- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

This is tricky, here's what you do

For the rental portion of the sale, type in rentals in the search bar in the upper right hand corner

then, Jump to rentals

then Do you Want to go directly to your Asset summary

then Describe the Asset

then Enter, enter till you get to this screen

enter all the cost information, apportion the amount related to the rental, because the remaining portion will be towards your personal residence( I'll show you how to enter that later).

then this screen, remember to check off that you purchased and sold the asset

then this screen(please note that dates and percentages used do not reflect your personal information and for illustrative purposes only.

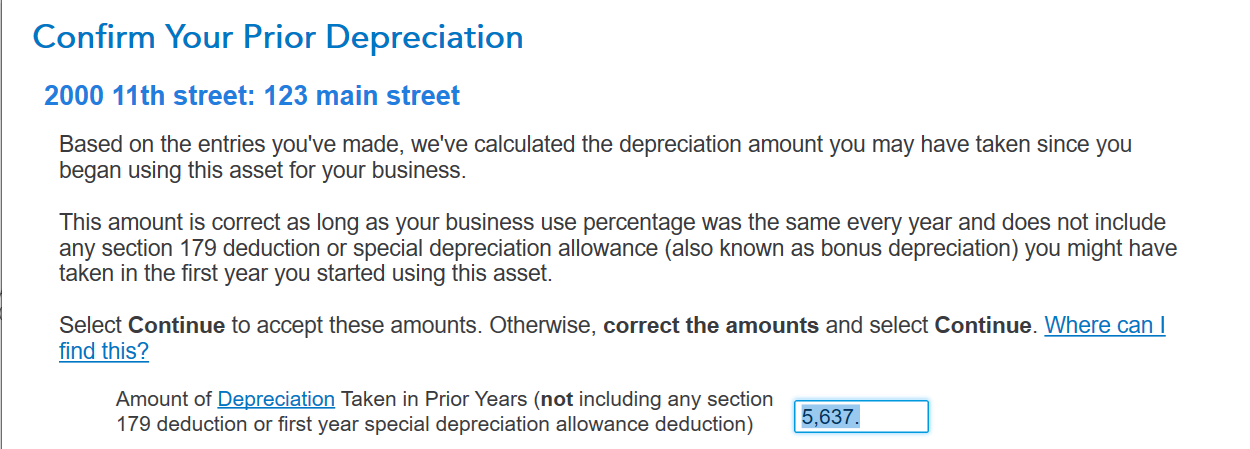

then this screen will autopopulate the prior depreciation taken based on the percentage portion used for the rental as you previously indicated.

here's the tricky part when you get to next screen which will ask you if special handling is required, you enter no. If you answer yes, it will "NOT" take you to next screen to input your sales information

And now for the sales portion of your home

On top, Wages and Income/ Sale of your Home

next screen Sale of your main home

hit continue, continue then input the adress of the home

then this screen

Remember, we only want to use the selling price portion that pertains to your personal residence of the home, not the rental

then to the screen which asks about the date and purchase price of the home . Remember, we only want to use the portion that pertains to your personal residence of the home and not the rental.

then continue, continue till you get to this screen

again, the 140 is for illustrative purposes only. You will figure out how many days during the period was used for the rental and enter it.

then next and then the screen Reason for Sale

then enter number of months used, and then number of months owned

then you will get to screen Depreciation Taken after 1997, hit Yes then this screen

Again, you will only take the amount that pertains to the personal use of the house. Take the total amount of depreciation accumulated on the house "less" the amount previously calculated for the business portion of it. See earlier illustration. $5,637.

And then just take the input to the finish line( a couple of yes or no questions) and everything should flow through seamlessly on Sch D line 10 for the sale of the house and line 11(4797) sale of the business property.

We invite you to come back and let us know the outcome!

**Mark the post that answers your question by clicking on "Mark as Best Answer"