- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

First, check with the school as you may have access to the form via your online account there. If you do file without a copy of the Form 1098-T, you will still need to have the school's federal ID number, as the IRS will not accept the credit without that number. If they cannot give you a copy of the form, ask for the amount of any tuition paid, any scholarships, and the federal ID.

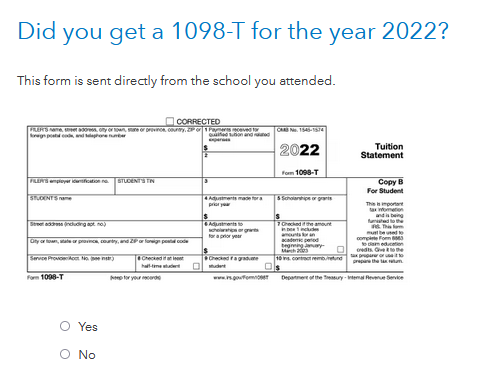

You will report this in the Deductions and Credits section under Education. If you are filing without the form, click to Start or Revisit the area for Form 1098-T and look for the screen Did you get a 1098-T for the year 2022? Answer No.

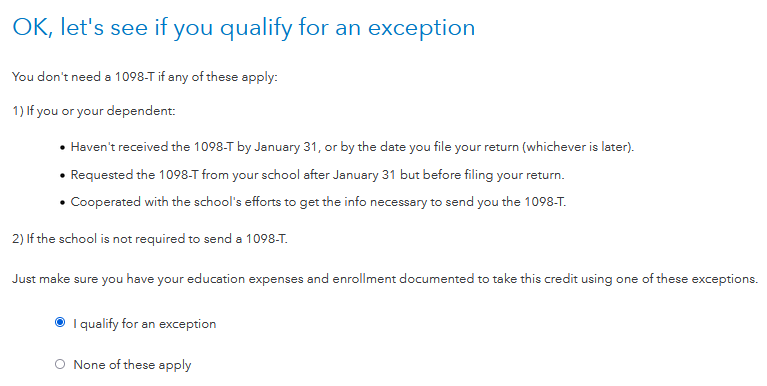

Then, if you have attempted to obtain the form from your school but have not been successful, check that you qualify for an exemption and Continue.

It will allow you to enter tuition costs in an alternative screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"