- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Amending last year’s return while also filing this year’s return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending last year’s return while also filing this year’s return

Thanks to all who chimed in on my other post. I have another question as well, also involving MLPs in trusts.

I’m using Turbotax Business to file a fiduciary 1041 trust return as trustee. This trust is my mother’s, who passed away in 2018. I made several MLP investments in this trust in 2020. Consequently, I had various suspended passive activity losses to carry forward into the next tax year, i.e. 2021. Unfortunately, 2020 was also my first year using Turbotax Business, so I didn’t realize I needed to check the box that says “Section B1 (Qualified Business Income Deduction)” to have it actually enter the QBI suspended passive activity loss carryforwards in the appropriate fields in Section A. I belatedly realized my mistake while doing 2021’s taxes, finding nothing there where these should have been.

Naturally, I’d like to fix this. I assume I'll need to amend my 2020 return and include those carryforwards so I don't lose them. My question is, how should I handle 2021’s return in light of that? For now, I’ve filed for an extension. But can I go ahead and file the 1041 return for 2021 with the suspended losses from 2020 already carried forward, pursuant to the amended return I also intend to file? Or, should I wait for that amended return to be accepted first before filing 2021’s return?

On a related note, Turbotax says the amended return can’t be e-filed, so what should I do? Where do I attach the required explanation statement to a paper return?

Thanks for any advice.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending last year’s return while also filing this year’s return

Amend the 2020 return first so you have the carryforward correct on the 2021 return.

The 2021 return can be filed before the 2020 amendment has been filed/processed.

Paper file the amended return as it cannot be efiled thru the TT system.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending last year’s return while also filing this year’s return

Thanks. Do I need to include any instructions for the additional refund that will be due, since the QBI will reduce the tax liability? Such as Form 8888?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending last year’s return while also filing this year’s return

Sorry ... the ONLY way to get a refund on an amended return is one single check mailed to the address on the 1041X.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending last year’s return while also filing this year’s return

Thanks. So do I need to include a 1040X, even though this is a 1041 return? I would assume that makes it not applicable. I should be due back about $180, so what are my options for that? Also, the IRS instructions say to include an attached sheet listing the lines with figures that changed. But that would be about half of the figures on the return, so that seems a little excessive. What about just highlighting the amounts that are different on the return itself, and making a note of it in a cover letter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending last year’s return while also filing this year’s return

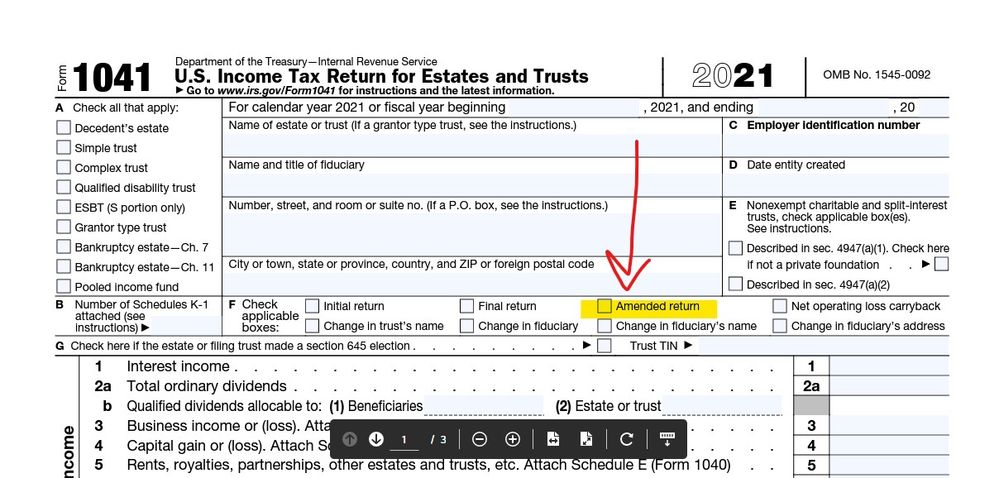

Sorry ... I meant the 1041X not a 1040X. Of course there really is no 1041X ... it is a 1041 with the amended box checked ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending last year’s return while also filing this year’s return

@Critter-3 OP needs to amend Form 1041, not 1040.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sburner

New Member

norman422tobby

New Member

afletchertfc

New Member

mjlee999

New Member

travisbens

New Member