- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- ADU Short Term Rental Schedule E mortgage and interest

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ADU Short Term Rental Schedule E mortgage and interest

We built an fully detached ADU behind our primary residence in 2022 and started renting it through airbnb in 2023. Should I enter real estate taxes, mortgage interest, and insurance in schedule E, even though it's being entered into the deductions section later? Does TurboTax know to split these out or should I do something like a square footage calculation since the ADU makes up 26% of the total square footage of the two properties or should I just enter these values in one place and skip the other?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ADU Short Term Rental Schedule E mortgage and interest

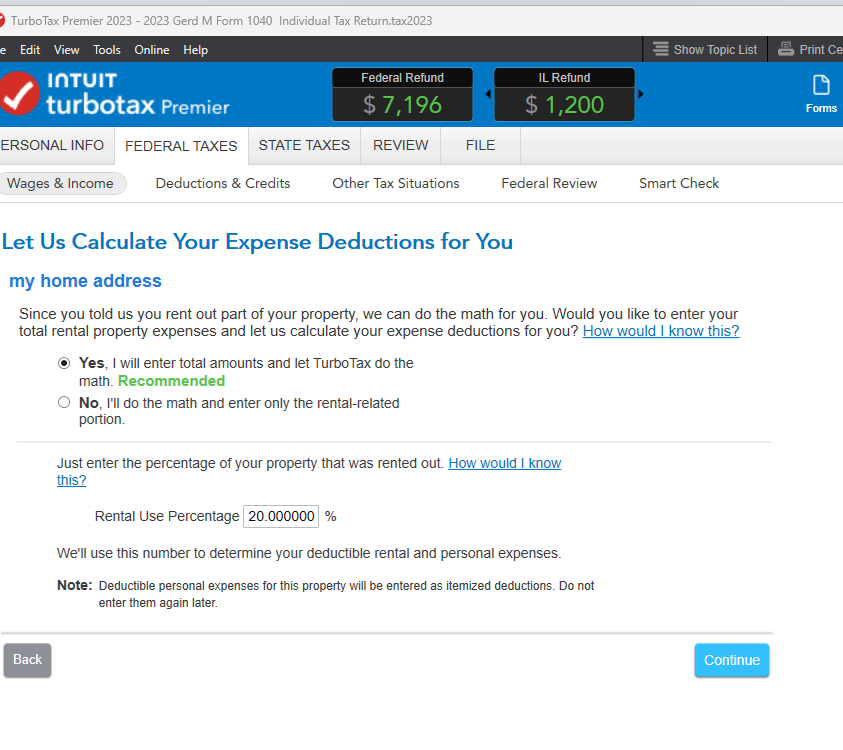

You could do it either way.

Calculate the 26% on your own and enter your Rental Expenses.

Or, in the Property Profile section, enter your Business Use % as 26% and TurboTax will apply that to your Rental Expenses like Mortgage Interest, Property Tax, Insurance, etc.

If you're using TurboTax Desktop, you can adjust any expenses on Schedule E that would apply 100% to the rental, rather than the 26%.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ramseym

New Member

eric6688

Level 2

breanabooker15

New Member

rhartmul

Level 2

kristinacyr

New Member