- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You could do it either way.

Calculate the 26% on your own and enter your Rental Expenses.

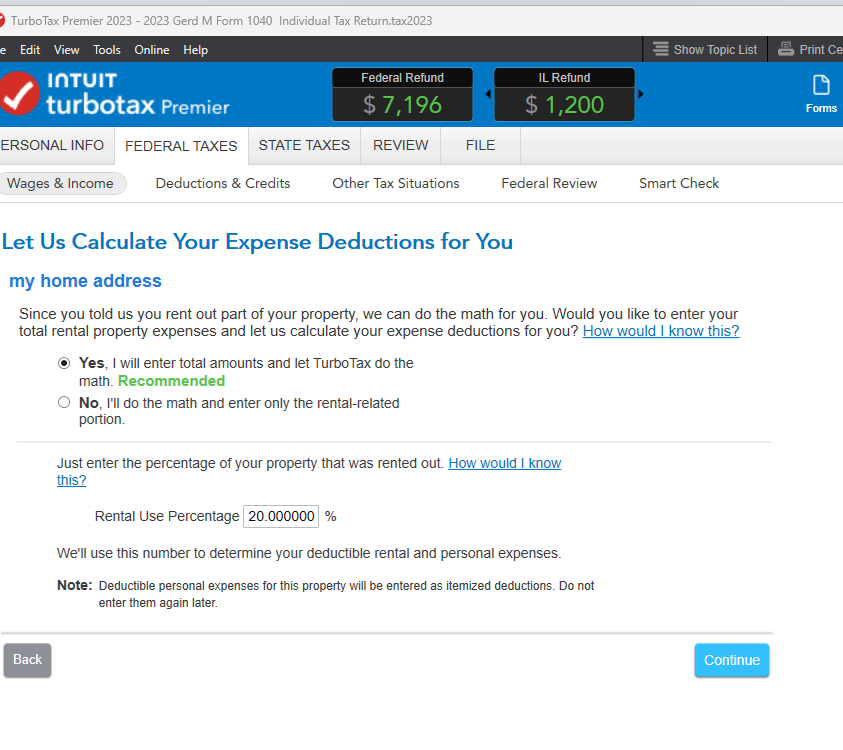

Or, in the Property Profile section, enter your Business Use % as 26% and TurboTax will apply that to your Rental Expenses like Mortgage Interest, Property Tax, Insurance, etc.

If you're using TurboTax Desktop, you can adjust any expenses on Schedule E that would apply 100% to the rental, rather than the 26%.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 27, 2024

10:44 AM