- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to enter a 1099-misc for rental less than 14 days..."schedule e" gives me an error because it is less than 14 days and therefore not taxable.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter a 1099-misc for rental less than 14 days..."schedule e" gives me an error because it is less than 14 days and therefore not taxable.

You are referring to "the Masters exemption". It is named that because so many people take advantage of it every year during the big annual golf tournament in Georgia.

It doesn't matter whether you earn $100 or $10,000 during those 14 days that you rent out space—you don't have to report the earnings on your taxes. However, to qualify, you must:

- Rent part of or your entire house for no more than 14 days during the year

- Live in the house yourself for more than 14 days during the year or at least 10% of the time that you rent it to others.

Less than 15 days of Rental Activity? If you don't qualify for the exemption, use that link to report your rental income.

There's a special rule if you use a dwelling unit as a residence and rent it for fewer than 15 days. In this case, don't report any of the rental income and don't deduct any expenses as rental expenses. See IRS topic 415.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter a 1099-misc for rental less than 14 days..."schedule e" gives me an error because it is less than 14 days and therefore not taxable.

Thanks. This does apply to me: There's a special rule if you use a dwelling unit as a residence and rent it for fewer than 15 days. In this case, don't report any of the rental income and don't deduct any expenses as rental expenses.

But, what do should I do about my 1099 MISC form? where can I account for that?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter a 1099-misc for rental less than 14 days..."schedule e" gives me an error because it is less than 14 days and therefore not taxable.

You can leave the 1099-MISC off your return and claim Section 280A(g) if the IRS inquires,

OR

You may enter the 1099-MISC under

Personal Income

Other Common Income

Income from Form 1099-MISC

If they listed the income in Box 1 as rent, you will need to select "Nonbusiness income from the rental of personal property or equipment" on the "Source of 1099-MISC Income" screen.

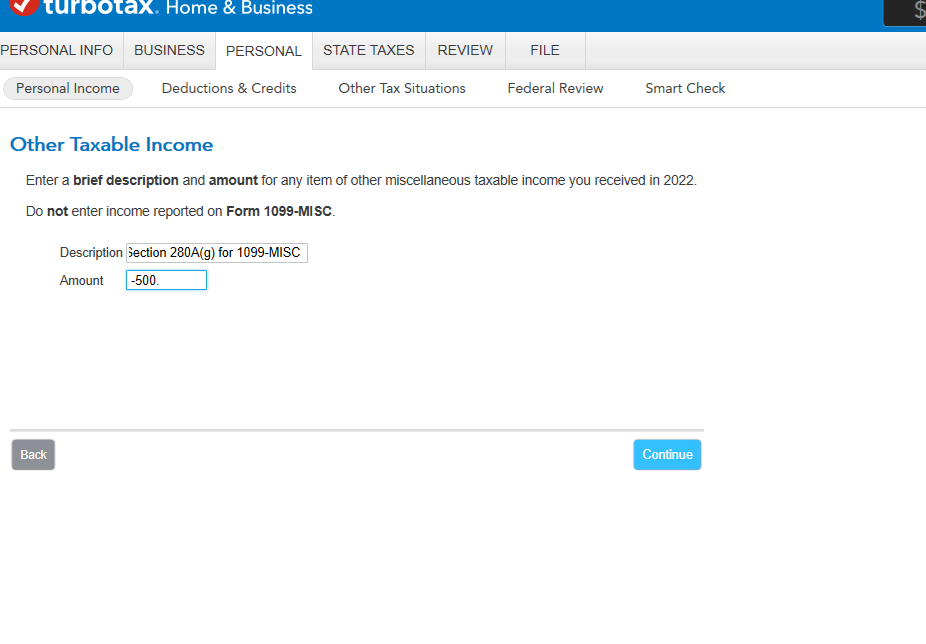

Next, make a correcting entry to remove the income from your Adjusted Gross Income (AGI)

Personal Income

Less Common Income

Miscellaneous Income, 1099-A, 1099-C

Other reportable income (last option on list)

Type something like "Section 280A(g) for 1099-MISC" into the Description Box so the IRS understands what you are doing

Type the amount of the 1099-MISC income AS A NEGATIVE NUMBER (put - in front of the amount)

The amount of the 1099-MISC will be on Schedule 1 line L 1.

The negative amount will be on Schedule 1 line 12.

Schedule 1 carries forward to the 1040 line 8

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jays1951-gmail-c

Level 2

4md

New Member

josephmarcieadam

Level 2

user17558933183

Returning Member

chinyoung

New Member