- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Follow-up Questions for Mike9241

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Follow-up Questions for Mike9241

Hi Mike9241,

You replied to my questions on 03/04/2022, but you never replied to my follow-up questions (please see below). I thought these message boards were for discussion purposes, but apparently I was incorrect. Hopefully, you or someone else can answer my questions below. Thank you.

Hi Mike9241,

Thank you so much for your prompt and informative reply.

TC Pipelines was indeed held through a broker, but on the Consolidated 1099 statement that they produced, there is no 1099-B statement regarding this exchange/sale. I also received a Form 8949 and Schedule D statement from the broker, and there is no indication of this exchange/sale.

TC Pipelines did provide a Final K-1 and a 2021 Sales Schedule as you mentioned. When entering K-1 information on TurboTax (TT), regarding “Describe Partnership Disposal”, I want to enter “Complete Disposition”, but the “Learn More” section indicates “If a passive activity or former passive activity is involved in a like-kind exchange, the activity should NOT be considered fully disposed of and current year losses and passive carryovers are still subject to the passive activity loss rules.” As this was a LIKE-KIND EXCHANGE of shares involving 2 passive activities, I thought “Complete Disposition” would not be the correct choice. Another choice offered on TT is “Disposition was not via a sale”, which didn’t seem correct either. I chose “No entry”. You are telling me to enter “Complete Disposition”, which is fine.

I don’t see on TT where to enter that the K-1 is Final, but I will try to find that.

When you said “in the k-1 disposition info you list sales price only as an the 751 income cost as 0 ordinary income as sales price”, I don’t understand exactly what you are telling me. I apologize for my ignorance.

As there is no 1099-B, when you said “on the 1099-B which should indicate cost basis not reported to IRS you'll need to change that to the computed basis”, I will try to enter that if I encounter a place to do so.

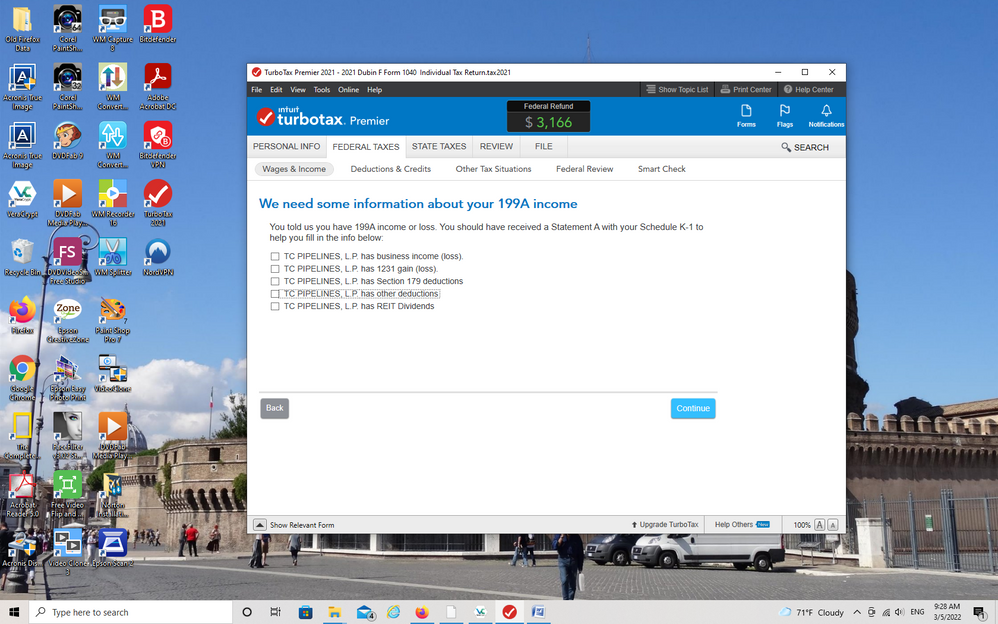

On the K-1, there is indeed a line 20Z1 entry for Section 199A Publicly Traded Partnership Income with one number indicated, but TT wants much more information than this single entry provides. Please see screen shot below:

Thank you so much for your patience and understanding. Any detailed instruction that you can provide is greatly appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Follow-up Questions for Mike9241

You posted a lengthy reply to a specific "Champ" but when you want to do that and have the Champ notice it, you need to use the @ before the Champ's username---

So @Mike9241

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Follow-up Questions for Mike9241

Also, while you are waiting for @Mike9241 to reply, take note of the following:

You have to check one of the boxes in the screenshot below (in the program) and it appears it should be the box indicating you disposed on your interest.

Due to tax reform (the TCJA), like-kind exchanges are now limited to exchanges of real property.

See https://www.irs.gov/newsroom/like-kind-exchanges-now-limited-to-real-property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Follow-up Questions for Mike9241

@Faustind i can't answer why the broker did not report the transaction. contact TC pipeline and your broker

https://www.tcpipelineslp.com/contact/ these are Canadian companies and so I can't say what the reporting requirements are for them to US brokers. nor could I find any tax info on the web as to how to treat the merger. there is US tax Law, Canadian tax law and US/Canadian tax treaties,

normally when there is a proposed merger you would have received some documentation form the companies about it an that would normally describe the tax consequences.

the PTP is gone. it is now part of the corporation through the merger

every PTP/company merger that I've seen (and I've been doing this for decades) resulted in the merger being taxable but this is two Canadian businesses

there is always the possibility that the broker did not have the info to report the transaction at the time the 1099-B was issues. a latter 1099-B could come out reporting the sale. the only item likely to be correct is te sales price.

You should have received .7 TCP for each share of the PTP you had. the FMV of TCP on the date the merger closed would be the value but again these are Canadian companies that trade on the Toronto exchange so a conversion from C$ to US$ may be necessary.

if the merger was taxable the FMV of the new security vs the tax basis of the old security is the gain or loss. usually, a worksheet is provided to allow shareholders to computer the income

you also report the info on the k-1 and if it was indeed taxable merger you indicate a disposition so any suspended losses are freed yp.

note these are Canadaian companies so I can't speak to the QBI question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Follow-up Questions for Mike9241

@Mike9241, Thank you so much for the great, detailed information. I will pursue more information from both my broker and from TC Pipelines regarding unresolved issues. Thank you for your patience and guidance.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17525953115

New Member

bcspencer

Level 1

pairahoos

Level 2

BlindDog09

Level 1

shanesnh

Level 3