- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Wife and I both did DoorDash--Inputting as separate businesses, but income from 1st being overwritten when inputting 2nd

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife and I both did DoorDash--Inputting as separate businesses, but income from 1st being overwritten when inputting 2nd

We both did DoorDash in 2020, so I inputted these as separate businesses (with slightly different business names). However, once I input the income from the 1099-NEC for my income then back out and try to input the income from my wife in her separate business, I find that the software has auto-filled the field with the income from my business. Then, when I change the income in this field to show my wife's income, I then find that the income from my business has been deleted! Do I need to consider us as a single business for this even though we got separate NEC-1099 forms? Or is it a software bug? (Shouldn't separate businesses be compartmentalized in terms of the inputted data?)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife and I both did DoorDash--Inputting as separate businesses, but income from 1st being overwritten when inputting 2nd

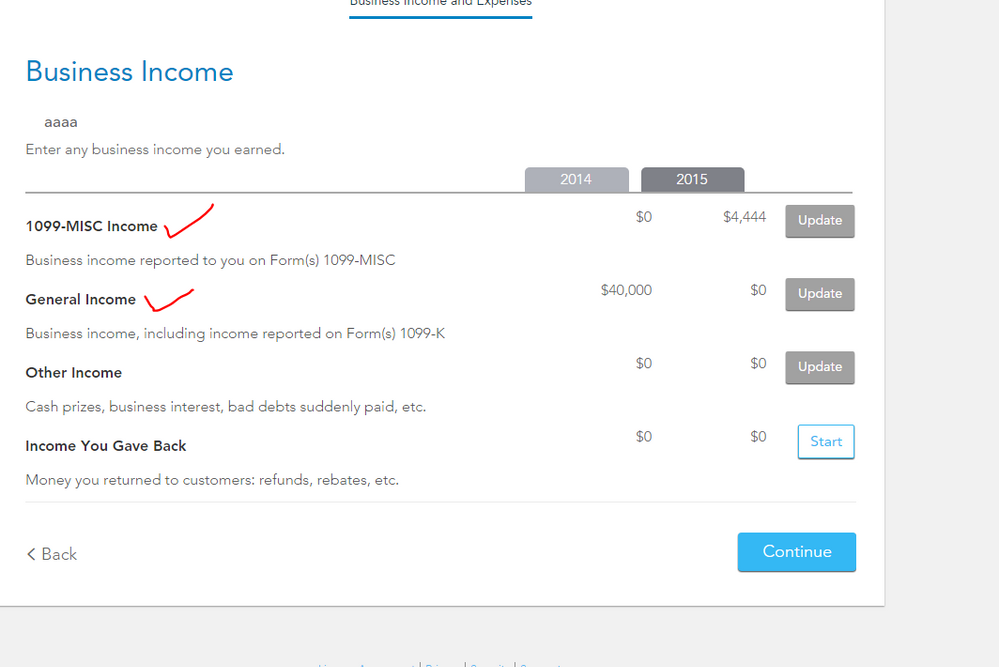

If you started a separate Sch C for the other spouse then the 1099 should not be reflected at all in the new form ... most likely a bug. May I suggest you simply delete the 1099 form and simply enter all the income for the business in the general income section ... entering in the 1099 is for your use only and the IRS only sees the total on the Sch C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife and I both did DoorDash--Inputting as separate businesses, but income from 1st being overwritten when inputting 2nd

Yes, separate businesses should be completely separate from one another in TurboTax in terms of data inputs for income and expenses.

When you revisit the business section of your return, you should see two separate businesses entered for the different names you mentioned. Edit each one and double-check that one is showing that you did the work and the other shows that your wife did the work. Once you are certain that there is a business for each of you, then go through the process of entering the income for each separate business.

You mentioned that you entered income and tried to 'back out' to enter the income for the second business. Don't back out of the process. Enter the income and keep moving forward even if you do not enter your expenses at this time. Backing out may not have tied the income to the business correctly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife and I both did DoorDash--Inputting as separate businesses, but income from 1st being overwritten when inputting 2nd

I deleted my wife's business and then went thru and completed all the info for my business (which is under my name). Then I created a new business for my wife (with a slightly different business name and under her name) and began filling it out. When it got to the 1099-NEC page, it again auto-filled it with the info from my business (including the income), and then I changed the amount and then completed my wife's business info. When I finished and went back to the 'Business Income and Expenses' overview page, I found (again), that the income from MY business had been deleted (but still showed the mileage credit), and it only showed my wife's business income. I think the software is buggy.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife and I both did DoorDash--Inputting as separate businesses, but income from 1st being overwritten when inputting 2nd

If you started a separate Sch C for the other spouse then the 1099 should not be reflected at all in the new form ... most likely a bug. May I suggest you simply delete the 1099 form and simply enter all the income for the business in the general income section ... entering in the 1099 is for your use only and the IRS only sees the total on the Sch C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife and I both did DoorDash--Inputting as separate businesses, but income from 1st being overwritten when inputting 2nd

Thanks for the work-around!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wife and I both did DoorDash--Inputting as separate businesses, but income from 1st being overwritten when inputting 2nd

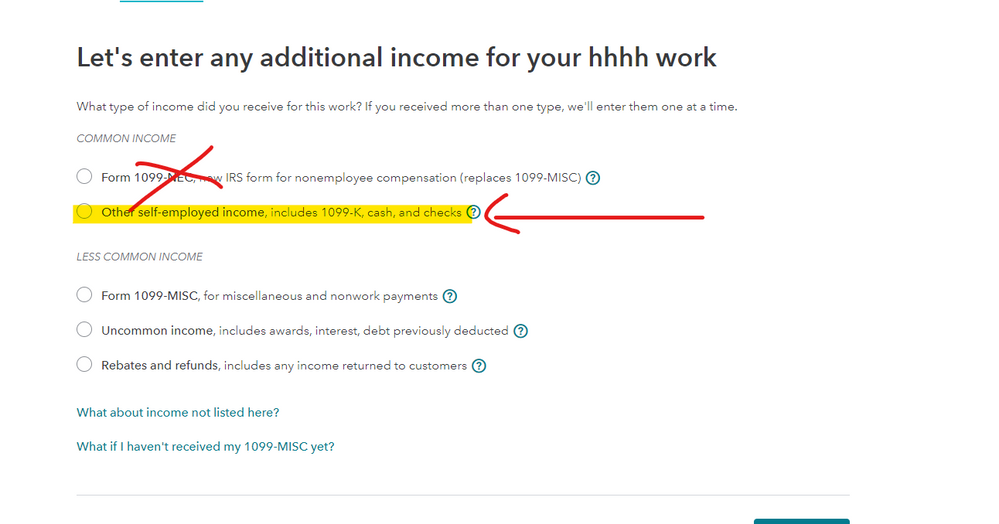

Updated screen shot for the 2020 program ...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joebisog

New Member

ej13722

New Member

TaxesForGetSmart

Level 1

jetblackus

New Member

kylejent

New Member