- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Will Turbo Tax create a question on whether a stimulus was received (for those claiming the credit because did not get stimulus)? Will it auto-generate where needed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Turbo Tax create a question on whether a stimulus was received (for those claiming the credit because did not get stimulus)? Will it auto-generate where needed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Turbo Tax create a question on whether a stimulus was received (for those claiming the credit because did not get stimulus)? Will it auto-generate where needed?

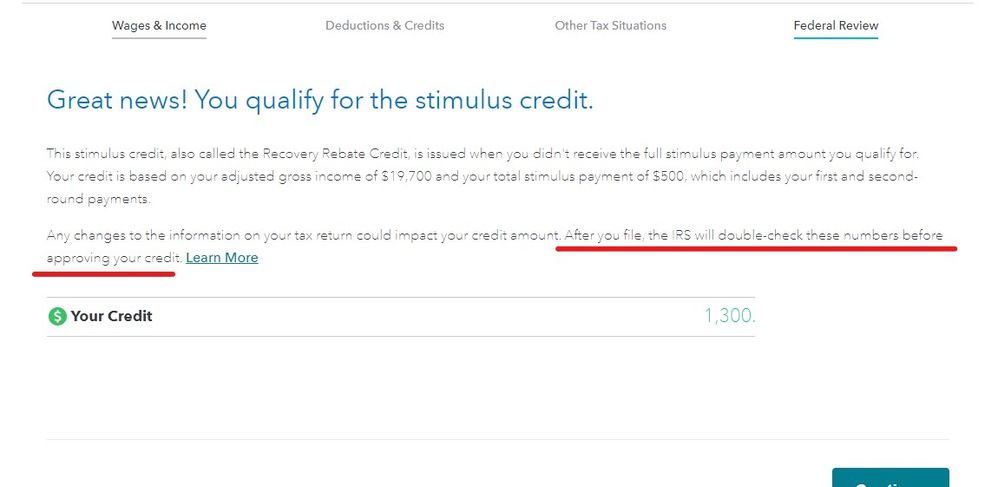

Yes, we have these questions. The questions are in the section Federal Review, near the end of the TurboTax interview.

Once the information is entered you will see your refund increase or balance due decrease, and TurboTax will enter the amount of the credit on Line 30 of Form 1040 for you.

The IRS is distributing payments through January 15, 2021. Please wait until after this date to submit your tax return so that you will be filing the most accurate return possible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Turbo Tax create a question on whether a stimulus was received (for those claiming the credit because did not get stimulus)? Will it auto-generate where needed?

The IRS will stop mailing checks on 1/15 so if you don't get it by the time the efiling opens at the end of the month you can apply for the missing money on the 2020 return.

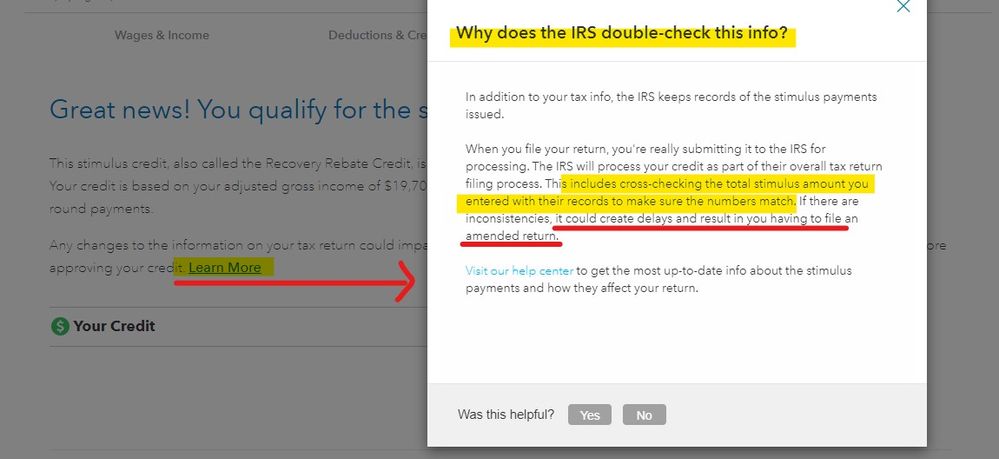

CAUTION to those eager to jump the gun ... if you do NOT enter the correct amount of stimulus the IRS did pay you in advance then expect your eagerness to delay your return being processed. And since the IRS is still suffering from understaffing due to the covid situation and perpetual underfunding and they are also stretched thin managing the last minute tax law/form changes on top of sending out second stimulus payments expect the delays to be long.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Turbo Tax create a question on whether a stimulus was received (for those claiming the credit because did not get stimulus)? Will it auto-generate where needed?

@SusanY1 @Critter-3 Thank you, I received it today even though IRS site says “Status not Available.”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Turbo Tax create a question on whether a stimulus was received (for those claiming the credit because did not get stimulus)? Will it auto-generate where needed?

That is very common. Those look up tools are often not up to date which is why we warn folks to take a breath and wait it out.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

emilysheppard0485

New Member

DC1520

New Member

44lizard

New Member

rem52

Level 1

theDoc

New Member