- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You may have to choose the Other (land, second homes, personal items) investment sale option if using TurboTax online to enter your investment sale if you don't have a form 1099-B, I think that is what is causing confusion here. You will be given an option to indicate that you sold stock and you can then enter a capital loss. The following only applies if you are usind the desktop version of TurboTax:

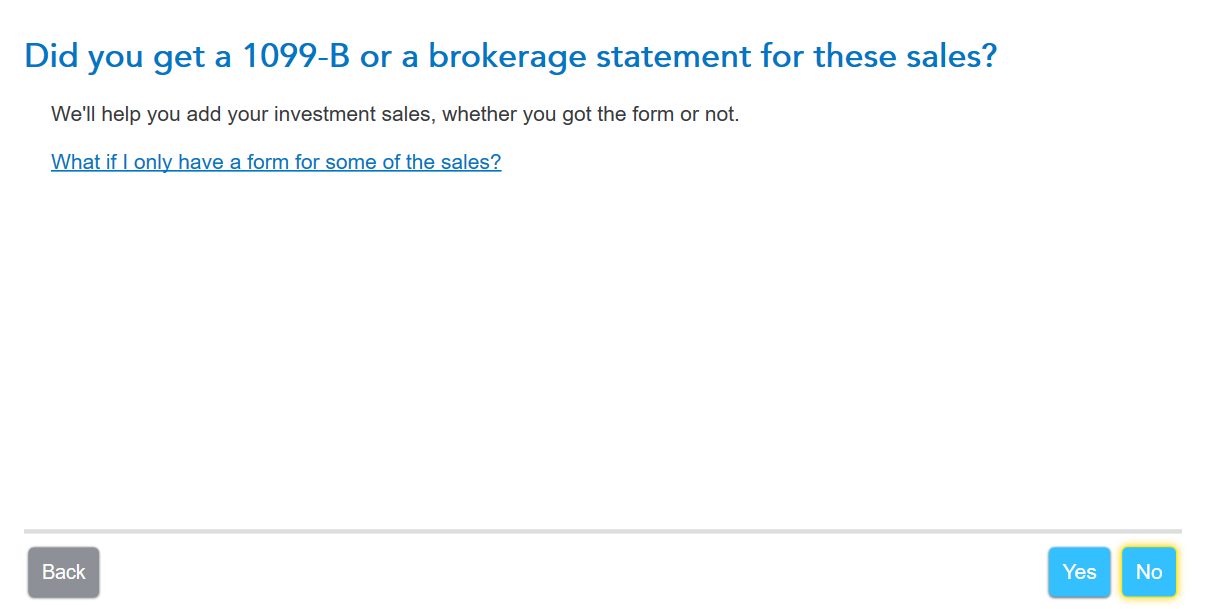

When I go to enter an investment sale in TurboTax I see a screen that says Did you get a 1099-B or a brokerage for these sales? and when I answer "No" I don't see a reference to a form 1099-B being created.

Here are the steps I took:

- Choose the Federal option on your left menu bar

- Choose Wages & Income

- Choose the Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto) option

- Choose Add investments

- Choose the Stocks, Bonds, Mutual Funds option and follow the instructions

After step 5 I see the question regarding having a form 1099-B or not.

{Edited 3/29/23 at 1:45 PM PST}

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 29, 2023

1:26 PM