- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

You would report the loss as a sale of stock in TurboTax as follows:

- Choose the Federal option on your left menu bar

- Choose Wages & Income

- Choose the Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto) option

- Choose Add investments

- Choose the Stocks, Bonds, Mutual Funds option and follow the instructions

Enter the date you purchased the stock, date it was liquidated, cost and sale proceeds (amount distributed to you.) It will be a capital loss, which are limited to a net deduction of $3,000 per year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

Thanks for the reply! I received a 1099-DIV with the nondividend distribution in Box 3, which I entered into TurboTax. To make sure, I should leave this 1099 DIV I've entered into TurboTax and add an additional investment to show the loss per your instructions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

Additional question... Your instructions force me to create a 1099-B that is supposed to be from a broker or a bank, but I have only received a 1099-DIV that shows nothing more than the nondividend distributions in Box 3. Can I legitimately create a 1099-B record when I don't actually have one that reflects the loss between my original investment and my nondividend distribution since TurboTax specifically says the info "should match the 1099-B from your financial institution"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

A few comments:

- Hopefully you know how much you paid for the stock. This is key; you do appear to know this based on the facts.

- The 1099-DIV reporting in box 3 is only taxable if you received an amount in excess of your stock cost.

- So if the amount on the 1099-DIV does not exceed your stock cost, you do not need to enter it.

- You note that your stock did not go to zero. This means that you have a capital loss.

- You need to take your stock cost, subtract the 1099-DIV amount to arrive at the remaining stock cost basis. This amount represents your capital loss.

- Then for form 8949, you need to enter a zero sales price and the remaining cost basis to arrive at the capital loss for schedule D.

- You would note that you did not receive a form 1099-B; at least that is what your limited facts lead me to believe.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

Appreciate the help. I do know my original purchase price. After reading IRS Publication 550 on Nondividend Distributions, I understand that it reduces my cost basis as you say. I cannot find any evidence anywhere after lots of Googling that I can actually claim the loss of my new (barely) reduced cost basis since it was a dissolution and not a liquidation. My reading indicates that if it had been reported in Box 9 as Cash Liquidation Distribution that I could claim the capital loss. No 1099-B received, and I see going through the form I can choose "no 1099-B received". I'm a bit nervous about creating the 1099-B when I cannot find evidence that I can claim the loss in the case of dissolution, though it does seem that I should be able to. Just haven't dealt with dissolution before and not sure of the IRS rules. How confident are you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

To follow-up on the previous posts, you won't be creating a 1099-B in TurboTax. Rather, you will be entering your stock information with a basis that has been reduced as a result of the non-dividend distribution. Generally, in a dissolution a company is winding up its affairs, and ceasing its business operations with the end result being that it will no longer be a legal entity. Transactions of this type are entered on Form 8949, and such form will be created when you follow the advice from @ThomasM125.

The IRS instructions for Form 8949 do not require entry of a code when basis has been adjusted pursuant to a non-dividend distribution. Rather, those instructions provide that you should enter the name of the payer of any taxable non-dividend distribution, and the taxable part of the distribution. When you enter your information as suggested by @ThomasM125, Form 8949 will be prepared consistent with IRS instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

Thanks for the answer, but the problem that I'm having is that when I follow the step-by-step instructions by @ThomasM125, TurboTax forces me to create a 1099-B and takes me to a screen that asks "Which bank or brokerage is on your 1099-B?", not to the option of creating an 8949 form. As I answer the questions, it takes me to the Sales Section that says, "The info entered should match the 1099-B from your institution". The pulldown menu for the Sales Section allows me to choose "Long-term did not receive 1099-B form". It continues to ask for sales date info, proceeds (which I entered as $0) and cost basis (entered my reduced cost basis). The next screen allows me to check a box that says, "This was a useless security". When I'm done, it creates a 1099-B. Will this create the 8949 form I need? If not, how do get to a screen to create an 8949 form instead of a 1099-B?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

You may have to choose the Other (land, second homes, personal items) investment sale option if using TurboTax online to enter your investment sale if you don't have a form 1099-B, I think that is what is causing confusion here. You will be given an option to indicate that you sold stock and you can then enter a capital loss. The following only applies if you are usind the desktop version of TurboTax:

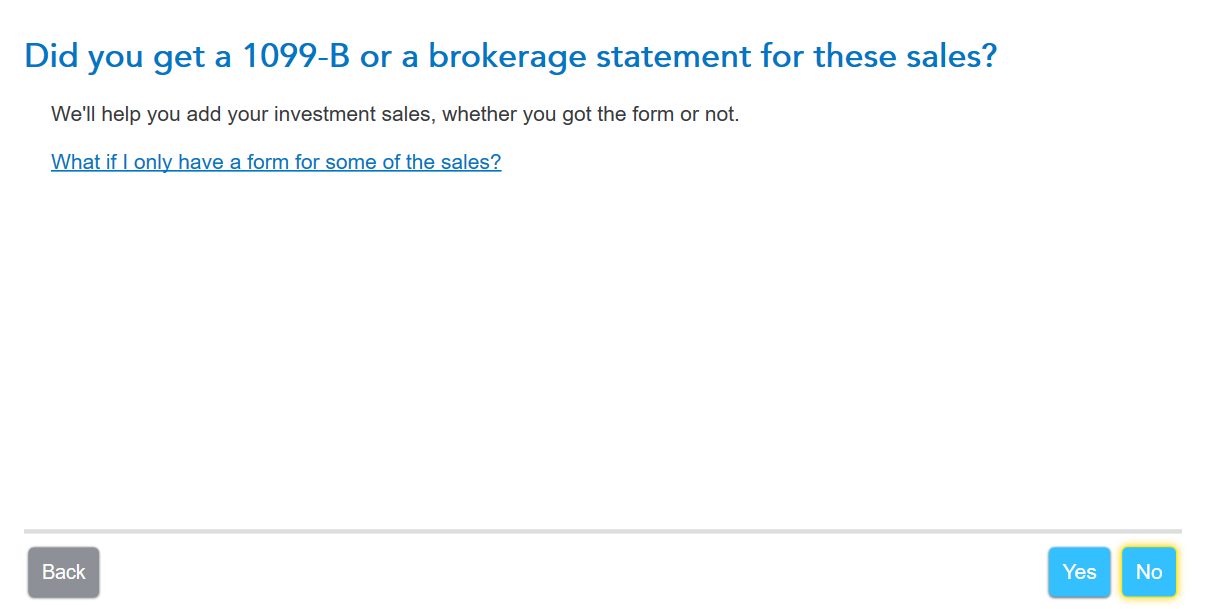

When I go to enter an investment sale in TurboTax I see a screen that says Did you get a 1099-B or a brokerage for these sales? and when I answer "No" I don't see a reference to a form 1099-B being created.

Here are the steps I took:

- Choose the Federal option on your left menu bar

- Choose Wages & Income

- Choose the Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto) option

- Choose Add investments

- Choose the Stocks, Bonds, Mutual Funds option and follow the instructions

After step 5 I see the question regarding having a form 1099-B or not.

{Edited 3/29/23 at 1:45 PM PST}

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter capital loss from dissolution of a company in which I owned stock and received a non-dividend distribution (stock didn't quite go to zero)?

Yes, I'm using the online version. I never have the option to answer whether I got a 1099-B or not. It dumps me straight into filling out a 1099-B. I am able to choose "Long-term no 1099-B" under the sales section and "This is a worthless security" on another screen afterward. When I try using the Other (land, second homes, personal items) investment sale option, it takes me to the exact same set of questions and still creates a 1099-B. No way around it. I did a search within TurboTax to find how to get to form 8949, and it says that you just enter your 1099-B and TurboTax will generate the 8949 and populate Schedule D automatically with no need to enter an 8949 directly. It appears that it is generating a 1099-B to serve both purposes since it does give me the option to say I didn't receive a 1099-B within it and also that it was a worthless security. My tax refund is accurate compared to my own calculations, so I'm going with it creating a 1099-B. Can't find any other way to do it. Thanks, Thomas, and all of you who responded, for being patient with me and helping to nudge me toward what I must assume is the proper way to handle it considering the confusion in how TurboTax is set up.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

emh_SpencerTop

Level 1

jypwlee

Level 2

gjgogol

Level 5

TaxMan81

Level 2

alanealive

Level 2