- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- 1099-B 1d box has a negative proceed but Turbo Tax won't allow it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

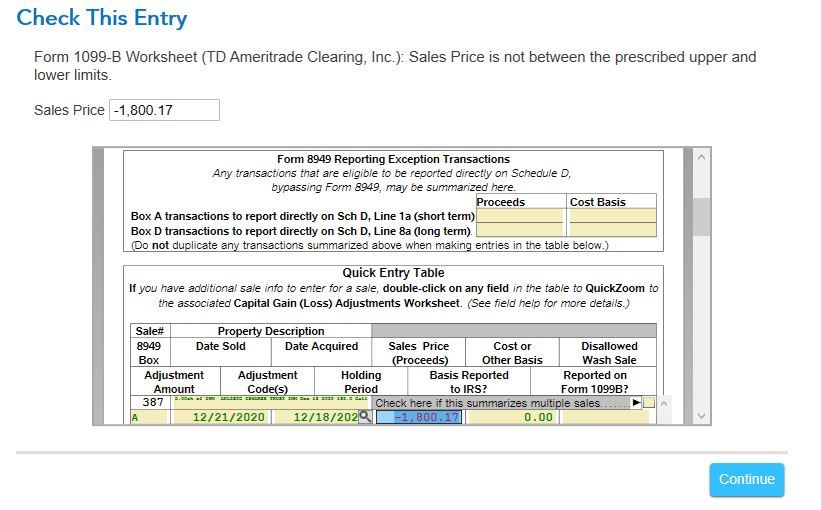

I imported my 1099-B from TD Ameritrade, but when I try to finish up the review I have a few transactions that were negative proceeds in 1d. It allowed me to put negative amount in but when I try to do a wrap up, it won't let me do it. Is this an issue with anybody else?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

Check out this article: How do I fix my 1099-B negative values?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

i'm having the same issue. I read a post from prior year that it was a bug and it was fixed but now it is back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

Be aware that your category Box A or Box D sales without adjustments do not require Form 8949, so there is no reason to import or key in those transactions.

Instead use the "enter a summary" option to put your numbers on Schedule D Line 1a or Line 8a.

--

If you have wash sales, it gets more complicated since those adjusted transactions have to be itemized on Form 8949 and the summary totals adjusted accordingly.

Enter the wash sales on Form 8949, then use the subtotal results on the bottom of that form to know how much to subtract. Be sure to NOT check the adjustments box in the summary window.

--

Alternatively, if entry of Wash Sales is too tedious,

summarize and check the box for adjustments and enter the disallowed amount.

This summary will go on Schedule D Line 1b or 8b.

You will be making the mail-in election.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

Yes, I'm having the same issue. Turbo Tax is asking me to fix 96 entries. The negative numbers are the result of short option sales and appear correct, as reported by TD Ameritrade. Need to know when this will be fixed and what needs to be done on my end.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

the problem is with your broker's setup for importing into turbotax. call your broker.

if you sold an option short the proceeds still should be positive as should be the cost of the close-out unless the option expired in which case cost is zero.

I also short options and when I import from my broker the proceeds are positive numbers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

I figured out my issue. It was happening when I sold a call option and then closed out the option at a loss. Fidelity was reporting it as a net negative number. To fix it I went and updated to show both sides of the transactions. So I showed my initial sell (basis) and showed proceeds as a lower amount. They still net to the same loss but my basis is no longer a zero. Luckily I only had 3 to manually fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

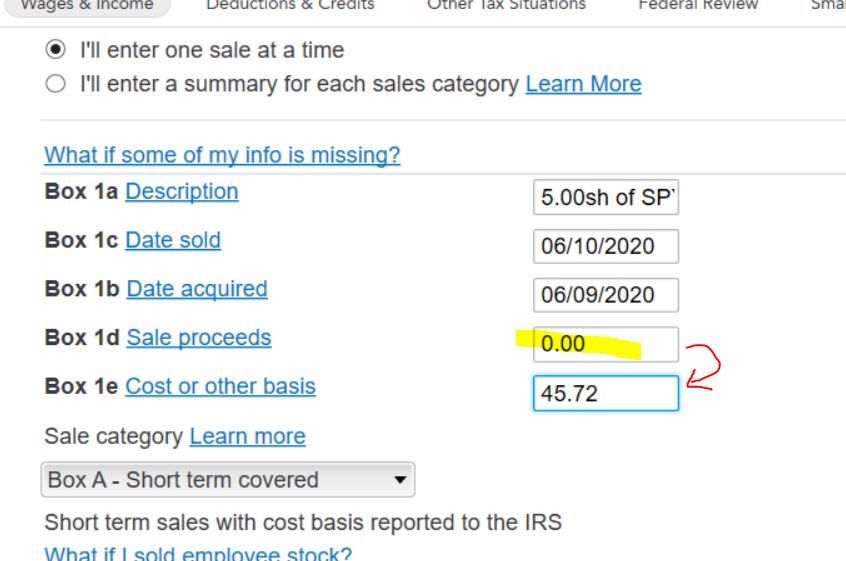

FYI... after reading multiple threads and spending hours of my time, I have edited all the negative proceeds numbers to show $0, and switched the negative number into the cost basis box (with NO (-)negative sign...this threw me at first). and the NET Gain/Loss is then correct. This is what was recommended by one of the experts. REALLY annoying and hopefully TT fixes this, but I did not want to wait for the fix and have this hanging over my head.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

@Mike9241 BUT, if you close a short position for a LOSS, the sale proceeds will need to be entered into TT as $0, and the loss entered as your "cost basis"... this is currently the only way to get an accurate number in the Gain/Loss column. I just spent hours fixing many lines like this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

if you close a short position, or a long position, enter the cost and proceeds as positive numbers,

a loss will show as a negative number in Form 8949 Col (h)

--

At tax time, you have the option to summarize your transactions by Sales Category.

IRS requires details to be listed on a Form 8949,

or on your other forms (e.g. consolidated 1099-B) which have the same information and in the same manner as Form 8949.

Either way, if you choose to summarize, you have to mail the transaction details to the IRS within three business days of IRS accepting your e-Filed tax return.(unless you have attached a PDF of the transactions details to your e-Filed return. Last I looked, TurboTax does not offer this feature).

Exception: if you summarize Category A or Category D, Form 8949 is not needed for transactions without adjustments. No mailing is necessary.

---

As an active investor, be aware that your category Box A or Box D sales without adjustments do not require Form 8949, so there is no reason to import or key in those transactions.

Instead use the "enter a summary" option to put your numbers on Schedule D Line 1a or Line 8a.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B 1d box has a negative proceed but Turbo Tax won't allow it

Check out this article: How do I fix my 1099-B negative values?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

peanutbuttertaxes

New Member

kkrana

Level 1

user17539892623

Returning Member

djpmarconi

Level 1

yingmin

Level 1