- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Getting lots of error messages during "smart Check." "Form 1099-B... Cost or Adjustment Basis does not match the value on the Capital Gain Adjustment worksheet."

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting lots of error messages during "smart Check." "Form 1099-B... Cost or Adjustment Basis does not match the value on the Capital Gain Adjustment worksheet."

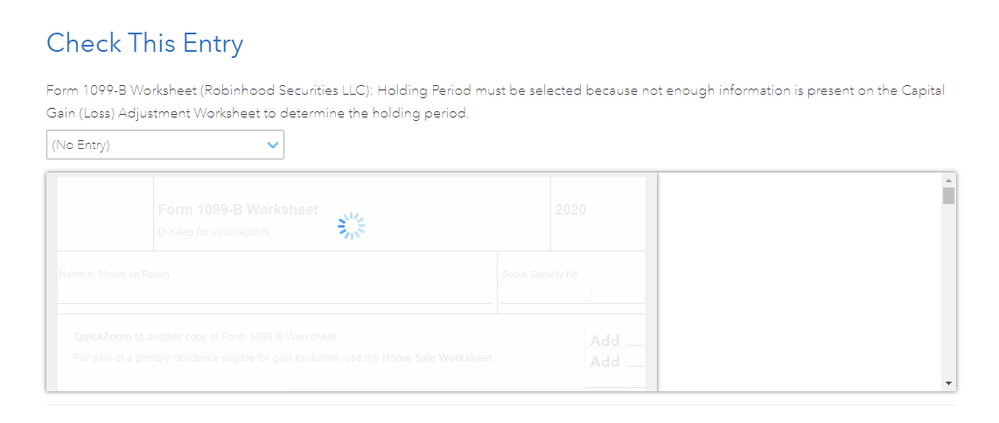

I am having the same issue this is what I am seeing:

Form 1099-B Worksheet(Robinhood Securities LLC): Holding Period must be selected because not enough information is present on the Capital Gain(Loss)Adjustment Worksheet to determine the holding period.

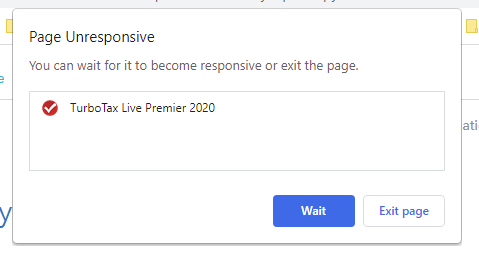

I cannot click the window to choose entry it will go to a page unresponsive.

There are only 930 line items on my 1099-B I am stuck on this window. I did try opening a different browser and have the same issue. I did delete the entire import and re-import it back still have the same issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting lots of error messages during "smart Check." "Form 1099-B... Cost or Adjustment Basis does not match the value on the Capital Gain Adjustment worksheet."

You can delete the individual entries and just add a summary of each of the different sales categories. Your 1099-B should have those groupings. For example "Short-term covered" or "Long-term covered".

- Open or continue your return and search for stock sales.

- Select the Jump to link in the search results.

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2020?.

- If you land on Your investment sales summary, select Add more sales.

- On the OK, what type of investments did you sell? screen, select Stocks, Bonds, Mutual Funds, then Continue.

- When asked how you want to enter your 1099-B, select I'll type it myself.

- Answer the questions until you can select Enter sales section totals.

- You'll now be able to enter the total proceeds (sales) and cost basis, along with the sales category. Refer to your 1099-B for the amounts and category. When finished, select Continue.

If you have non-covered sales, then TurboTax will prompt you to upload a pdf copy of the transactions.

Entering the summary of sales categories will eliminate the problem with some individual transactions giving error messages.

All of the transactions have already been reported to the IRS, except for non-covered that are not reported to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting lots of error messages during "smart Check." "Form 1099-B... Cost or Adjustment Basis does not match the value on the Capital Gain Adjustment worksheet."

The Net gain or Loss on my form does not match what is reported here , Will that be an issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting lots of error messages during "smart Check." "Form 1099-B... Cost or Adjustment Basis does not match the value on the Capital Gain Adjustment worksheet."

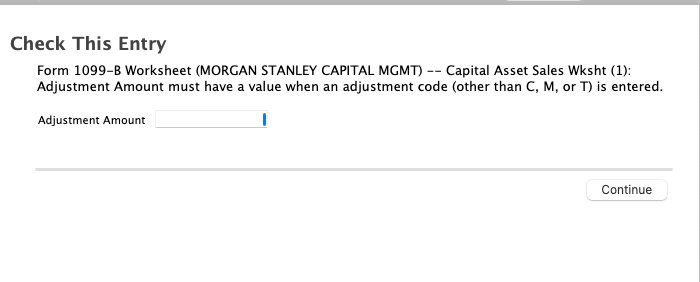

Managed to figure this out with the help from TurboTax Support

The column: Wash Sale Loss Dissallowed must be added as "Adjustment" to match my Net Gain or Loss on the Form. All is good now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting lots of error messages during "smart Check." "Form 1099-B... Cost or Adjustment Basis does not match the value on the Capital Gain Adjustment worksheet."

How did you make that change? I keep getting the error "Holding period must be selected because not enough information is presented". I go back into my E-Trade stocks and try to edit within TurboTax there's isn't any option to select any holding periods.

TurboTax fix this bug!! Alot of my friends have been having this error and another one about wash sales. A couple of them were desperate to get their refund that they just went to H&R to have it done because they couldn't resolve this. These TurboTax bots aren't helpful either. Clearing cache or trying a different browser does NOT work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting lots of error messages during "smart Check." "Form 1099-B... Cost or Adjustment Basis does not match the value on the Capital Gain Adjustment worksheet."

It's year 2024 and looks like the error still haven't be fixed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting lots of error messages during "smart Check." "Form 1099-B... Cost or Adjustment Basis does not match the value on the Capital Gain Adjustment worksheet."

You are posting on an old thread. We'd love to help you complete your tax return, but need more information. Can you please clarify your question? What sort of error message are you getting and where in the program?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting lots of error messages during "smart Check." "Form 1099-B... Cost or Adjustment Basis does not match the value on the Capital Gain Adjustment worksheet."

Hello CatinaT1,

But a more generic issue is: How do I see the whole form (in this case worksheet) so that I know the context of this request and know how to fix it? It is impossible to even know what it is talking about without the whole form available to me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting lots of error messages during "smart Check." "Form 1099-B... Cost or Adjustment Basis does not match the value on the Capital Gain Adjustment worksheet."

In the Online versions, you may view your tax return under Tax Tools, then Tools, then View Tax Summary, then Preview my 1040.

In the online versions, you may view or print at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets after you have paid for the software.

In the Desktop versions, one can look at the tax return by clicking FORMS, or by viewing the PDF through the Print Center.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

saintptl

New Member

cab312

New Member

jim

New Member

booba75018

New Member

alau52

Level 1