- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You can leave the 1099-MISC off your return and claim Section 280A(g) if the IRS inquires,

OR

You may enter the 1099-MISC under

Personal Income

Other Common Income

Income from Form 1099-MISC

If they listed the income in Box 1 as rent, you will need to select "Nonbusiness income from the rental of personal property or equipment" on the "Source of 1099-MISC Income" screen.

Next, make a correcting entry to remove the income from your Adjusted Gross Income (AGI)

Personal Income

Less Common Income

Miscellaneous Income, 1099-A, 1099-C

Other reportable income (last option on list)

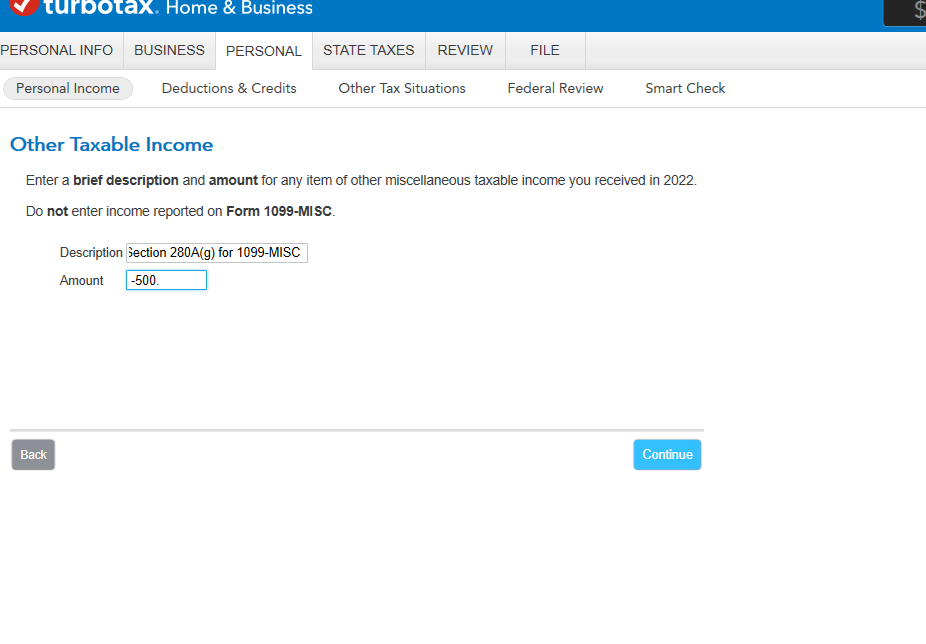

Type something like "Section 280A(g) for 1099-MISC" into the Description Box so the IRS understands what you are doing

Type the amount of the 1099-MISC income AS A NEGATIVE NUMBER (put - in front of the amount)

The amount of the 1099-MISC will be on Schedule 1 line L 1.

The negative amount will be on Schedule 1 line 12.

Schedule 1 carries forward to the 1040 line 8

**Mark the post that answers your question by clicking on "Mark as Best Answer"