- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Employer Stock Worksheet Line 14 Column D

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Stock Worksheet Line 14 Column D

When using the smart check, I keep getting asked for line 14 column D (date) to be entered. What is line 14 column D referring to?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Stock Worksheet Line 14 Column D

That is referring to the Grant Date of your stock, which you can enter in the review. The Employee Stock Interview helps you to calculate your cost basis if you don't know it.

However, if you know the Cost Basis of the shares you sold (reported on Form 1099-B), you don't need to use the Employer Stock Worksheet and can report it a a regular stock sale.

Your cost basis is the Exercise Price (which may be reported on Form 3922), plus the discount you were taxed on your W-2. If you have an amount in Box 14 of your W-2, divide that amount by the number of shares exercised (for example, Box 14 is $1000, you exercised 100 shares, that's $10/share).

If the Exercise Price is $50, add the $10, and your Cost Basis per share is $60. Sometimes it is easier to do it this way, if you're having issues with the worksheet.

Enter your 1099-B in the Investment Income section, under Stocks, Bonds, Crypto, etc. Scroll down to 'Add Investments'. Skip Import, and choose the 'Stocks' icon.

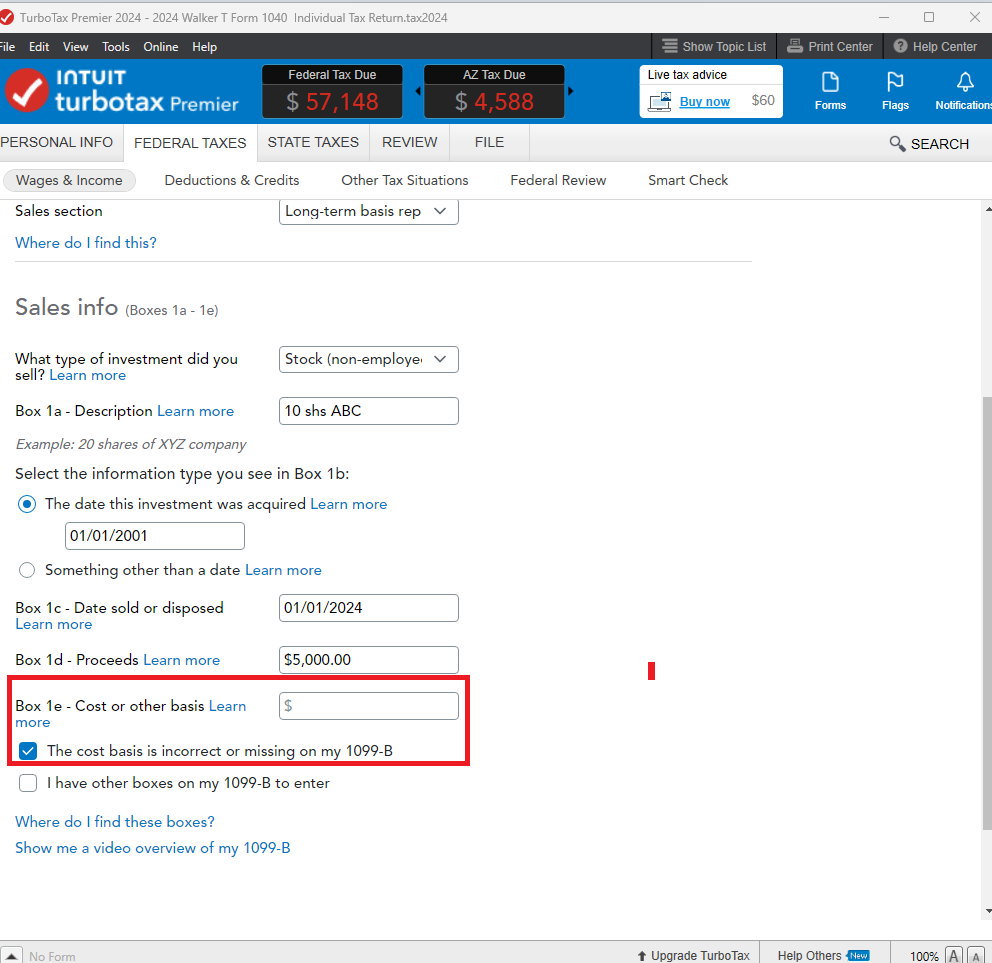

Enter the name on your 1099-B, choose NO for Employee stock, then enter the amounts/dates shown on your 1099-B. You can chose date as 'Various' if the shares were acquired at different times. then check the box 'the cost basis is missing or incorrect.

On the next page, choose 'none of these apply', then indicate 'I know my Cost Basis and need to enter an adjustment', then enter the Cost Basis you calculated.

Here's How to Delete Forms in TurboTax Online if you want to delete the Employer Stock Worksheet and enter your stock sale as outlined above, plus detailed info on Employee Stock Purchase Plans.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tucow

Returning Member

RedCC2B

Level 1

Waylon182

New Member

mc510

Level 2

mjshort

Level 2