- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

I have found the best way to treat the 1099-Q distribution in TurboTax is to enter the distribution first, then enter your form 1098-T expenses and scholarship income. That way, you will be asked to enter your room and board expenses, which may not appear if you enter your form 1098-T expenses first.

If you enter things in this order, your income reported on your 1099-Q should be properly accounted for in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

You can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. You cannot double dip! When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records.

On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

It's a complicated situation and the interview, by necessity, is complicated. But when the info is entered correctly, TT does handle it correctly. But, it's a good idea to review the worksheets and may actually be easier to make the corrections there, as you did (not available to online users). In particular, TurboTax usually assumes you will claim a Tuition credit. So it reduces the amount used for the earnings exclusion, on the 1099-Q, for the amount used for the credit. When you get to the screen, in the interview, titled “Amount Used to Calculate Education Deduction or Credit”, verify the amount you want to use or change it.

You are not allowed to double dip. You cannot claim expenses for the 529 distribution that were used for the tuition credit or were covered by tax free scholarship. Sometimes part of the 529 distribution ends up being taxable, even though it's the same amount as the expenses.

________________________________________________________________________________________

Qualified Tuition Plans (QTP 529 Plans) Distributions

General Discussion

It’s complicated.

For 529 plans, there is an “owner” (usually the parent), and a “beneficiary” (usually the student dependent). The "recipient" of the distribution can be either the owner or the beneficiary depending on who the money was sent to. When the money goes directly from the Qualified Tuition Plan (QTP) to the school, the student is the "recipient". The distribution will be reported on IRS form 1099-Q.

The 1099-Q gets reported on the recipient's return.** The recipient's name & SS# will be on the 1099-Q.

Even though the 1099-Q is going on the student's return, the 1098-T should go on the parent's return, so you can claim the education credit. You can do this because he is your dependent.

You can and should claim the tuition credit before claiming the 529 plan earnings exclusion. The educational expenses he claims for the 1099-Q should be reduced by the amount of educational expenses you claim for the credit.

But be aware, you can not double dip. You cannot count the same tuition money, for the tuition credit, that gets him an exclusion from the taxability of the earnings (interest) on the 529 plan. Since the credit is more generous; use as much of the tuition as is needed for the credit and the rest for the interest exclusion. Another special rule allows you to claim the tuition credit even though it was "his" money that paid the tuition.

In addition, there is another rule that says the 10% penalty is waived if he was unable to cover the 529 plan withdrawal with educational expenses either because he got scholarships or the expenses were used (by him or the parents) to claim the credits. He'll have to pay tax on the earnings, at his lower tax rate (subject to the “kiddie tax”), but not the penalty.

Total qualified expenses (including room & board) less amounts paid by scholarship less amounts used to claim the Tuition credit equals the amount you can use to claim the earnings exclusion on the 1099-Q.

Example:

$10,000 in educational expenses(including room & board)

-$3000 paid by tax free scholarship***

-$4000 used to claim the American Opportunity credit

=$3000 Can be used against the 1099-Q (usually on the student’s return)

Box 1 of the 1099-Q is $5000

Box 2 is $600

3000/5000=60% of the earnings are tax free

60%x600= $360

You have $240 of taxable income (600-360)

**Alternatively; you can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. Again, you cannot double dip! When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records, in case of an IRS inquiry.

On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

***Another alternative is have the student report some of his scholarship as taxable income, to free up some expenses for the 1099-Q and/or tuition credit. Most people come out better having the scholarship taxable before the 529 earnings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

Crazy! Same thing just happened to me. Had already entered 1098-T and then entered 1099-Q. The 529 contributions were already taxed and all distributions were used for tuition. TurboTax mis-calculated and increased taxes and reduced refund. This is clearly not correct. I went from getting a substantial refund to owing money. Called TurboTax and they said to enter 1098-T and delete 1099-Q. This is BS. I've been a TurboTax user every single year since the 80's and since I switched to TurboTax on-line, the product has gotten worse every year. Way more clicks and useless screens of information to navigate through that add no value other than trying to extract more money from my pocket for Intuit.

I'll bet many less astute customers are over paying taxes due to this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

We paid my son's college expenses for 2020 and have entered the 1098-Ts (2) under our taxes. I am entering the 1099-Qs (2) on his taxes as his SSN is on these forms as the "recipient". Upon entering the 1099-Qs on his taxes, it appears to report the amounts from these forms (or a portion of them) as taxable income. The 1098-T qualified expenses are significantly higher (double) than the combined 1099-Qs amounts, yet his taxes reflect that he is having to pay taxes? This doesn't seem correct. Any thoughts? I am happy to share exact numbers of more details if needed. Also, we had already had 4 years of the AOTC so our taxes reflect a $2000 tuition credit if that helps. Thank you for any advice you can offer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

What if the 1098-T and the 1099-Q forms are on separate tax filings (parents / child)? How would you resolve this issue in this scenario? (We paid my son's college expenses for 2020 and so we have entered the 1098-T under our taxes. I am entering the 1099-Qs (2) on his taxes as his SSN is on these two forms as the "recipient". Upon entering the 1099-Qs on his taxes, it appears to report the amounts from these forms (or a portion of them) as taxable income. Our qualified expenses on the 1098-T are significantly higher (more than double) than the combined 1099-Qs amounts, yet his taxes reflect that he is having to pay taxes? This doesn't seem correct. Any thoughts? I am happy to share exact numbers of more details if needed. Also, we had already had 4 years of the AOTC so our taxes reflect a $2000 tuition credit if that helps. Thank you for any advice you can offer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

I'm not a tax expert/professional. I just noticed that when I entered the data, the tax refund dropped. This shouldn't have happened because I already paid the tax on that income and the gains are tax free when used for approved college expenses, which they were. So I knew something was wrong. After a lot of searching, I discovered this is a known problem with TurboTax. I also discovered it got it wrong last year and filed an amended return. I'm not happy TurboTax didn't get me the maximum refund like they advertise. I just checked all the guarantees and there seem to be just enough weasel words to avoid any refund unless switching to another tax package that actually gets this correct. Ain't nobody got time for that! Maybe next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

The 1098-T is only an informational document. The numbers can be entered (or not entered) and/or adjusted as needed. That is, you can enter them on both your return and the student's return.

Since you used $2000 of tuition on your return, reduce the box 1 amount by $2000, when you enter it on his return.

The 1099-Q is also only an informational document. The numbers are not required to be entered in TurboTax.

When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax (TT) will enter nothing about the 1099-Q on the actual tax forms.

On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

Since you know none of the 1099-Q is taxable ("Our qualified expenses on the 1098-T are significantly higher -more than double- than the combined 1099-Qs amounts"), just delete the 1099-Q.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

Thank you for your response. I did not realize you could enter the 1098-T amounts in the separate tax filings for both our taxes and my son's. When I enter the 1098-T, in his taxes, the Fed and State refunds return to the same amounts prior to me entering the 1099-Q figures. So, that makes sense and I hope it is correct (it seems to be to me). Thank you again for your suggestion. Much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

Ugh. I have spent the last two hours dealing with this. My son had some income in 2020 so we used TT to work on his returns which asked for the 1099-Q info (of which he is the beneficiary because Fidelity paid the school directly) but it prevented him from entering college expenses because he is a dependent on our taxes. The result was that he had an additional "$2,000" in income that he owes taxes on according to TT - which makes no sense at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

@dfell12 Being a dependent should not have prevented him from entering his expenses. It only prevents him from claiming a credit or deduction.

In TurboTax (TT), enter at:

Federal Taxes Tab (Personal for H&B version)

Deductions & Credits

-Scroll down to:

--Education

--Education Expenses

You can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. You also cannot count expenses that were paid by tax free scholarships. You cannot double dip!

On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

You can do a quick estimate to see if you even need to enter the 1099-Q.

Example:

$10,000 in educational expenses(including room & board)

-$3000 paid by tax free scholarship

-$4000 used to claim the American Opportunity credit

=$3000 Can be used against the 1099-Q (usually on the student’s return)

Box 1 of the 1099-Q is $5000

Box 2 is $2800

3000/5000=60% of the earnings are tax free; 40% are taxable

40% x 2800= $1120

You have $1120 of taxable income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

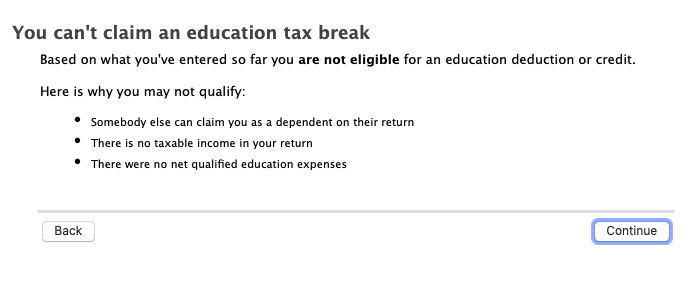

Thanks. Here is what I ran into on the TT screen. Let me know what the workaround is to enter education expenses because I couldn't find one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

That screen doesn't say that you didn't enter expenses, it just says he can't claim a credit.

Look at the student information worksheet to see if the expenses were used in calculations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

I always follow through on Turbo Tax questions and it NEVER handles these distributions correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TurboTax continue to fail in handling 1099-Q and qualified 529 distributions?!!

Thank you for your very helpful and comprehensive post! 2021 will be my first year accounting for a 529 withdrawal and this will help me greatly.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Aussie

Level 3

parent123

Level 1

in Education

Click

Level 5

Michael16

Level 4

fredtex1

Level 2