- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Entering RSU Information into Turbo-Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

I have searched the forums, but can't seem to come across the answer, for what I'm guessing is a pretty simply operation in Turbo-Tax.

In prior years I was Granted RSU's, Some Vested in 2021.

In 2021ONLY shares to Cover Taxes were Sold, the balance simply transferred to Stocks that I have done nothing with.

How Do I enter this in Turbo-Tax, I am using the desktop Version, As I understand there may be some differences in Online vs. Desktop.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

For this transaction, you only want to list the cost basis of the shares you sold. Since they were exercised and sold on the same day, the cost basis and proceeds should be just about the same number. You may have a small loss if any transaction fees were charged. In your example, the $50,000 is the cost basis of all the shares that were exercised. Since you only sold 25% of them to cover taxes, the cost basis is 25% of $50,000 or $12,500. The 75% you are holding does not need to be reported anywhere in the stock sales section until the year you actually sell them. When you do sell them their cost basis will be $37,500, 75% of $50,000.

The sales category should be listed on your 1099-B. It is definitely short-term. Covered or not is whether the basis is reported to the IRS. Usually, it is a short-term covered transaction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

Most likely the stock sale was included as income on your W-2 and reported on Form 1099-B. To avoid double taxation:

- You will need to change the stock basis on the date of the sale, to the price on the date of sale.

- The result is zero gain or a minor loss due to brokers commission/fees.

- The IRS will expect to see that information on your tax return.

To enter your 1099-B form, see Where do I enter a 1099-B?

For additional information, see the TurboTax article: Non-Qualified Stock Options.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

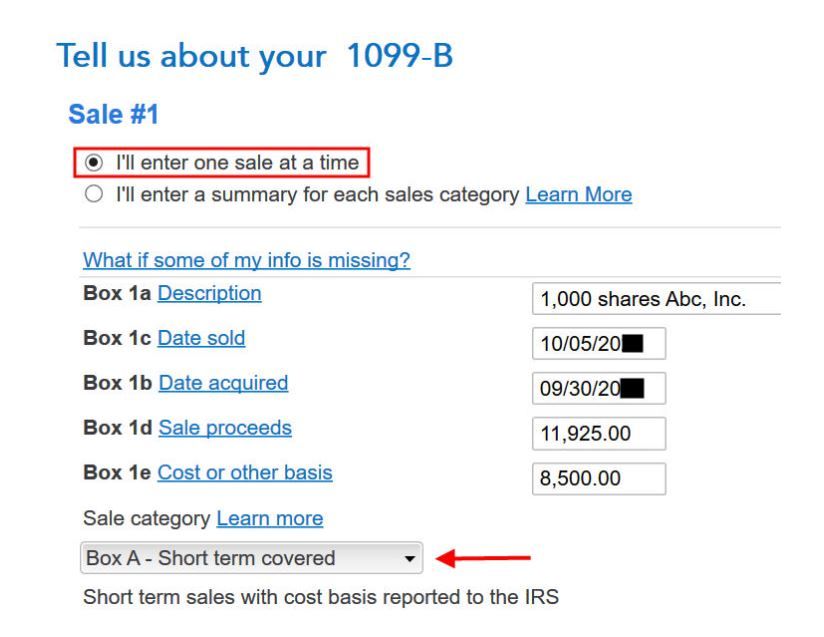

Do I Enter in TT in the 1099B Section, as shown in Pic.

If So using an Example as.

1000 shares granted

250 Sold for Taxes

Share Price at time of sale $50

Date Sold 01 Mar2021

What would go in 1d, 1e, and Sale Category, Assuming that I sold No shares other than those to cover Taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

Yes. Although 1000 shares were granted, they were not all sold. The only information that should be entered here is the actual number of shares that were sold. The value on the vesting date of those same shares will be your cost basis (check your W-2 and divide that total by the number of shares received on the vesting date). The amount reported as taxable income on your W-2 becomes your cost basis for all vested shares.

Summary:

- When you receive an RSU award, you don't actually own the stock until it vests. Accordingly, there is nothing to report at the time of the award.

- Once the stock has vested, the fair market value of the stock gets reported as ordinary income, usually in box 1 of your W-2. In some companies, employees can earn dividends from unvested RSUs — these are also reported in box 1 of their W-2 forms.

- After vesting, you own the stock outright. Should you later sell those shares, you'll get a 1099-B which will report the gain or loss from the sale.

Please update here if you need further assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

In your example you stated that you only sold 250 shares for taxes. Yet your screenshot indicates that you sold 1,000 shares. Did you copy these figures from an actual 1099-B?

Also, your per-share cost basis is the compensation you received at vesting (which is reported on your W-2) divided by the gross number of shares you received, including those sold for taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

So Would this be accurate using these Numbers? I’m just confused on the Sale Proceeds, and Sale Category (I think)…

1000 shares granted

250 Sold for Taxes

Share Price at time of sale(For Taxes) $50

Date Sold 01 Mar2021

Box1a Description: Company ABC

Box 1c Date Sold: 01Mar2021

Box1b Date acquired: 01Mar2021

Box 1d Sale Proceeds: $12,500

Box 1e Cost or other Basis: $50,000

Sale Category: ????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

Sorry the Screenshot was just to show the boxes in TT, it was not related tot he example numbers I presented, Sorry to add tot he confusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

For this transaction, you only want to list the cost basis of the shares you sold. Since they were exercised and sold on the same day, the cost basis and proceeds should be just about the same number. You may have a small loss if any transaction fees were charged. In your example, the $50,000 is the cost basis of all the shares that were exercised. Since you only sold 25% of them to cover taxes, the cost basis is 25% of $50,000 or $12,500. The 75% you are holding does not need to be reported anywhere in the stock sales section until the year you actually sell them. When you do sell them their cost basis will be $37,500, 75% of $50,000.

The sales category should be listed on your 1099-B. It is definitely short-term. Covered or not is whether the basis is reported to the IRS. Usually, it is a short-term covered transaction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

Agree with @RaifH. And Box 1a should show the number of shares sold. Example: "250 shares ABC".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

Thanks for all your help, So only the “Sell to Cover” gets reported, got it….

it should look like this then?

1000 shares granted

250 Sold for Taxes

Share Price at time of sale $50 (Only Shares Sold for Taxes)

Date Sold 01 Mar2021

Box1a Description: Sold 250 Shares ABC Company

Box 1c Date Sold: 01Mar2021

Box1b Date acquired: 01Mar2021

Box 1d Sale Proceeds: $12,380 (Example, Cost Basis Less Fees if any)

Box 1e Cost or other Basis: $12,500

Sale Category: ???? I will look on the 1099B, hopefully it is marked

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

So the 1099B States:

Reported to IRS, Gross Proceeds

So is that Short Term Covered then?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

Yes. Please keep track of those sold shares. I want to urge you to create a financial notebook that is kept separate from your tax return. Keep it safe and each year, add your year-end statements from all your financial accounts plus a copy of your W2’s, your carryover information, and proof of your basis in your various investments. You must keep tax records from the time you purchase until sold/ loss used plus 3 years. It is very easy to lose track of disallowed losses / carryforwards/ basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

Thank you for this thread, it has been very helpful. I have a similar situation, RSU's that were vested and a portion was sold to cover the taxes, and I am still holding the rest of the shares. In my case, though, part of the tax was paid with "Dividend equivalents". The income noted for RSU on my W-2 includes both the sale of the stock and the value of the dividend equivalents. Where do I add these in TurboTax? I did not get a 1099-B., and the dividend equivalents are not on a 1099-DIV either.

For example:

Shares released 160

Shares traded to pay tax 55

Shares issued (and held) 105

Dividend equivalents $136.00

Market value per share $144.84

Total Tax $8,102.20

Trade value ($7966.20)

Dividend equivalents (136.00)

---------------------------------------

Amount due $0.00

Income reported on W-2. $8,102.20

Any idea where or how I should enter the $136?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

The gross value of the vested RSU's and dividend equivalents are already included in Box 1 of your W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering RSU Information into Turbo-Tax

So, a follow up question. I know the div equivalents are already included in Box 1 of W-2. What I cant figure out is if this could cause a double taxation on Trading site(whichever company it is used by the employers ). I have several dividends paid by Trading company XYZ for the same name as my employer. Dates of dividends distributed by Trading company XYZ do not match those of Vesting schedule. Could I be double paying taxes on these dividends? Or companies usually pay this without reporting those cash equivalents on Trading company XYZ?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lukas1994

Level 2

RyanK

Level 2

ellenbergerta

New Member

john-maneval

New Member

biggertcate

New Member