in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Can I take the education exemption if I never recieved a 1098-T?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I take the education exemption if I never recieved a 1098-T?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I take the education exemption if I never recieved a 1098-T?

First, check with the school as you may have access to the form via your online account there. If you do file without a copy of the Form 1098-T, you will still need to have the school's federal ID number, as the IRS will not accept the credit without that number. If they cannot give you a copy of the form, ask for the amount of any tuition paid, any scholarships, and the federal ID.

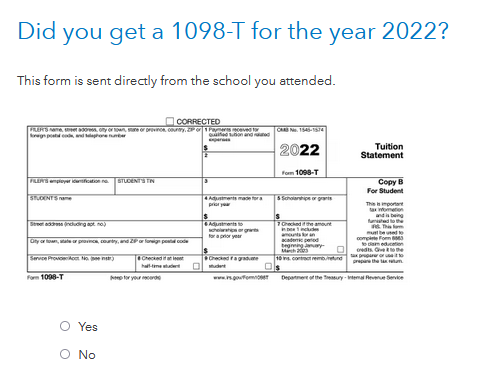

You will report this in the Deductions and Credits section under Education. If you are filing without the form, click to Start or Revisit the area for Form 1098-T and look for the screen Did you get a 1098-T for the year 2022? Answer No.

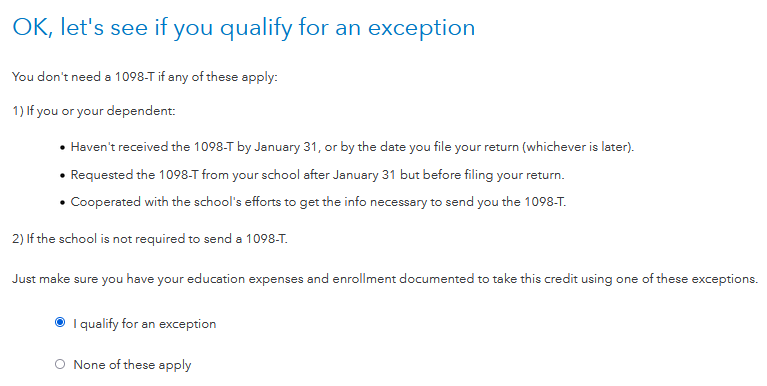

Then, if you have attempted to obtain the form from your school but have not been successful, check that you qualify for an exemption and Continue.

It will allow you to enter tuition costs in an alternative screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I take the education exemption if I never recieved a 1098-T?

Q. Can I take the education credit if I never received a 1098-T?

A. Probably not. But, it depends on the reason that you didn't receive a 1098-T.

Many schools no longer mail out the 1098-T. You obtain it from your school account, on line.

To be eligible for the tuition credits, the course must be taken at "an eligible institution". The school should be able to tell you if it is an eligible educational institution. In general, an eligible educational institution is an accredited college, university, vocational school, or other postsecondary educational institution, including accredited, public, nonprofit, and proprietary (privately-owned, profit-making) postsecondary institutions. Additionally, in order to be an eligible educational institution, the school must be eligible to participate in a student aid program administered by the Department of Education. If they issue a 1098-T they are probably an eligible institution.

Enter your school at the link below, to see if it's on the dept. of education list.

https://ope.ed.gov/dapip/#/home

A form 1098-T was made a requirement for the education credits a few years ago. However, if you qualify for an exception, you may still claim the AOC, without a 1098-T. If you attended an eligible institution, you most likely qualify for an exception.

Exception 1098-T exception

“However, a taxpayer may claim one of these education

benefits if the student doesn’t receive a Form 1098-T because

the student’s educational institution isn’t required to send a

Form 1098-T to the student under existing rules (for example, if

the student is a nonresident alien, has qualified education

expenses paid entirely with scholarships, or has qualified

education expenses paid under a formal billing arrangement). If a

student’s educational institution isn’t required to provide a Form

1098-T to the student, a taxpayer may claim one of these

education benefits without a Form 1098-T if the taxpayer

otherwise qualifies, can demonstrate that the taxpayer (or a

dependent) was enrolled at an eligible educational institution,

and can substantiate the payment of qualified tuition and related

expenses.” https://www.irs.gov/pub/irs-pdf/f8917.pdf

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Tamayabsmothers

New Member

robinsonmd109

New Member

in Education

menomineefan

Level 2

eohiri

New Member

emilybwell9

New Member