receive a Form 1099-S that reported this sale - Yes

Date sold - per date reported on 1099-S

Selling price - do I enter

what was reported on 1099-s times (1 - business use percentage) or what

has been reported on 1099-S???

Sales expenses - do I enter

sales expenses times (1 - business use percentage) or

100% of sales expenses ????

Tell us about the purchase of your home

Date Bought or Acquired - entered <date>

Adjusted cost basis - overall cost basis or

(1-business use percentage)*overall cost basis??

Did you rent out all or part of the home after ... 1997 - yes

Depreciation after May 6, 1997

Depreciation after May 6, 1997 - should I enter $xxx4 (output from the

depreciation deduction for Residential (from the sale of rental output))or $xxx1??

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to report home sale with Variable Business Use Percentage over the years as rental with turbotax 2022

You are essentially selling two separate properties, the rental and the home. The rental section will handle all depreciation recapture and the home portion will be handled in the home sale section.

For the sale of Rental Asset(s:(

Yes - use only the business use percentage for sales price and sales expenses in the rental portion of your property.

sales price (business portion only) - is it correct that I should enter overall sales price * business use percentage??? (similar to concept of pub 523 "business" version of work sheet 2)

sales expenses (business portion only) - is it correct that I should enter overall sales expenses * business use percentage ???

For the Sale of your home portion:

Selling price - do I enter what was reported on 1099-s times (1 - business use percentage) or what has been reported on 1099-S??? Personal portion only

Sales expenses - do I enter sales expenses times (1 - business use percentage) or 100% of sales expenses ???? Personal portion only

Adjusted cost basis - overall cost basis or (1-business use percentage)*overall cost basis?? Personal portion only

Depreciation after May 6, 1997 - should I enter $xxx4 (output from the depreciation deduction for Residential (from the sale of rental output))or $xxx1?? Do not make an entry, this should be handled in the rental assets with the sales information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to report home sale with Variable Business Use Percentage over the years as rental with turbotax 2022

Thank you for the reply. I will report the result after I have completed my turbo tax entry.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CCCD

New Member

davsemah

New Member

TaxpayerNoDoubt

Level 1

albuque20

New Member

RyanK

Level 2