- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Follow-up Questions for Mike9241

Hi Mike9241,

You replied to my questions on 03/04/2022, but you never replied to my follow-up questions (please see below). I thought these message boards were for discussion purposes, but apparently I was incorrect. Hopefully, you or someone else can answer my questions below. Thank you.

Hi Mike9241,

Thank you so much for your prompt and informative reply.

TC Pipelines was indeed held through a broker, but on the Consolidated 1099 statement that they produced, there is no 1099-B statement regarding this exchange/sale. I also received a Form 8949 and Schedule D statement from the broker, and there is no indication of this exchange/sale.

TC Pipelines did provide a Final K-1 and a 2021 Sales Schedule as you mentioned. When entering K-1 information on TurboTax (TT), regarding “Describe Partnership Disposal”, I want to enter “Complete Disposition”, but the “Learn More” section indicates “If a passive activity or former passive activity is involved in a like-kind exchange, the activity should NOT be considered fully disposed of and current year losses and passive carryovers are still subject to the passive activity loss rules.” As this was a LIKE-KIND EXCHANGE of shares involving 2 passive activities, I thought “Complete Disposition” would not be the correct choice. Another choice offered on TT is “Disposition was not via a sale”, which didn’t seem correct either. I chose “No entry”. You are telling me to enter “Complete Disposition”, which is fine.

I don’t see on TT where to enter that the K-1 is Final, but I will try to find that.

When you said “in the k-1 disposition info you list sales price only as an the 751 income cost as 0 ordinary income as sales price”, I don’t understand exactly what you are telling me. I apologize for my ignorance.

As there is no 1099-B, when you said “on the 1099-B which should indicate cost basis not reported to IRS you'll need to change that to the computed basis”, I will try to enter that if I encounter a place to do so.

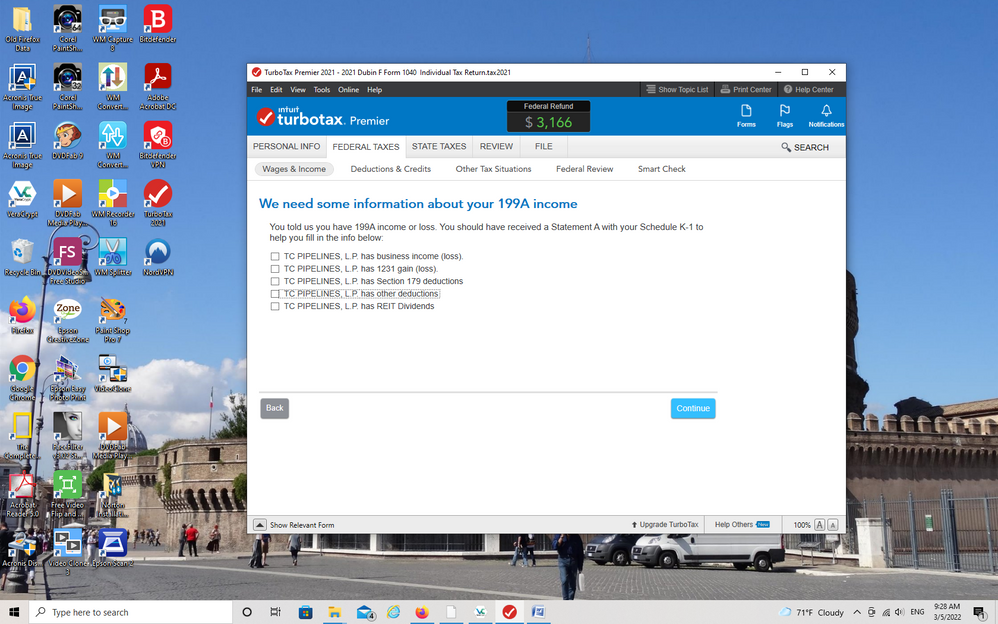

On the K-1, there is indeed a line 20Z1 entry for Section 199A Publicly Traded Partnership Income with one number indicated, but TT wants much more information than this single entry provides. Please see screen shot below:

Thank you so much for your patience and understanding. Any detailed instruction that you can provide is greatly appreciated.